Author: james Carter

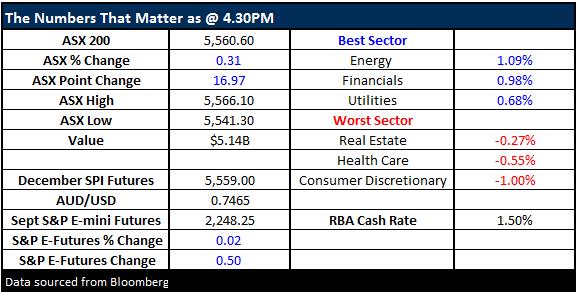

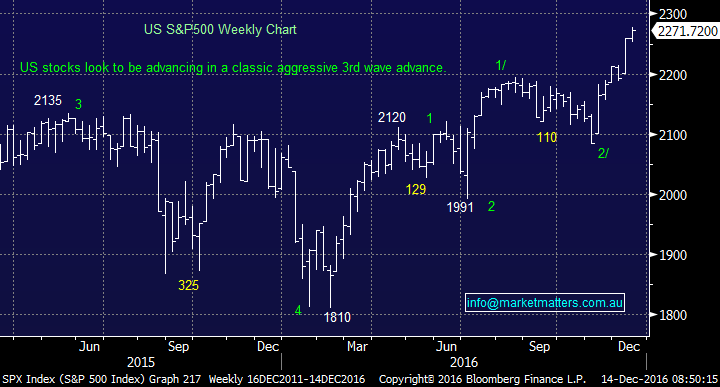

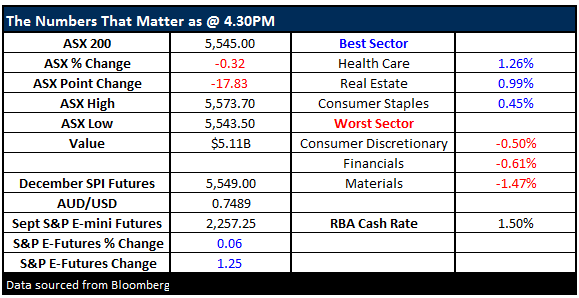

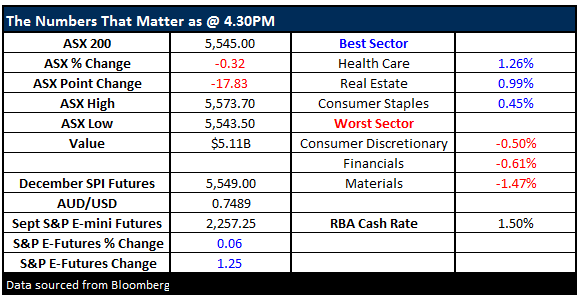

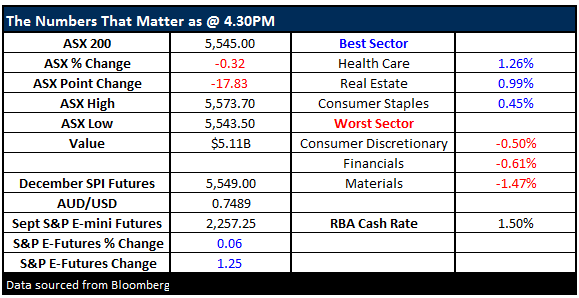

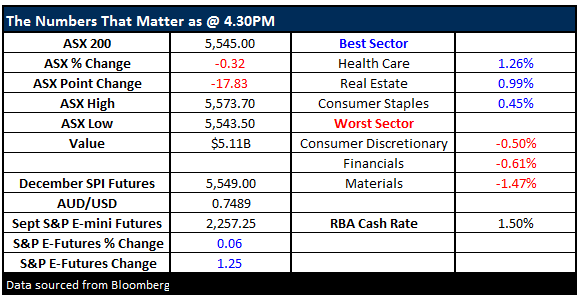

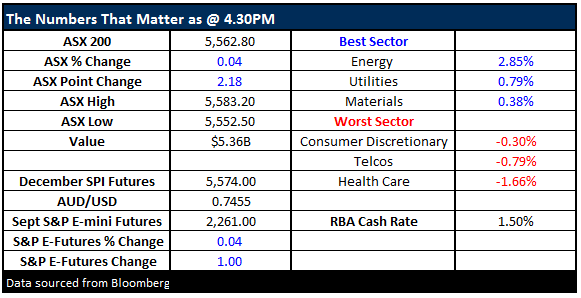

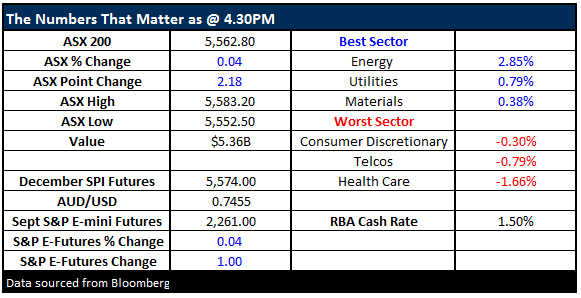

My Bloomberg this morning is telling me that the local ASX200 may have got it wrong yesterday when it fell 0.3%, following Asian indices lower after lunch – typically they all turned around and rallied to close up after we had closed and gone home. This morning The Dow is again up well over 100-points as the tech stocks regain their “mojo” with the NASDAQ rallying 1.2% to make fresh highs for 2016.

