Author: james Carter

A relatively small report to kick off the first full working / trading week of 2017 as subscribers like ourselves warm up for a very exciting year ahead. Please keep the questions coming at the rate of 2016 so we can ensure complete clarity on our views / approach in 2017. Additionally, we’ll be making some slight changes to report formats over the coming weeks / months, and we’d welcome your feedback on this.

Market Matters Morning Report 4th January 2017

Happy Christmas everybody!

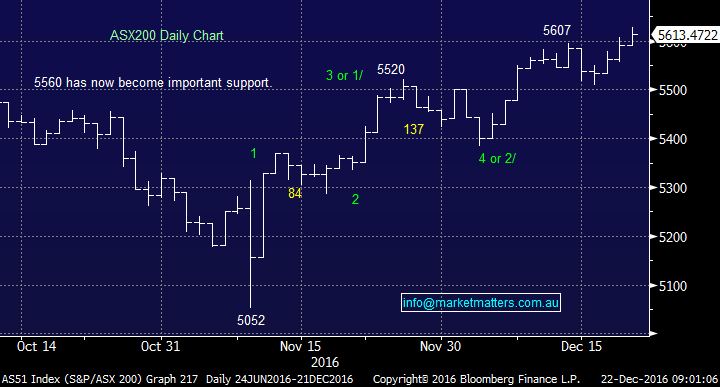

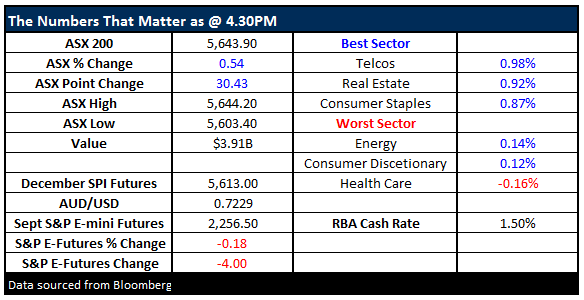

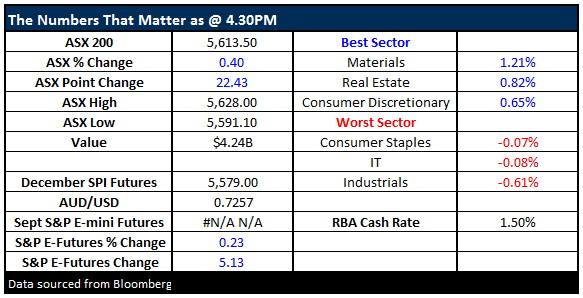

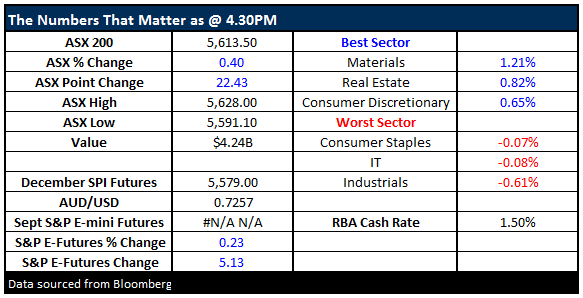

Yesterday, the local market continued with its seasonal strength, rallying another 22-points to close at a fresh high for 2016 – a nice way to be heading into Christmas. We felt this advance was a very high probability occurrence, the question now is what happens over the remaining few trading days into both Christmas and New Year’s Eve? We currently remain heavily committed to the market looking to sell into current strength, hence until we actually sell some holdings, forecasting this recent advance rally counts for nothing.

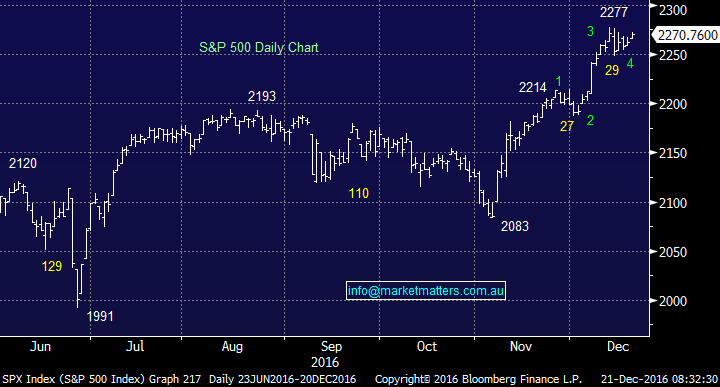

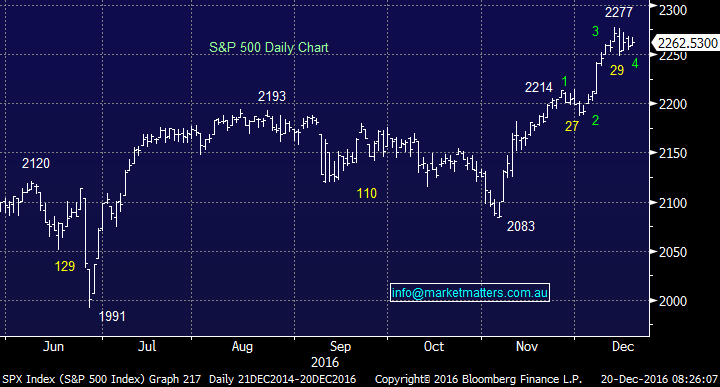

Both the news flow and the markets are slowing down for the festive season. US stocks were up again last night and remain on track to rally ~2% to fresh to all-time highs as we have been targeting – the Dow is flaunting with the psychological 20,000 level. Impressively, the S&P500 remains up close to 9% since Donald Trump was elected, an event most people were touting as potentially a big concern for stocks.

With two young kids this coming Sunday is not surprisingly the topic de jour in my house but we should not forget that stock markets are in their seasonally strongest fortnight and we anticipate some activity shortly. US stocks are continuing to digest the Fed’s forecast of 3 not 2 interest rate hikes in 2017 in a bullish manor. The S&P500 remains only 0.7% below its all-time high and we are still expecting a 2-3% rally before we all start singing “Auld Lang Syne” in twelve days time.

Really bullish, there's more to go in the reflation rally

Please enter your login details

Forgot password? Request a One Time Password or reset your password

One Time Password

Check your email for an email from [email protected]

Subject: Your OTP for Account Access

This email will have a code you can use as your One Time Password for instant access

To reset your password, enter your email address

A link to create a new password will be sent to the email address you have registered to your account.

Enter and confirm your new password

Congratulations your password has been reset

Sorry, but your key is expired.

Sorry, but your key is invalid.

Something go wrong.

Only available to Market Matters members

Hi, this is only available to members. Join today and access the latest views on the latest developments from a professional money manager.

Smart Phone App

Our Smart Phone App will give you access to much of our content and notifications. Download for free today.