Aussie stocks defy Trump concern & recover some of Fridays losses

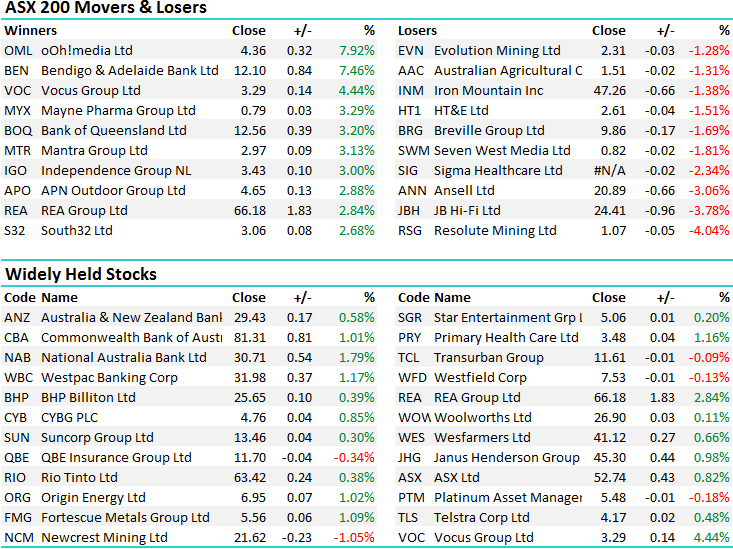

Ah…the range bound mkt continues to play out with Fridays weakness partially offset by some strength in the mkt today, and the index entering its 13th week of sideways trading action. Reporting season really heats up this week and a few of the bigger names came out today – more on that below, however the bigger corporate news out this morning was the announcement that CBA’s Ian Narev would retire by the end of the financial year after 5 ½ years in the top job.

For a number of reasons, potentially a similar hair line being one of them – I’ve been a massive fan of Ian Narev since he first joined CBA around 10 years ago. Despite the controversy in recent times, shareholders have also benefitted from it after he took over in Dec 2011. According to Bloomberg, CBA’s share price rose 66 percent since Dec 2011, beating the sector and trouncing the 35 percent gain for the S&P/ASX 200 Index over that period. Including reinvested dividends, CBA has the biggest total return of any of the big four Aussie banks during this period: 152 percent. CBA will be looking both internally and externally, and clearly they will be big shoes to fill.

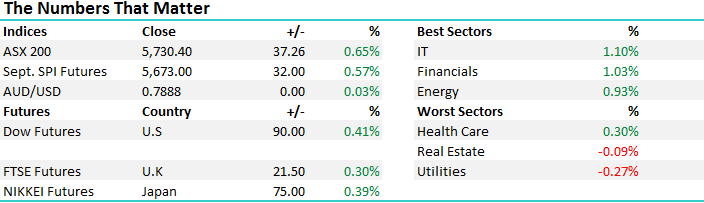

On the broader market today, the IT sector led the way while most weakness was felt in the Utilities - an overall range of +/- 35 points, a high of 5735, a low of 5700 and a close of 5730, up +37pts or +0.66%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

Bendigo Bank (BEN) – upgrades likely to flow through after BEN delivered a good result today and the stock put on +7.46% to close at $12.10. we have management in tomorrow afternoon however from the numbers today it seems theoperating environment for BEN is improving; with the outlook for margins, capital and bad debts positive. They’ve been strong in repricing loans of existing customers to improve margins and this sees the likes of Shaw and Partners analyst David Spotswood forecasting 5.9% revenue growth driven by 3.5% loan growth and 8bps margin expansion. If they assume cost growth of 2% as BEN target positive jaws and that bad debts remain well behaved, which should mean ~10% earnings per share growth plus a 5.9% dividend yield – hence why the stock was up today!

Bendigo Bank (BEN) Daily Chart

Newcrest (NCM) – missed expectations and the stock dropped, however a change in dividend policy probably helped somewhat to offset the negative share price reaction. Still, the stock was down -1.05% on the back of the result however it probably should have been more. In terms of underlying earnings, they printed $349m vs $442m consensus which is a big miss.

Newcrest Daily Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 14/08/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here