Aussie economy in good shape, index back above 6000 (BHP, MTS, MYO, XRO)

WHAT MATTERED TODAY

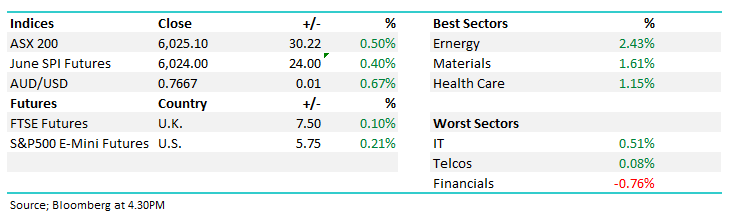

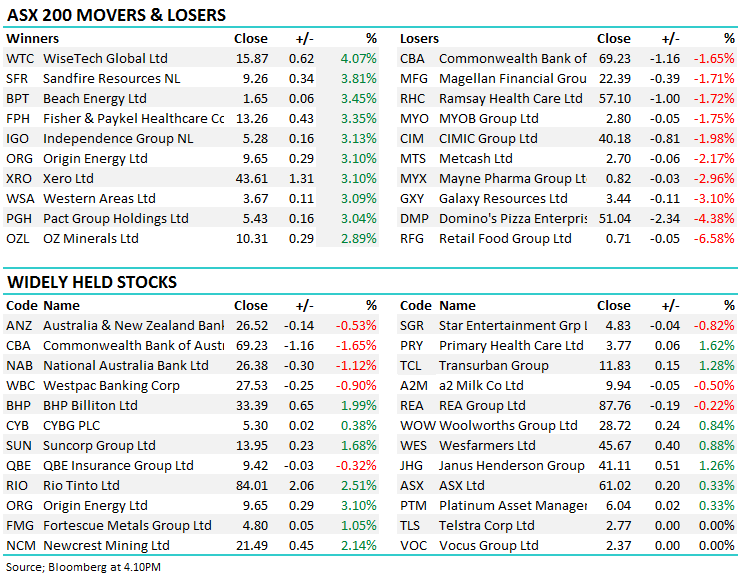

The market continues to chop around the 6000 level as the market rallied back above that level today. Buying was spurred on by strong Aussie GDP data released late in the morning showing a growth of 1% for the quarter, and 3.1% year on year. It was the resource names taking the index higher as the commodity index rebounded from yesterday’s weakness, oil the biggest beneficiary of this. Banks were weak, CBA in particular which had a large range, initially opening higher before falling more than 1% to finish $69.23. Westpac, ANZ & NAB were also lower with Morgan Stanley talking down the dividends – we tend not to agree with this view, although NAB’s dividend seems most susceptible, a view we discussed for the income report three weeks ago here.

Hear James talk about state of the market in today’s Direct from the Desk here:

Overall, the market put on 30pts or +0.5% to close at 6025.

ASX200 Chart

ASX200 Chart

CATCHING OUR EYE

Broker moves; Morgan Stanley came up with an interesting call on the accounting software providers today, initiating Xero with a buy, and MYOB with a sell. MYOB has come under fire recently after their proposal to buy a portion of Reckon, another software provider, fell through due to regulatory delays. We wrote about this last week, identifying the outperformance XRO is having over MYO that was outlined by Morgan Stanley today:

MYOB’s business is getting creamed by the more aggressive competitor Xero (XRO) with the proposed deal to buy some of the Reckon Business seen as a way to claw back some lost ground, however regulators delayed the move and today MYO have walked – unable to come to terms on an extended time table. MYO dropped sharply today, clearly broke through support on big volume. We have no interest in MYO

· MYOB (MYO AU): Rated New Underweight at Morgan Stanley; PT A$2.80

· Xero (XRO AU): Xero Rated New Overweight at Morgan Stanley; PT A$50

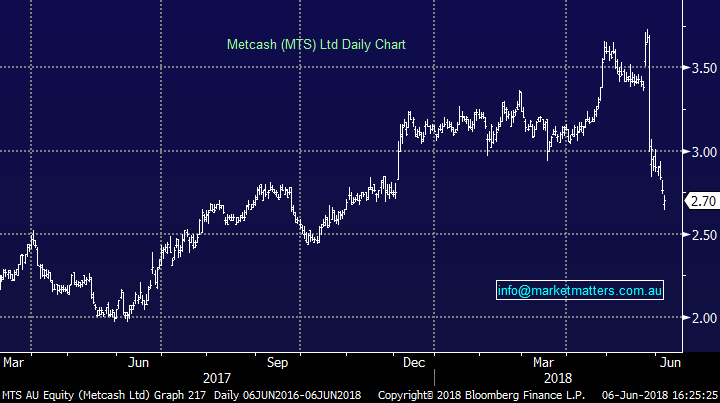

Metcash (MTS) $2.70 / -2.17%; weak today following the announcement the company would take a $352m non-cash impairment charge, devaluing a number of assets within the Metcash portfolio. The review into assets and subsequent impairment charge follows the loss of a large South Australian customer in Drakes Supermarkets that was announced a fortnight ago. With the weakness today, the market seems to have double charged Metcash for the loss of a large customer and it is starting to look interesting here after a fall of ~25% in just a week or so.

Metcash (MTS) Chart

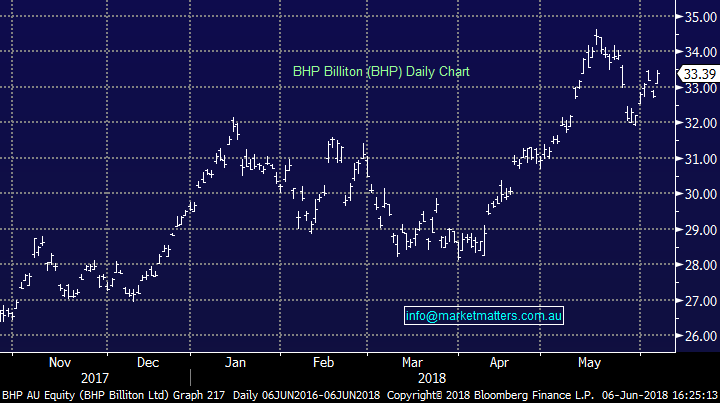

BHP Billiton (BHP) $33.39 / +1.99%; BHP rallied today, thanks to a tail wind from the commodity deck and rumours that their US Shale asset sale caught a number of bids in the first round. The reported bids fall between $US 7b and $US 9b which is slightly below what the market was expecting (up to $US 14b) however there are a few moving parts in the sale and the bids appear to exclude a number of assets within the portfolio. The market liked the ‘low ball’ bids as a number of players appear to be involved and BHP’s options are very much open at this stage. The company has flagged that all proceeds would return directly to the shareholder in the form of buy backs or dividends, a stock we like because of this.

BHP Billiton (BHP) Chart

OUR CALLS

We bought Eclipx in the income Portfolio, also looking to sell VCX above $2.70 (closed $2.69) and then buy IGL around $2.23 (closed $2.26). See income report here.

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 06/06/2018.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here