Author: james Carter

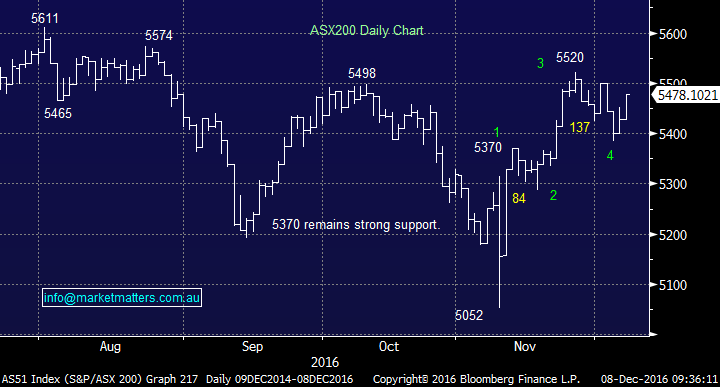

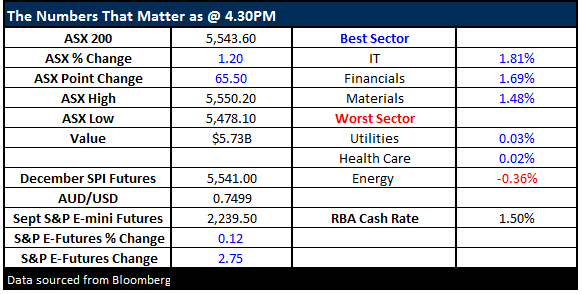

Last night global equities surged on speculation that the ECB (European Central Bank) will continue with its bond buying program hence keeping a lid on interest rates short-term. The Dow rallied almost 300-points to another all-time high led by the “yield play” stocks – REIT’s and Telco’s. Our call for the yield play yesterday remains on track:

