ASX storms higher as RBA pledges further support (PNI)

WHAT MATTERED TODAY

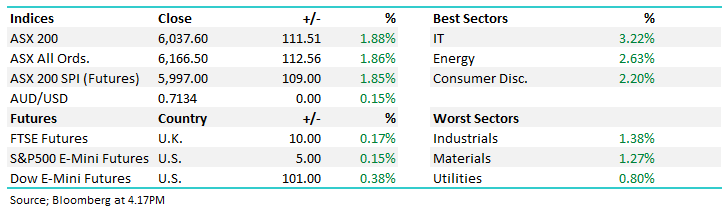

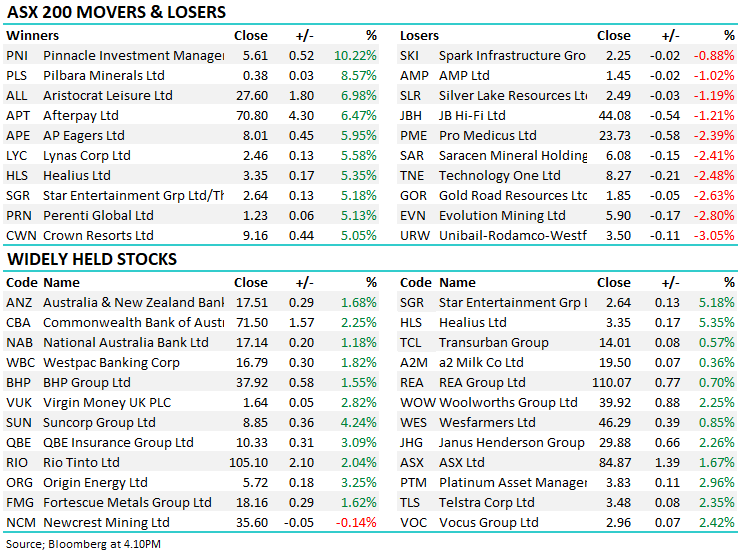

Stocks bounced back today with some decent buying across the board, IT names followed the US Tech sector higher while Energy + the retailers were also in the spotlight; however, gains were broad based with 10-11 sectors finishing in the black. Most love was in the BNPL space, Afterpay (APT) +6.5 after closing its Share Purchase Plan with about $136mworth of applications, Z1P up ~9% while Openpay (OPY) put on more than 20%. On the flipside, the gold stocks lagged Evolution Mining (EVN) -2.8%, Perseus (PRU) -2.6% while Newcrest (NCM) was mostly flat.

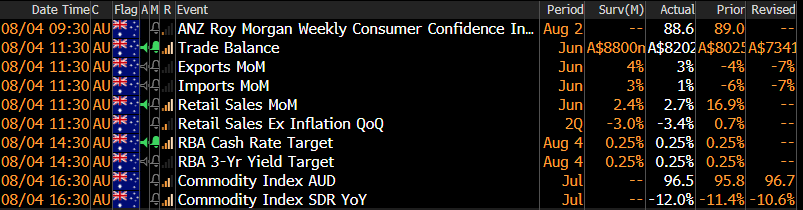

The RBA held rates on hold today as expected however they talked up further bond purchases plus said they could do more. Elsewhere, retail sales data was also a touch better month on month.

Source: Bloomberg

Around the region, Asian stocks were strong today, most of the region up nearly 2% while US Futures ticked higher throughout our time zone.

Overall, the ASX 200 added +111pts / +1.88% to close at 6037. Dow Futures are trading up +101pts / +0.38%

LOCAL REPORTING CALENDAR: CLICK HERE **Please note, data sourced from Bloomberg, not all ASX companies are on this list and dates can vary**

Today we had BWP Trust (BWP) / beat and Pinnacle (PNI) / beat which Harry covers off below. Nothing of significance out tomorrow.

I didn’t get a chance to update you this morning, so here it is this afternoon.

