Aussie market rallies for 3rd straight day (WPL, JHX, TLS)

WHAT MATTERED TODAY

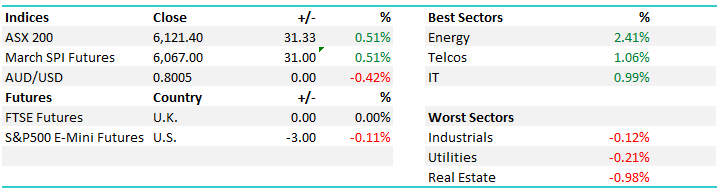

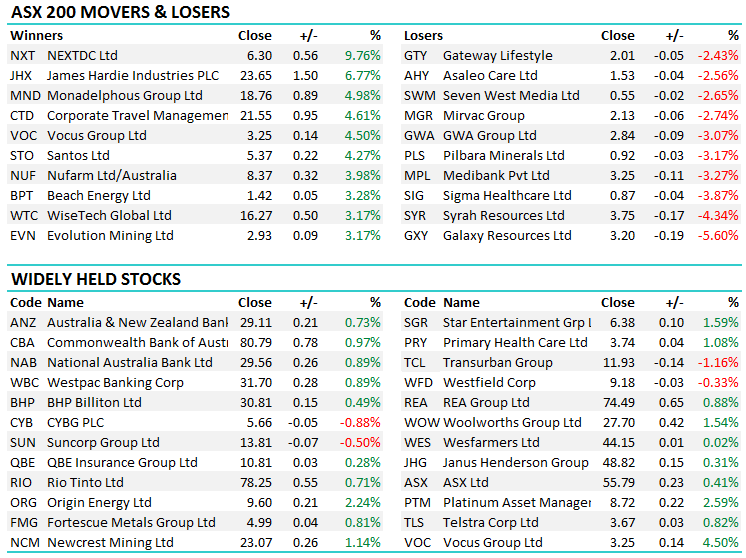

A good day for Aussie stocks with strong buying coming from the 10.30am low - the market closing on its highs. Energy the standout courtesy of a stronger Oil price with recent weakness in the sector now a distant memory. The S&P/ASX 200 index advanced 29 points, or 0.5 per cent, to 6119, the broader All Ordinaries index also rose 29 points, to 0.5 per cent, to 6228, while the Australian dollar reached US79.99c in late trading.

The excellent rebound over the last 3-days has seen the market up from the 5993 low on Wednesday to close today at 6121, a rally of 128pts/ 2.1%. February is traditionally a strong month for equities with the 5 year average printing a gain of 2.80% the traditional run up into the April peak, before the old sell in May adage becomes worth following…

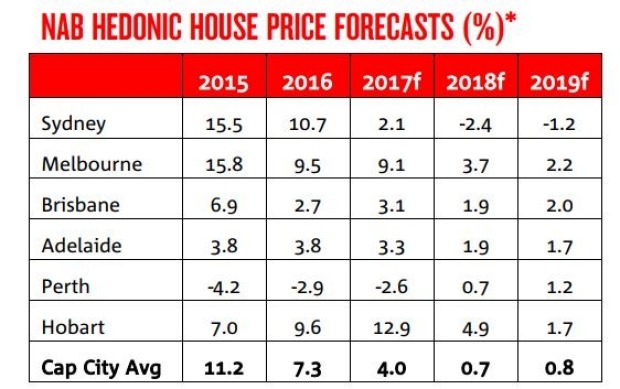

NAB was out today with a revision to their house price forecasts with a faster-than-expected deterioration in Sydney causing them to cut their outlook for prices this year. Here’s a quick snapshot…

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

CATCHING OUR EYE

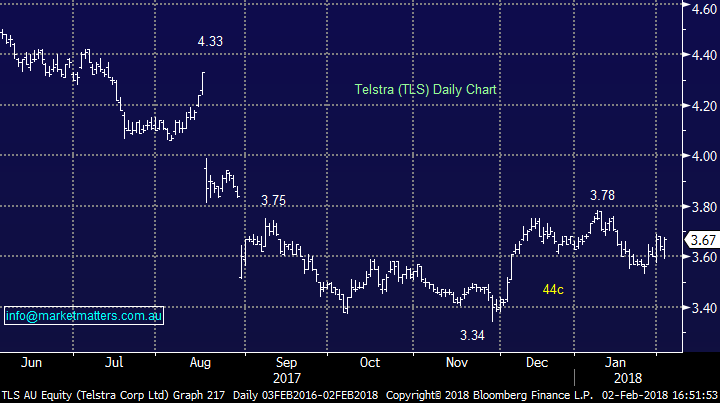

1.Telstra (TLS) $3.67 / +0.82%; hoisted the white flag today writing down the last of a $500 million investment in the video streaming business Ooyala, which was meant to be the credible rival to You Tube – the mkt knew this was coming, the write down was non-cash however it does highlight to sort of heightened risk in TLS’s ‘new business’ as it positions itself as a global tech player, Anyway, the stock bucked the news today and finished higher. We like TLS here and think it trades higher into Feb/Mar dividend.

Telstra Daily Chart

2. Woodside (WPL) $34.24 / 2.06%; Oil rebounded from this week’s weakness, up 2% overnight and another 0.4% in Asian trade, dragging the energy names with it. We are looking for oil to edge higher this year as pessimism seen last year wears off, heading toward US$70 a barrel. We own WPL in both portfolios.

Woodside Daily Chart

3.James Hardie (JHX) $23.65 / 6.77%; The building supplies company rallied strongly after announcing Q3 results pre-market, with a healthy quarterly profit of ~$70mil. The result was primarily driven by margin growth, with prices rising faster than volume which was received well by the market, mostly because the company is still producing below expectations and capacity whilst also reducing costs and inefficiencies within the business. Another $US earner that is starting to fly.

James Hardie Daily Chart

OUR CALLS

No changes today in the portfolio’s

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 02/02/2017. 5.09PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here