Author: james Carter

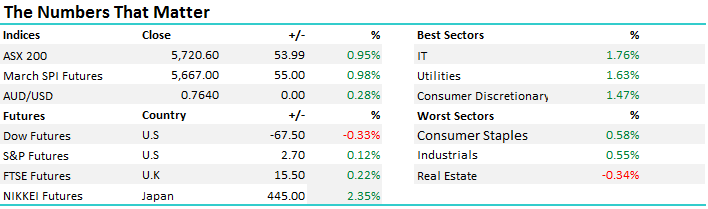

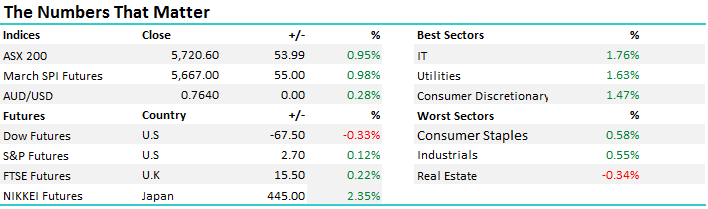

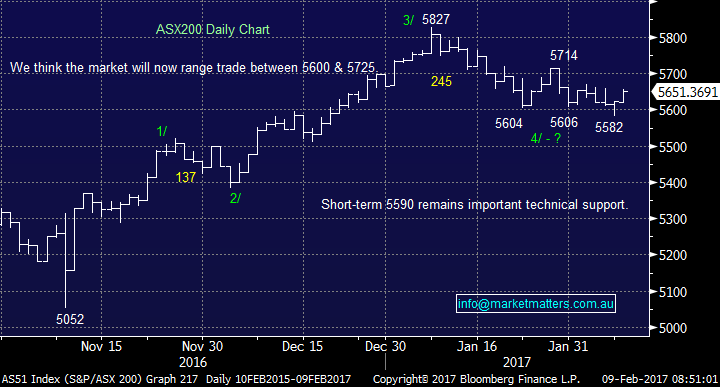

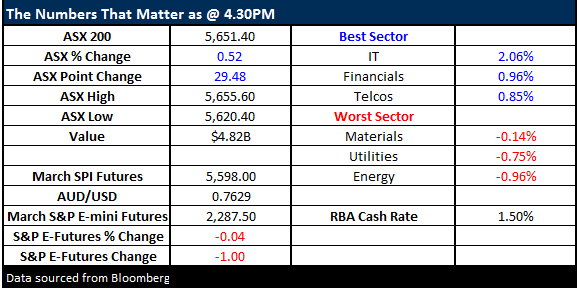

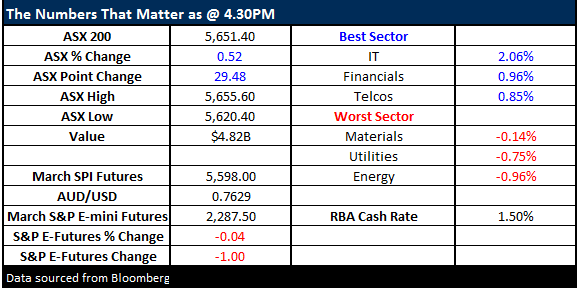

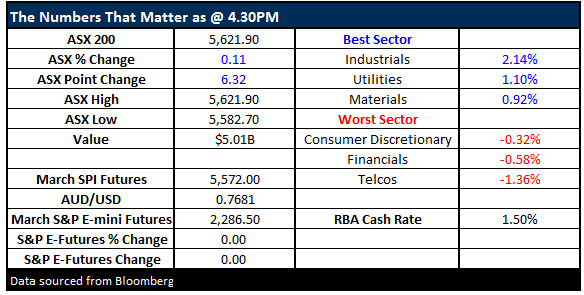

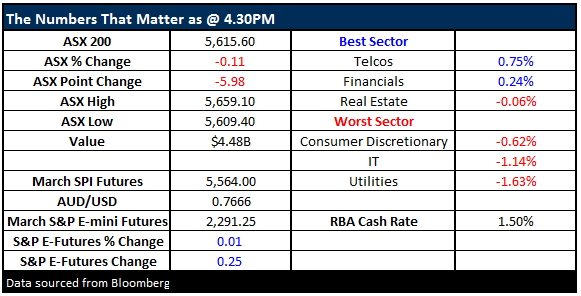

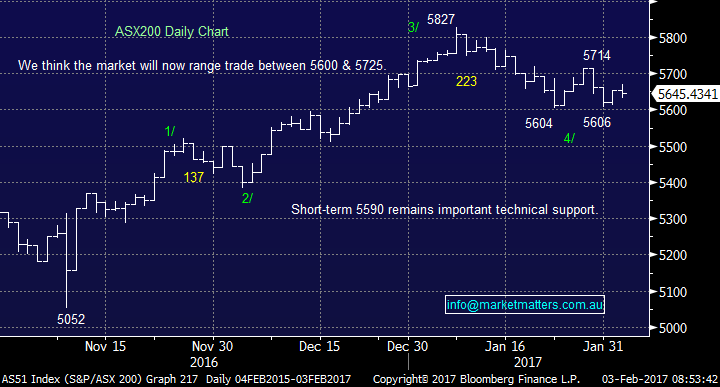

The ASX200 has bounced nicely after its failed attempt to break under the 5,600 level, with yesterday’s company reports aiding the positive sentiment e.g. Seven Group (SVW) +14.4%, Premier Investments (PMV) +11.9% and Carsales.com (CAR) +7.8%. The only real negative on the reporting front was Glenworth Mortgage Insurance (GMA) -14.8%, which fell as mortgage stress increases on Australian property, currently focused in mining areas. While we do not see a local property crash like many “experts”, our outlook is definitely on the soft side with any decent increase for property over the next few years extremely hard to rationalize.

**CORRECTION; In the afternoon report yesterday, we referred to a buy price in SGR of ~$3.76. This obviously should have been ~$4.76**

