Author: james Carter

Morning All,

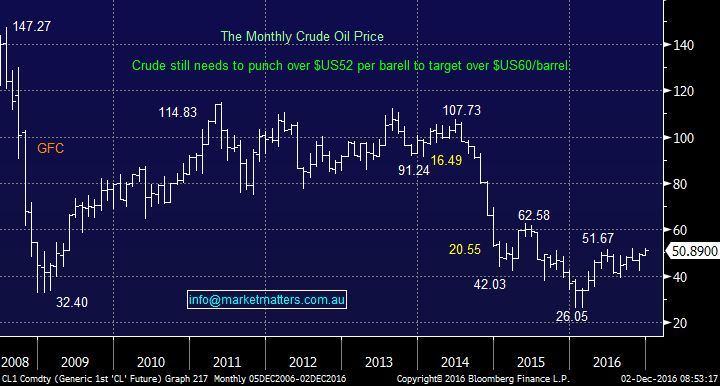

The oil price has dominated the financial news over the last 48-hours as OPEC finally managed to reach a deal to limit production in an effort to eliminate the excess inventory sitting in storage. OPEC members were clearly backed into a corner with many economies struggling with high debt, low growth and quite simply, they needed a higher Oil price to avoid continuing economic hardship.

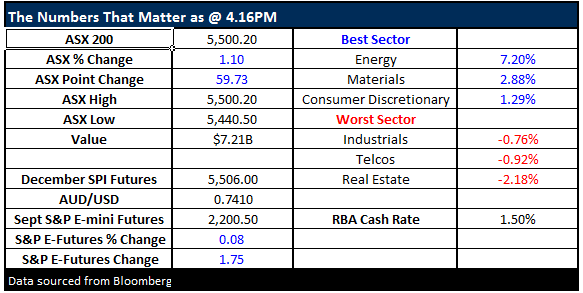

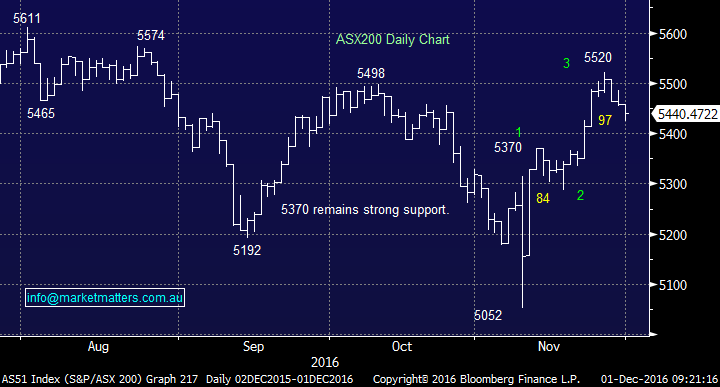

The market has been very active / interesting over recent days, culminating in a positive decision from OPEC last night which sent crude oil soaring over 8% – BHP is set to open up $1 this morning, even with a substantially weaker iron ore price overnight. This morning we are going to cover a few topics but predominantly the highly requested stops / exit strategies around our existing portfolio. We understand a number of you are shell-shocked after the collapse of Vocus (VOC) this week, a very uncomfortable move for all of us, however it’s no reason to panic and walk away from a successful strategy

Yesterday was probably our toughest day since the inception of MM, as we saw one of our holdings Vocus (VOC) plummet over 20%, courtesy of a poor update. Simply another story of a local company failing to merge / takeover another business in a successful manner over the short-term. The trend of underestimating how hard the implementation becomes in reality, appears ingrained in companies within the ASX200 – a potential warning to Boral investors in recent days.

