Author: james Carter

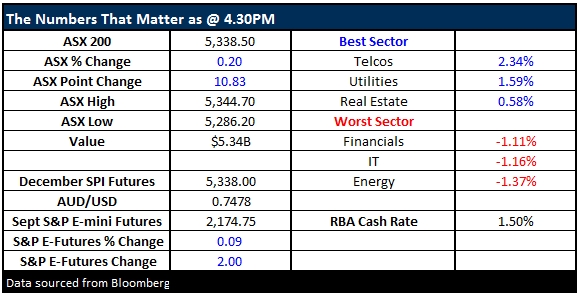

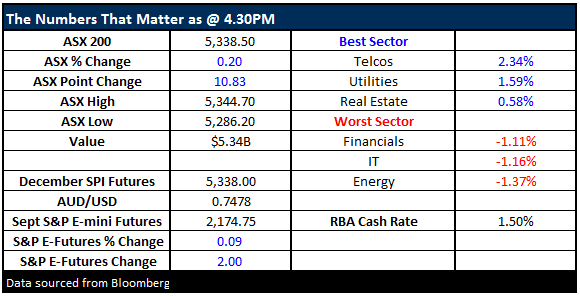

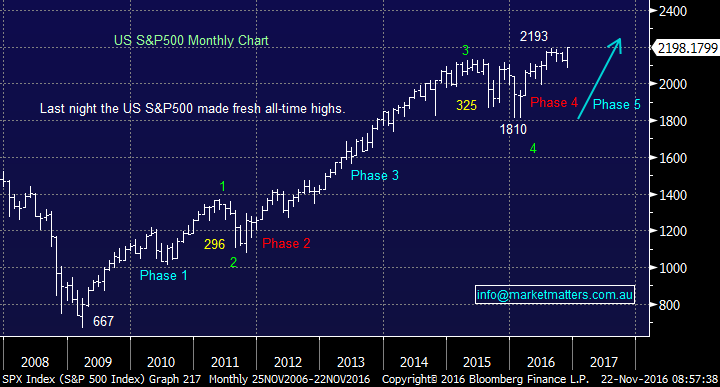

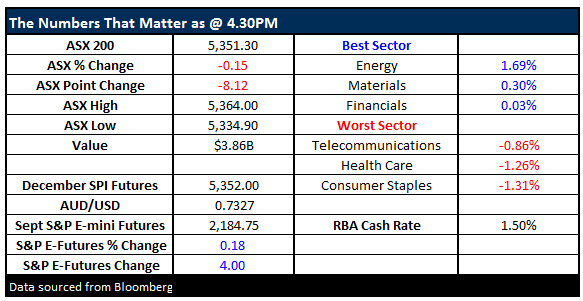

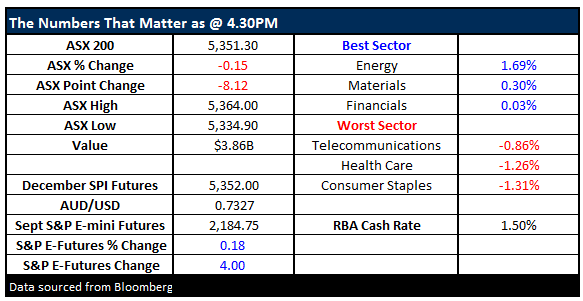

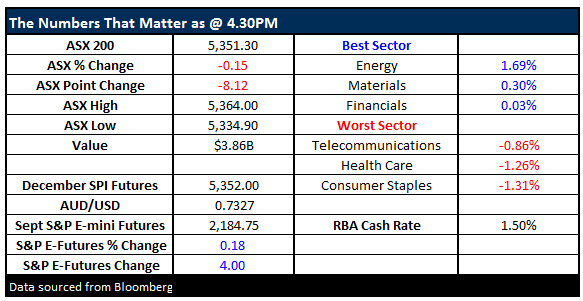

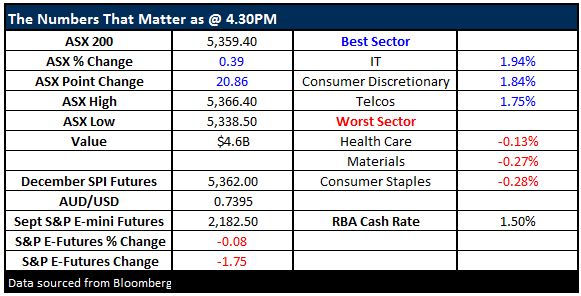

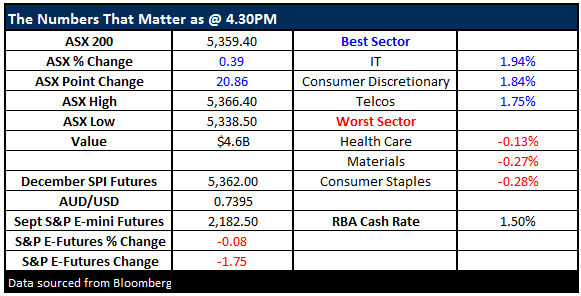

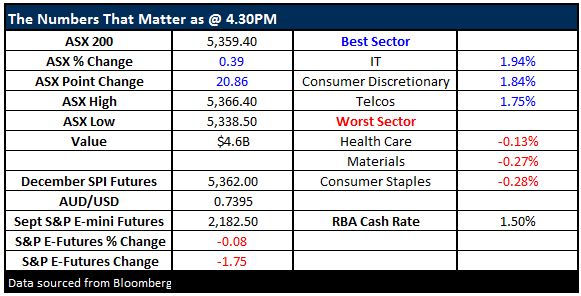

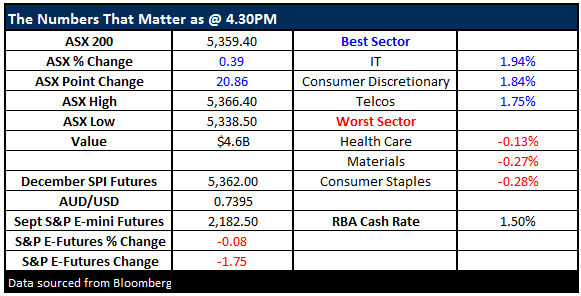

Last night global equity markets continued to surge with the S&P500 making the fresh all-time highs we have been forecasting all-year. Hopefully the local ASX200 will regain some much needed “mojo” into Christmas, it currently sits 4.9% below this year’s high, 12.1% below its 2015 high and a horrible 28% below its all-time high. On the index level at MM we channel a significant part of our energy into tracking the US market for 2 main reasons:

Great to see more questions flow in over the last week or so with a broader topic base – not just around the implications of Trump – although one has crept through the cracks! Firstly though, lets re-cap our view both in the very short term and for the end of CY16 and early CY17.

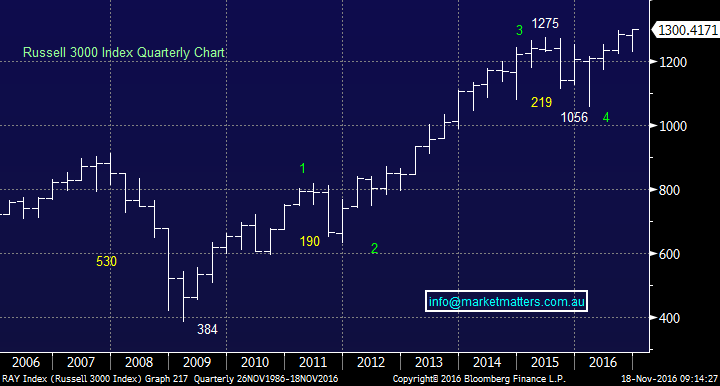

Today we are going look at the 13 stocks in the MM Portfolio hopefully giving clarity on our current thought process and plan moving forward. However firstly we will recap our medium term view for stocks which obviously has a significant bearing on our investment intentions over coming months / years. We have used the Russell 3000 quarterly chart to illustrate our views as it’s longer term and a broad index being based on the 3000 largest US listed stocks by market capitalisation.

Really bullish, there's more to go in the reflation rally

Please enter your login details

Forgot password? Request a One Time Password or reset your password

One Time Password

Check your email for an email from [email protected]

Subject: Your OTP for Account Access

This email will have a code you can use as your One Time Password for instant access

To reset your password, enter your email address

A link to create a new password will be sent to the email address you have registered to your account.

Enter and confirm your new password

Congratulations your password has been reset

Sorry, but your key is expired.

Sorry, but your key is invalid.

Something go wrong.

Only available to Market Matters members

Hi, this is only available to members. Join today and access the latest views on the latest developments from a professional money manager.

Smart Phone App

Our Smart Phone App will give you access to much of our content and notifications. Download for free today.