Author: james Carter

Morning All,

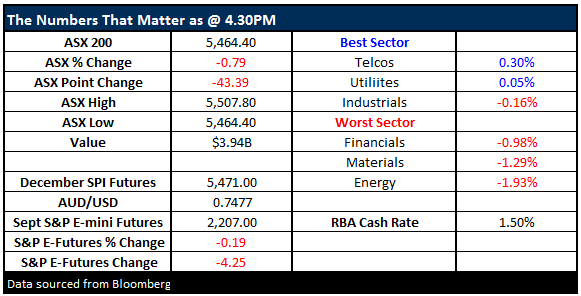

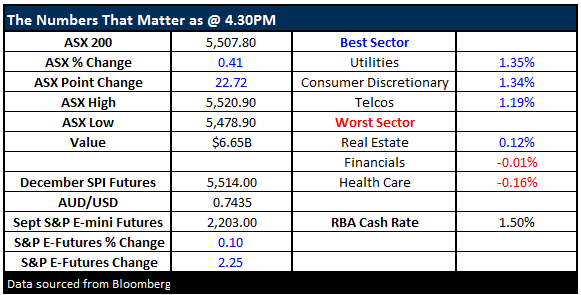

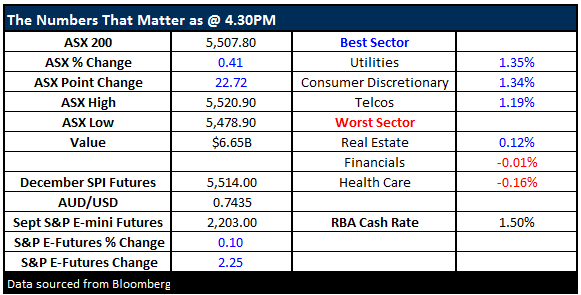

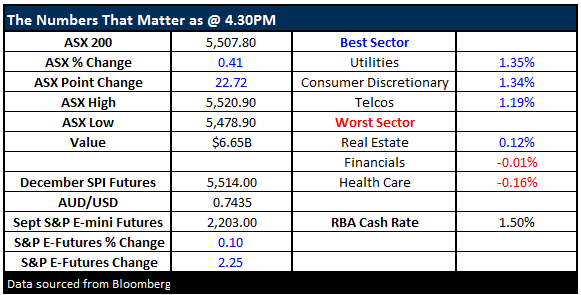

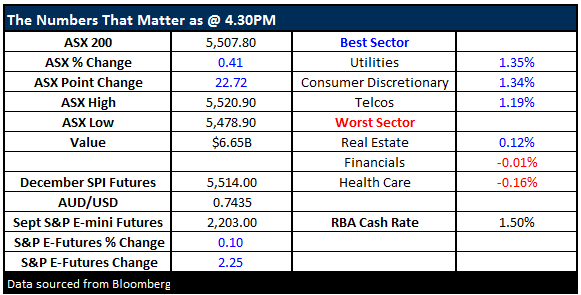

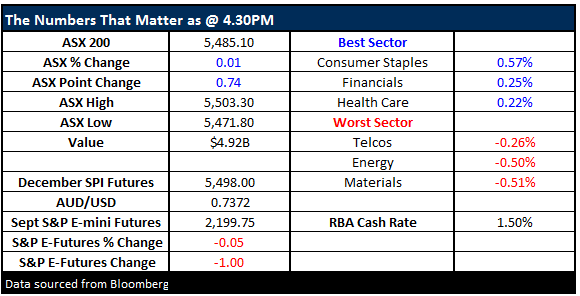

As the US sits back and enjoys their Thanksgiving the short-term bullish trend for the ASX200 has clearly been established. Even with no major leads from overseas markets the futures are pointing to a 25-point higher opening, well over 5500. We remain bullish with a break back over 5600 a very strong possibility for 2016, we will be watching both the seasonal and technical paths closely over coming weeks, for the traders we anticipate the below:

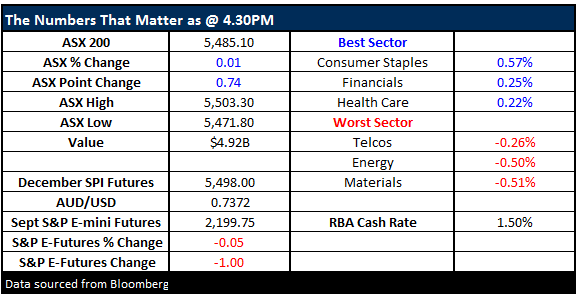

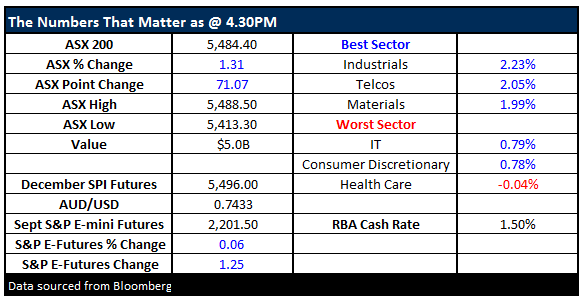

The local stock market has finally gained some of the strong positive sentiment that has been flowing in the US since the Donald Trump victory, over the last 2 days the ASX200 has rallied 137-points (2.5%). Yesterday’s buying was unrelenting sending the market higher throughout the day – see Wednesday’s MM Afternoon Report. The move felt like fund managers were being forced to increase their exposure to a rising market, a phenomenon that we have discussed and been expecting to eventually emerge. This buying coupled by a dearth of sellers because the very same institutions are underweight stocks can be explosive.

The “crowd” has had a tough time over recent years whether its panic selling of resources last Christmas, buying the banks at crazy levels mid-last year or chasing the yield play only a few months ago it’s been an uncomfortable ride. As investors we need to look 6-12 months ahead and always consider how the market is positioned. If everyone is already long there will simply be no buyers left however good the story, and when the horizon becomes vaguely cloudy the storm that follows can be ugly.

Really bullish, there's more to go in the reflation rally

Please enter your login details

Forgot password? Request a One Time Password or reset your password

One Time Password

Check your email for an email from [email protected]

Subject: Your OTP for Account Access

This email will have a code you can use as your One Time Password for instant access

To reset your password, enter your email address

A link to create a new password will be sent to the email address you have registered to your account.

Enter and confirm your new password

Congratulations your password has been reset

Sorry, but your key is expired.

Sorry, but your key is invalid.

Something go wrong.

Only available to Market Matters members

Hi, this is only available to members. Join today and access the latest views on the latest developments from a professional money manager.

Smart Phone App

Our Smart Phone App will give you access to much of our content and notifications. Download for free today.