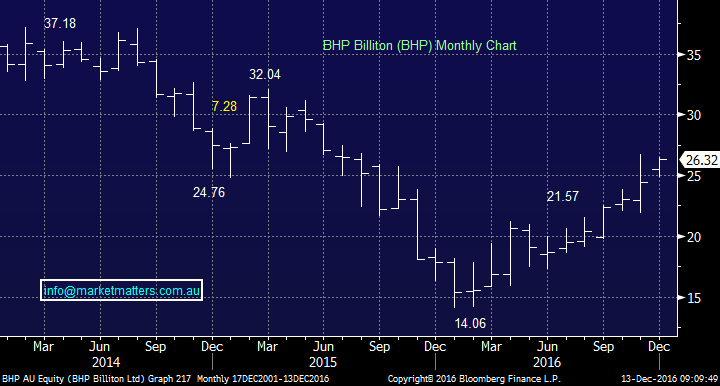

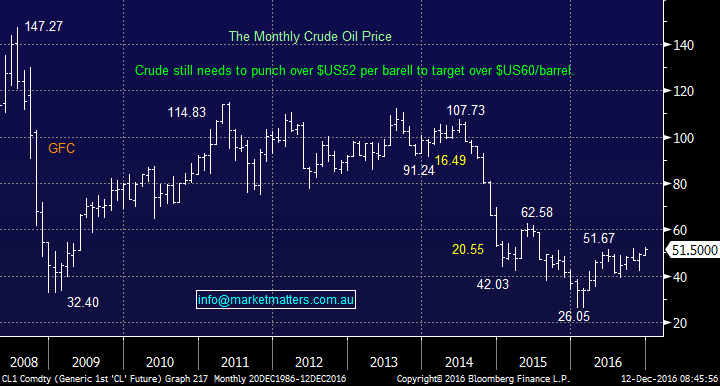

History tells us that fading the crowd often becomes an excellent investment thematic but as we all know it’s about the timing. When we started 2016 the market simply hated resource stocks, led by BHP with the often called “Big Australian” making multi-year lows in January just above $14. Yet here we are approaching Christmas and BHP is up ~85% while the ASX200 is up only 5% – there are plenty of other stunning performances within the sector e.g. FMG +267%!

We have had one question dominating from all directions over the last week – “what makes you believe a significant correction is looming” , we will address this is simple form today but first 2 important pieces of news caught our eye on the weekend.

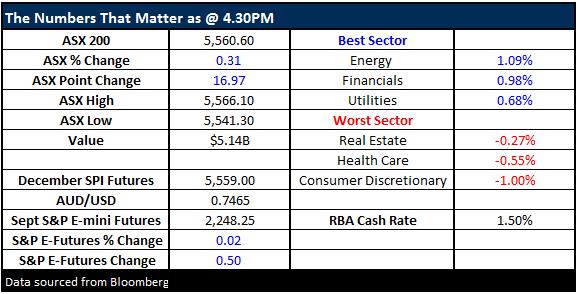

US equities have now increased in value by over a trillion dollars since Donald Trump won the race to the White House, certainly not what most pundits were forecasting before the US presidential vote. Last night, global equities continued their advance albeit with reduced momentum after the European Central Bank (ECB) pledged to extend Quantitative Easing (QE) into 2017, plus importantly stating they will add to the stimulus if the proposed reduction to €60bn per month from €80bn per month in asset purchases fails to strengthen the European economy.

Really bullish, there's more to go in the reflation rally

Please enter your login details

Forgot password? Request a One Time Password or reset your password

One Time Password

Check your email for an email from [email protected]

Subject: Your OTP for Account Access

This email will have a code you can use as your One Time Password for instant access

To reset your password, enter your email address

A link to create a new password will be sent to the email address you have registered to your account.

Enter and confirm your new password

Congratulations your password has been reset

Sorry, but your key is expired.

Sorry, but your key is invalid.

Something go wrong.

Only available to Market Matters members

Hi, this is only available to members. Join today and access the latest views on the latest developments from a professional money manager.

Smart Phone App

Our Smart Phone App will give you access to much of our content and notifications. Download for free today.