At what level does AMP become a buy?

Stock

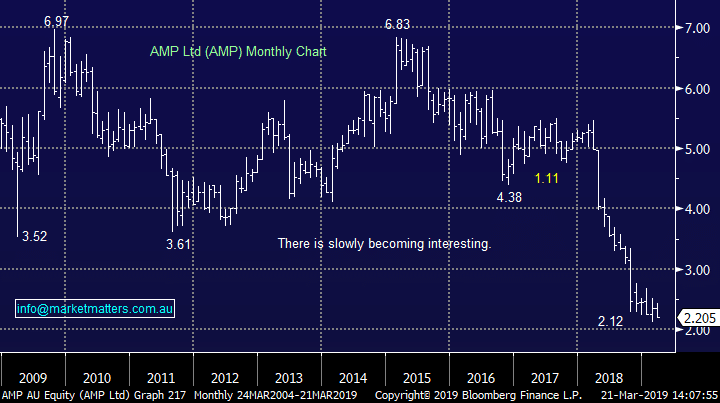

AMP Ltd (AMP) $2.205 as at 25/03/2019

Event

AMP is a household name that’s managed to do almost everything wrong over the last 3-years with the stock now trading at $2.20, down from around $5.00 12 months ago and a pre-GFC high above $10. 3 key points;- AMP is cheap versus the sector and versus itself historically – trading on an FY19 P/E of ~11.6x relative to its long term overage of ~14.1x, while its on just 1 x price to book value. Consensus yield is 12% grossed for franking however my analyst is forecasting just 3.60% / 90% franked for FY19.

- Since the Royal Commission we have seen some huge rallies in other members of the financial sector e.g. IOOF (IFL) +63% and Perpetual (PPT) +51%. While these stocks have different business mixes they show how “relief rallies” can accelerate when they gather momentum, particularly in financial stocks.

- While the selling in AMP has lost momentum, technically there needs to be a high volume, capitulation style low before buying this ‘dog’ for a turnaround.

Market Matters Take/Outlook