Author: james Carter

Apologies for the late report we had technical difficulties earlier.

Apologies for the late report we had technical difficulties earlier.

Theresa May is preparing a very important speech for tonight which markets are hoping will deliver a long-awaited blueprint of how the UK “hopes” to leave Europe – we must remember this is a two way negotiation with the whole EU. The respected Sunday Times has reported that May is ready to withdraw from tariff-free trade with the region in return for the ability to curb immigration and strike commercial deals with other countries – this article led to the pound falling over 1% yesterday, trading around 20% below its level prior to the BREXIT vote.

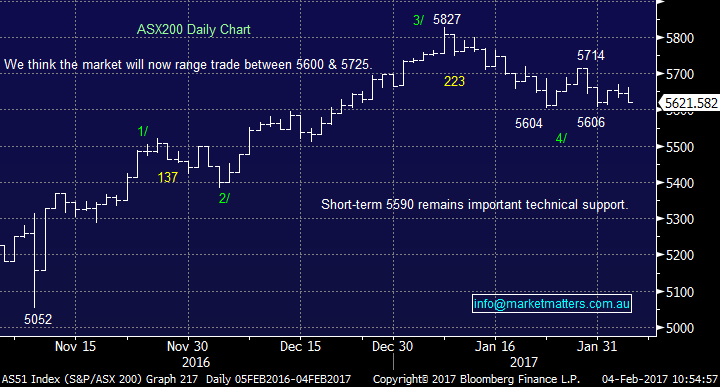

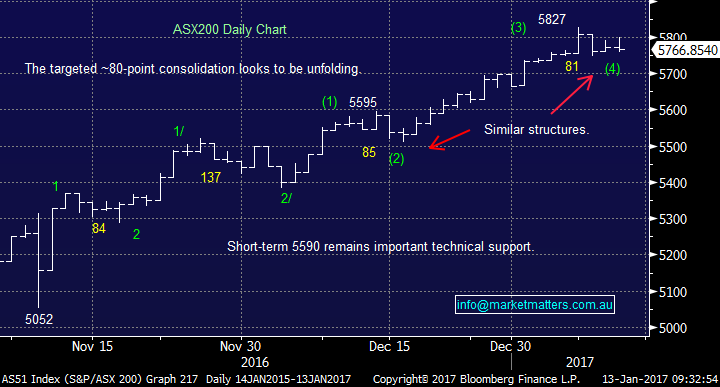

Morning everybody, after a relatively quiet start to the year we feel the markets are likely to become more active this week. The British Pound has opened down ~1.6% this morning due to comments in the UK’s Telegraph around Theresa May’s “strong” plans for BREXIT, initial movements by the FTSE should be interesting today. After 5 weeks of sideways choppy price action by the S&P500 it’s not a “big call” to anticipate some movement its simply statistically due.

As most global equity markets have entered a relatively quiet period, we thought today was an ideal time to follow on from yesterday’s report, which outlined our likely strategy for the current MM portfolio and look at how we like to manage risks / use stops.

Really bullish, there's more to go in the reflation rally

Please enter your login details

Forgot password? Request a One Time Password or reset your password

One Time Password

Check your email for an email from [email protected]

Subject: Your OTP for Account Access

This email will have a code you can use as your One Time Password for instant access

To reset your password, enter your email address

A link to create a new password will be sent to the email address you have registered to your account.

Enter and confirm your new password

Congratulations your password has been reset

Sorry, but your key is expired.

Sorry, but your key is invalid.

Something go wrong.

Only available to Market Matters members

Hi, this is only available to members. Join today and access the latest views on the latest developments from a professional money manager.

Smart Phone App

Our Smart Phone App will give you access to much of our content and notifications. Download for free today.