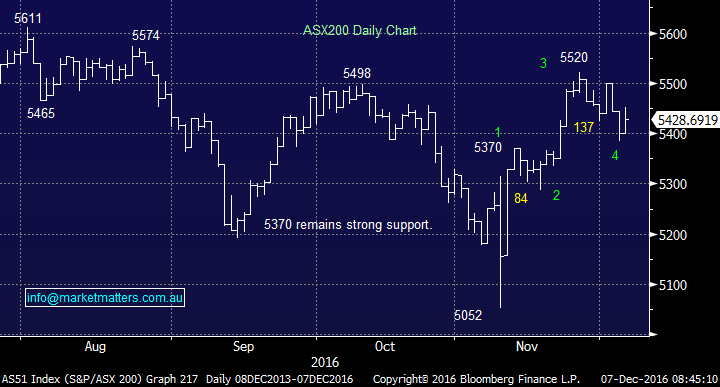

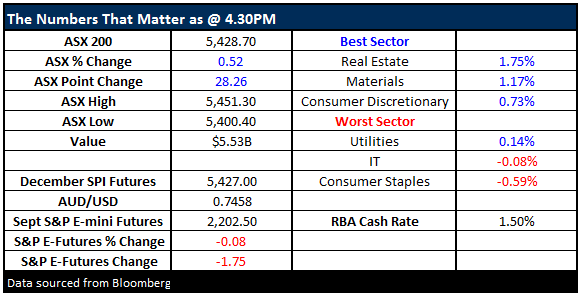

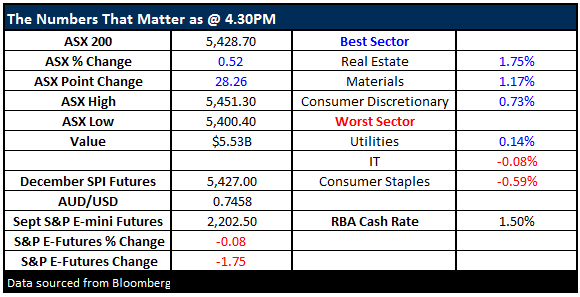

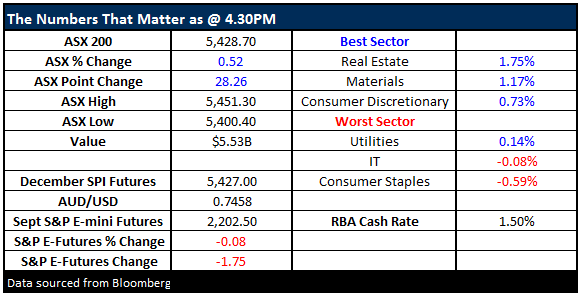

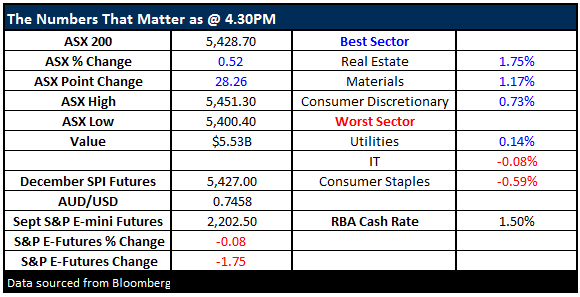

The local market only gaining 28-points yesterday was a disappointment compared to most global indices but today the market is looking to open up another ~30-points. The price action intra-day yesterday told a tale which we believe is likely to follow through into 2017 – BHP fell 59c from its early highs, banks gave up much of their gains but the “yield-play” stocks rallied hard e.g. Sydney Airports (SYD) +20c plus other poor performers in 2016 got an obvious bid tone e.g. Age Care stocks.