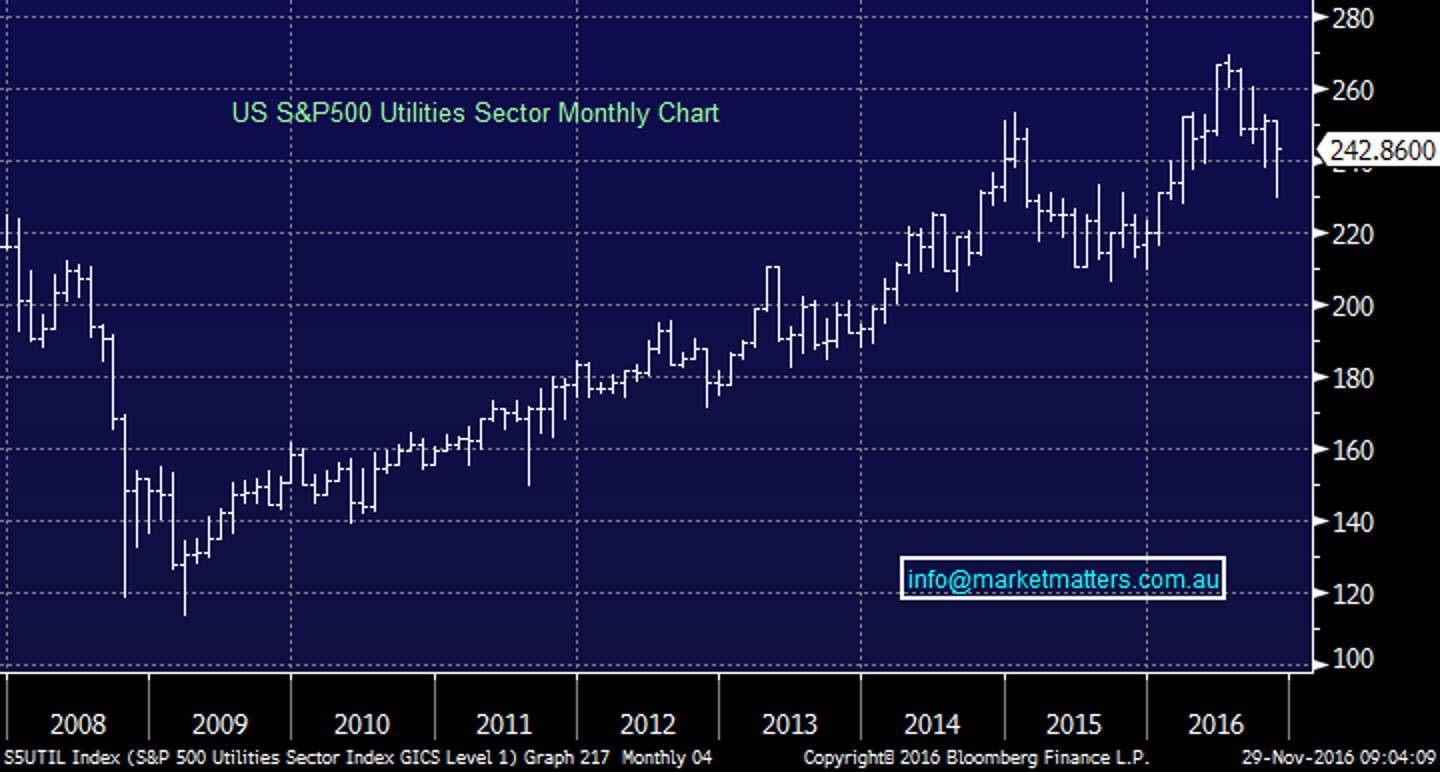

Last night was a relatively quiet on Wall Street, with the one thing catching our eye… The strong performance from the Utilities Sector, gaining over 2% on a down day. In a similar but less dramatic fashion to our local “yield play” / utilities sector, the American Utilities have corrected 14.9% over the last 4-months. Our view recently, which led to the purchase of Transurban (TCL) and Westfield (WFD) as the sector had fallen too far, too fast.

Really bullish, there's more to go in the reflation rally

Please enter your login details

Forgot password? Request a One Time Password or reset your password

One Time Password

Check your email for an email from [email protected]

Subject: Your OTP for Account Access

This email will have a code you can use as your One Time Password for instant access

To reset your password, enter your email address

A link to create a new password will be sent to the email address you have registered to your account.

Enter and confirm your new password

Congratulations your password has been reset

Sorry, but your key is expired.

Sorry, but your key is invalid.

Something go wrong.

Only available to Market Matters members

Hi, this is only available to members. Join today and access the latest views on the latest developments from a professional money manager.

Smart Phone App

Our Smart Phone App will give you access to much of our content and notifications. Download for free today.