Aussie stocks outperform again (CGC, ELD)

WHAT MATTERED TODAY

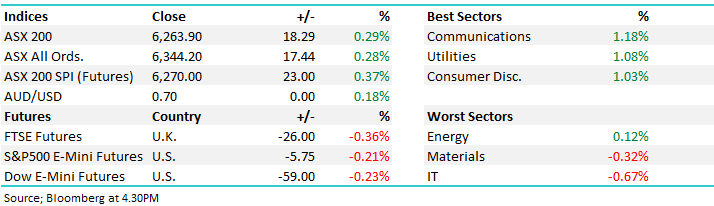

Not a lot across the ticker today although the local market continued to outperform both the US and other regional markets – the sugar hit of lower rates still working through local stocks by the look of it, although at a less aggressive pace than we saw yesterday. Overseas markets are cooling – US Futures were down 0.20% during out time zone today while Asian stocks tracked marginally lower, yet we continued to be supported.

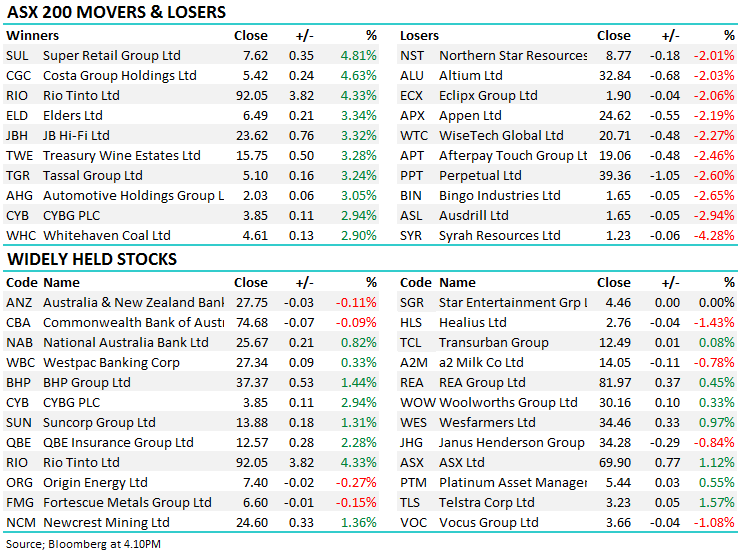

A number of stocks went ex-dividend today – QBE, BHP, RIO, S32, ASX, CTD, MND, RWC, TWE just to name a few out of the ASX200. For the most part these stocks performed well, holding at least part of the dividend helping the index rise against the tide today. Treasury Wine Estates (TWE) might have paid an 18c dividend today, but the stock put on 32c to close +2.07% higher. QBE, which we own in the Growth Portfolio, finished flat despite the 28c div it paid. The biggest by indexation points were BHP & Rio which combined paid almost 15 index pts away in dividends – but only took 8pts away today i.e. they continued their strong run of outperformance.

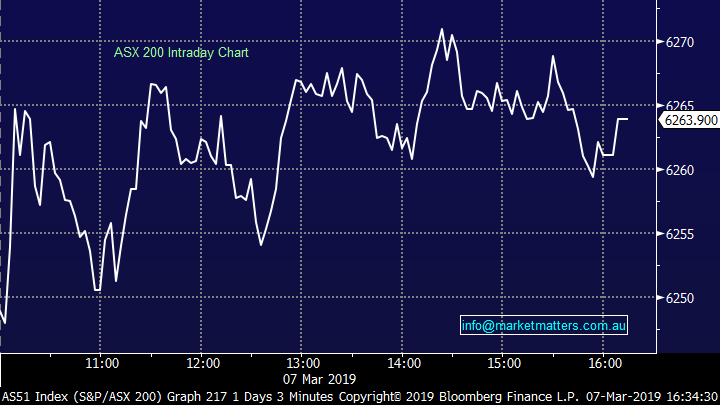

Overall today, the ASX 200 rose by 18 points or +0.29% to 6263. Dow Futures are currently trading down -61pts / -0.24%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Apart from the broader strength of the index today – its 12th day of gains out of the last 15 trading days with the market putting on more than 200pts in the process, Ag stocks caught my eye with Fruit & Veg company Costa (CGC), which we own in the Growth Portfolio adding +4.63% however there was buying across the sector – Elders (ELD) which has been on its knees of late rallied +3.34% while Salmon producer Tassal (TGR) rallied hard +3.24%, closing at new all-time highs of $5.10. Clearly some money coming back into Ag.

Reiterating what we wrote in the Weekend Report last Sunday…. M&A activity in the Agricultural sector is heating up. This is typical when highly cyclical stocks decline on the back of shorter term transient factors like weather.

· Costa Group (ASX:CGC) downgraded in January due to weak prices for berries, tomatoes and avocados rather than structural issues – the 40% decline in share price was aggressive

· Cattle company Australian Agricultural (ASX:AAC) has been hit from QLD floods - the share price is more than 40% below the years high

· Graincorp (ASX:GNC) received a takeover bid in December when its share price was low while RuralCo (ASX:RHL) received one this week from Nutrien and shares rallied 45%

Buying structurally sound companies into cyclical weakness can yield good results.

Costa Group (CGC) Chart

We wrote about the path of most pain this morning and that continued to play out today with any selling being bought . We’re clearly in a strong market – its frothy – but its strong and in that type of environment, surprises tend to come on the upside. We outlined our approach this morning, and to re-cap the crux, we’re not buyers in general here but concede that it’s hard to fight the tape – today another example of that.

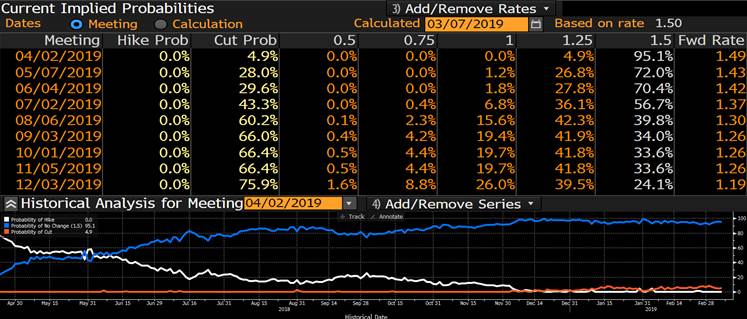

While we didn’t expect the market to be as strong as it has been in the first 2 months of the year, up 10% (I doubt anyone did and that’s why it’s there), we did think early strength in Q1/2 would play out. The sugar hit of lower rates is clearly in play at the moment, however the reality of why rates are going down will bite (at some point) and stocks will be sold.

Implied interest rate probabilities at varying points in the future. The market has now priced a 0.25% rate cut on Melbourne Cup day

Broker Moves

· TPI Enterprises Upgraded to Add at Morgans Financial; PT A$1.31

· Myer Upgraded to Hold at Deutsche Bank; PT Set to A$0.50

· Brambles Downgraded to Neutral at BofAML

· OZ Minerals Downgraded to Hold at Argonaut Securities; PT A$10

OUR CALLS

No changes today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 07/03/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.