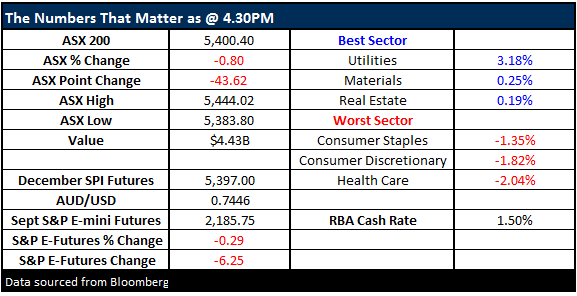

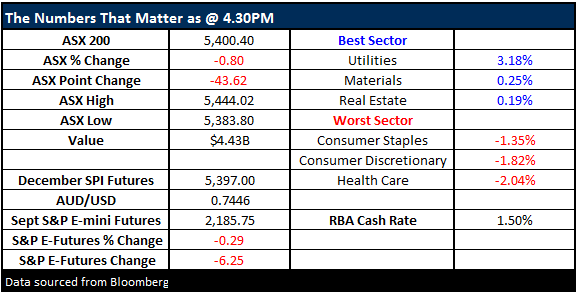

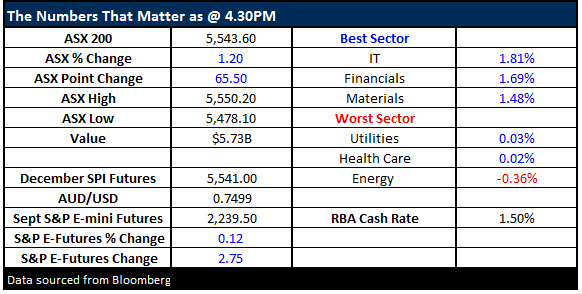

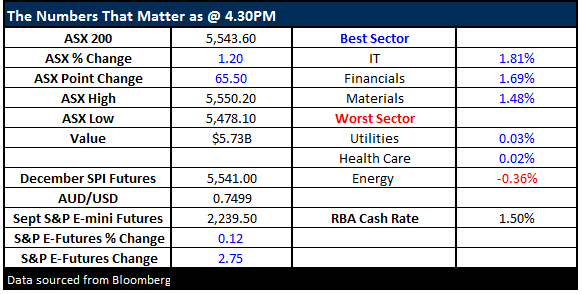

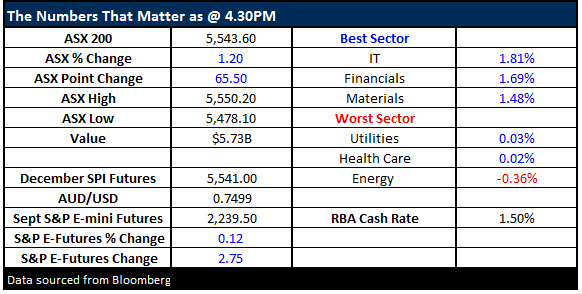

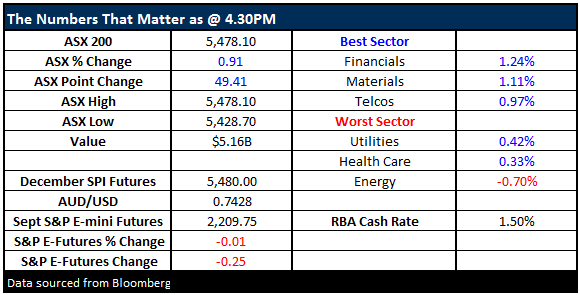

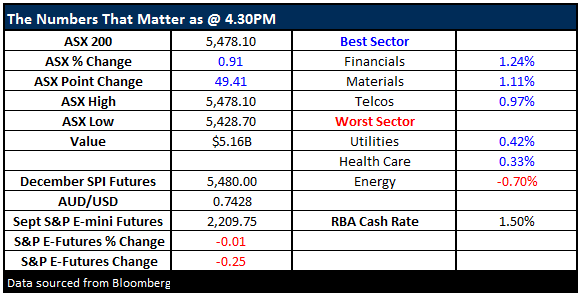

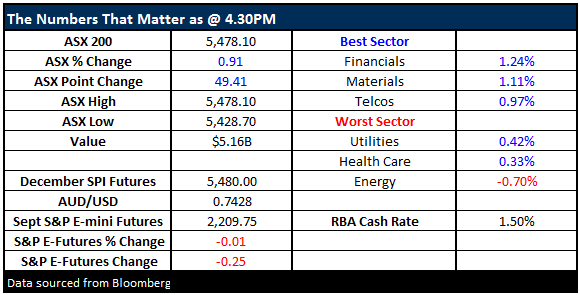

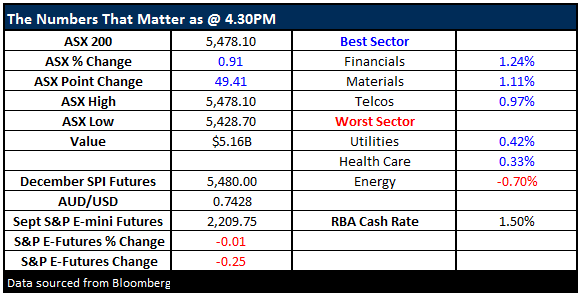

In yet another déjà vu moment for our time zone yesterday, it felt like stocks were in for a tough few days following the Italian referendum. Although the anti-government NO Vote winning was anticipated by the polls, unlike the Trump result, the crushing margin sent our ASX200 down 43- points (0.80%) and the European / US futures lower. However, this morning our Bloomberg is showing strong gains from most of Europe and the S&P500 gaining ~0.6% in a reaction bearing resemblance to the US election, just on a smaller scale.

Really bullish, there's more to go in the reflation rally

Please enter your login details

Forgot password? Request a One Time Password or reset your password

One Time Password

Check your email for an email from [email protected]

Subject: Your OTP for Account Access

This email will have a code you can use as your One Time Password for instant access

To reset your password, enter your email address

A link to create a new password will be sent to the email address you have registered to your account.

Enter and confirm your new password

Congratulations your password has been reset

Sorry, but your key is expired.

Sorry, but your key is invalid.

Something go wrong.

Only available to Market Matters members

Hi, this is only available to members. Join today and access the latest views on the latest developments from a professional money manager.

Smart Phone App

Our Smart Phone App will give you access to much of our content and notifications. Download for free today.