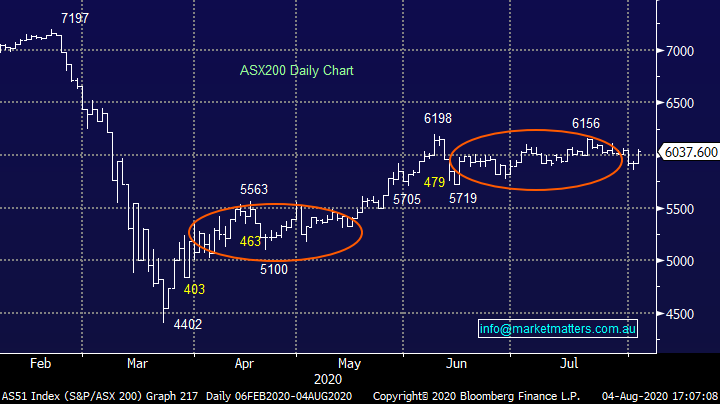

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

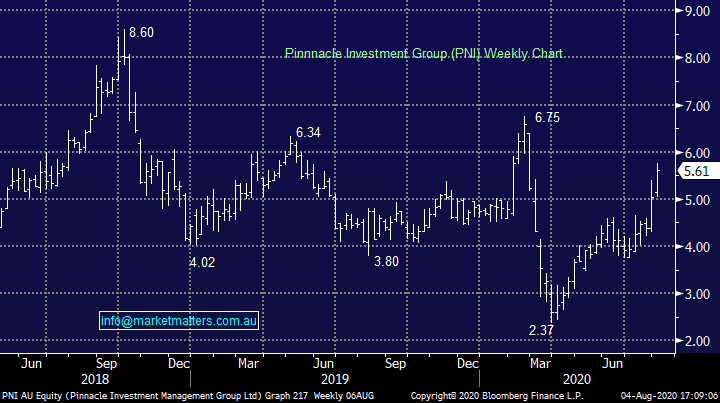

Pinnacle (PNI) +10.22%: jumped out of the gates today continuing the recent strength to rally to 5 month highs on the back of a strong full year report. Pinnacle, which provides support frameworks and distribution for a number of boutique funds it also invests in, saw profit climb 5.6% to $32.2m for FY20 despite the volatility in markets over the 12 months. Key to the result was ~15% increase in profit from its equity interest in the managers with 5 out of the 16 affiliate funds producing a performance fee, while part of the growth also came from the stake purchased in Coolabah Capital in December. FUM across the network grew $4.4b in the period with $3b inflows & an additional $3b in acquired funds (Coolabah) more than offsetting $1.6b of negative performance.

Pinnacle is doing a lot right in the funds management segment which is facing a big structural shift – for the most part boutique funds are struggling to get going as large players with low costs dominate flows. Pinnacle has found a way to leverage the often-better returns of smaller funds on a larger scale, while using its distribution platform to generate flows which drops down to returns on the equity stakes. We like this business

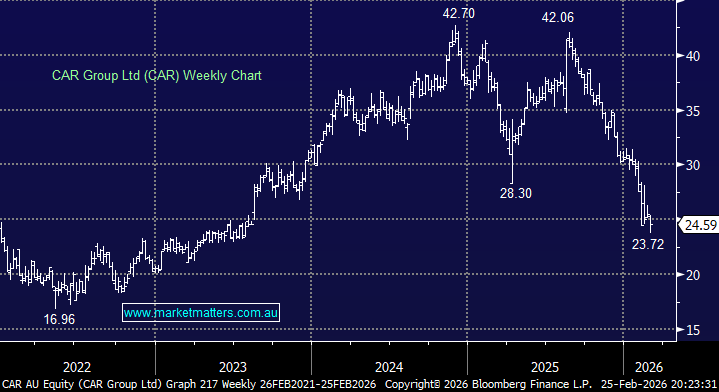

Pinnacle (PNI) Chart

BROKER MOVES:

**Not available today**

OUR CALLS

No changes today

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.