Author: james Carter

Firstly, the US Fed left interest rates unchanged as anticipated last night with policy makers still targeting 3 rate hikes throughout 2017. The Feds opinion varies, like most peoples, on the extent to which Donald Trump will boost growth by cutting taxes, lifting regulation and simply spending – it definitely feels like 2017 will be a Trump dominated year.

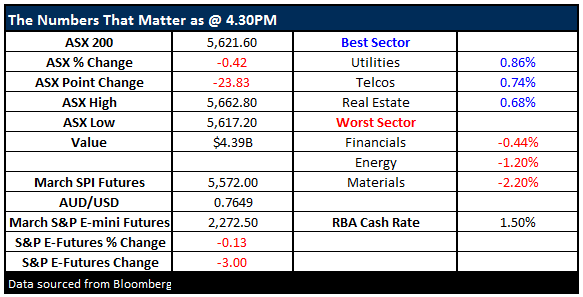

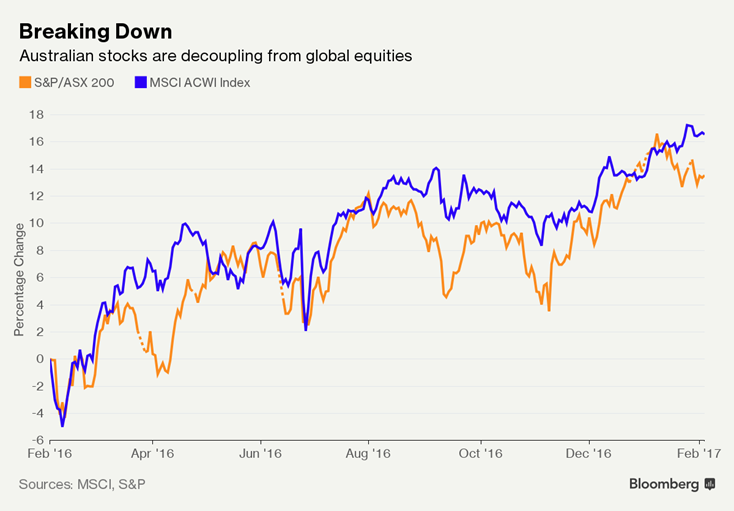

We may finally be getting a little volatility in global stock markets courtesy of Donald Trump but locally we have already seen some tremendous moves within the market itself on the stock level in 2017. It’s very important to keep abreast of what’s unfolding within our market to try and avoid the landmines that appear scattered throughout the Australian share market e.g. Virtus Health (VRT) down 17.7% yesterday.

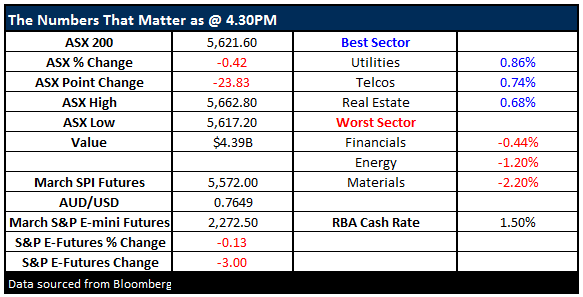

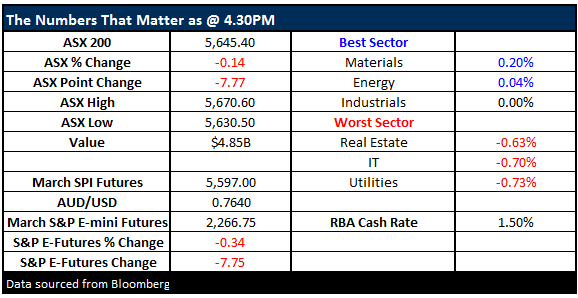

Donald Trump’s immigration actions over the weekend appear at least in the short-term to have put the brakes on US stocks as the Dow plunged over 200-points at one stage in its overnight session. The market has been totally in the “glass half full” camp since his election victory last November but we feel the growth euphoria is ready to evaporate as concerns are likely to grow around potential trade wars.

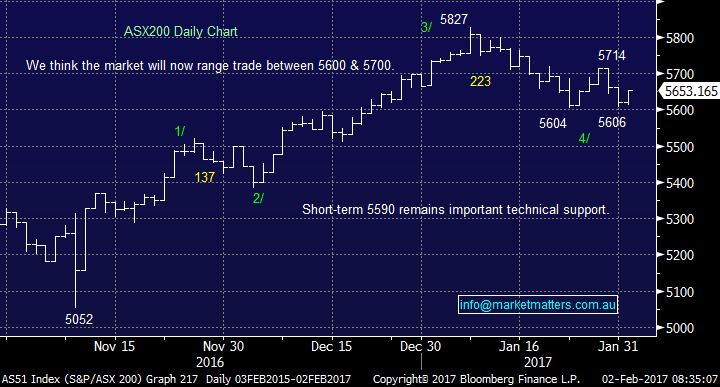

Stocks continue to climb a wall of worry as investors have one eye the Whitehouse awaiting Donald Trump’s next move while watching US equities continuing to eke out gains to all-time highs. We have now seen ~34% of the S&P500 stocks have now reported with 74% beating earnings estimates giving the market a nice shot in the arm (although that number is pretty much in-line with historical averages).

Really bullish, there's more to go in the reflation rally

Please enter your login details

Forgot password? Request a One Time Password or reset your password

One Time Password

Check your email for an email from [email protected]

Subject: Your OTP for Account Access

This email will have a code you can use as your One Time Password for instant access

To reset your password, enter your email address

A link to create a new password will be sent to the email address you have registered to your account.

Enter and confirm your new password

Congratulations your password has been reset

Sorry, but your key is expired.

Sorry, but your key is invalid.

Something go wrong.

Only available to Market Matters members

Hi, this is only available to members. Join today and access the latest views on the latest developments from a professional money manager.

Smart Phone App

Our Smart Phone App will give you access to much of our content and notifications. Download for free today.