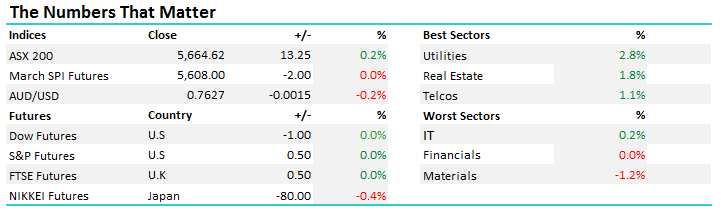

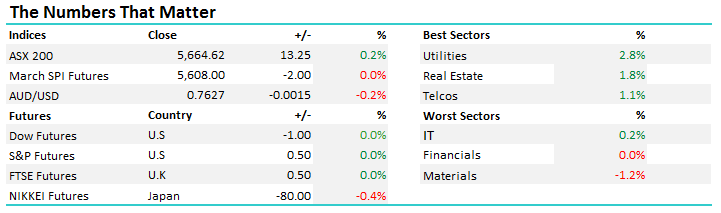

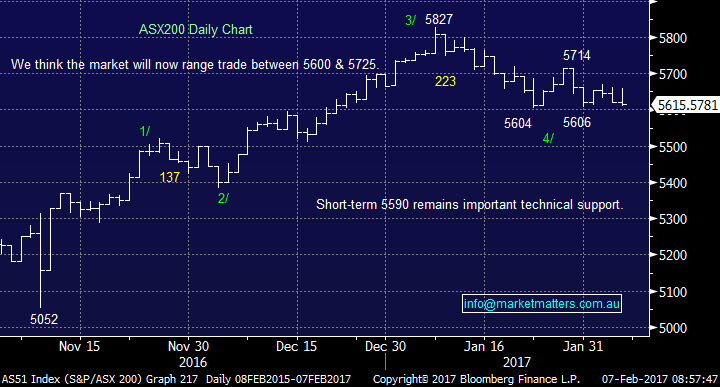

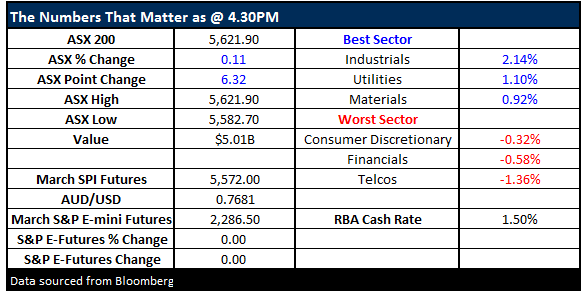

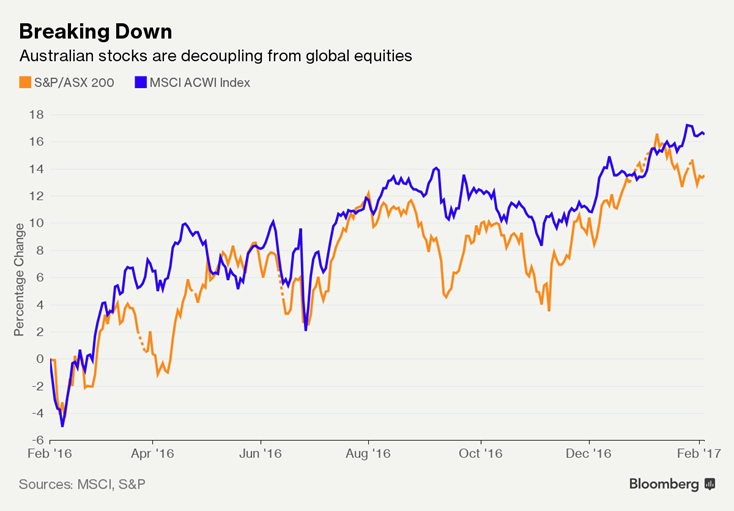

The local share market continues to feel very “saggy” at best, falling 6-points yesterday after the Dow rallied 188-points to test its all-time high. This morning the ASX200 will again test 5600 support, a 220-point / 4% correction while global equities remain firm, not great price action from local stocks. Australian investors have certainly moved into the “glass half empty” mindset and while the momentum remains poor reallocation of our 24.5% cash position into the market will definitely not be aggressive – things just do not “feel” right at present. Ideal candidates at present, are stocks with a low correlation to the ASX200 index i.e. low beta stocks.

Bloomberg this morning is leading with an interesting story titled “The Stock Market down under is decoupling from the world”, are we being cast aside? Over the last 5-years local stocks have been the region’s most correlated index to global index heavyweights the S&P500 and MSCI World Index but this has unravelled so far in 2017.The reason is simple the US Fed is looking to raise interest rates 3 times this year but in Australia markets are only factoring in a 15% chance of rise over the same period – a definite relative negative for our local banks – which make up a large portion of our index.

Global markets are now treading water after pricing in some major positives since Donald Trump’s election victory, investors simply want to see some justification for the rerating stocks have enjoyed. This is normal trading activity after a 15.3% rally in the ASX200, in this case since the US election. It’s easy to understand the psychological dynamic, nobody wants too much market exposure before a weekend when “Tweets” will be flying but conversely nobody is keen to liquidate large stock holdings with clearly strengthening US and global economies.

Really bullish, there's more to go in the reflation rally

Please enter your login details

Forgot password? Request a One Time Password or reset your password

One Time Password

Check your email for an email from [email protected]

Subject: Your OTP for Account Access

This email will have a code you can use as your One Time Password for instant access

To reset your password, enter your email address

A link to create a new password will be sent to the email address you have registered to your account.

Enter and confirm your new password

Congratulations your password has been reset

Sorry, but your key is expired.

Sorry, but your key is invalid.

Something go wrong.

Only available to Market Matters members

Hi, this is only available to members. Join today and access the latest views on the latest developments from a professional money manager.

Smart Phone App

Our Smart Phone App will give you access to much of our content and notifications. Download for free today.