ASX starts the week on the back foot (HSO, SYR)

WHAT MATTERED TODAY

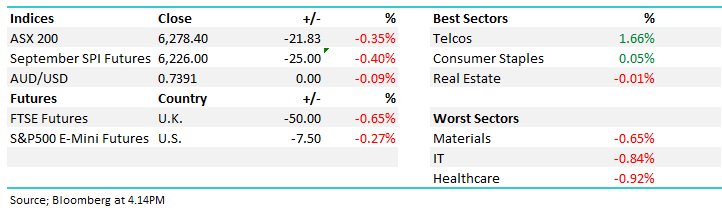

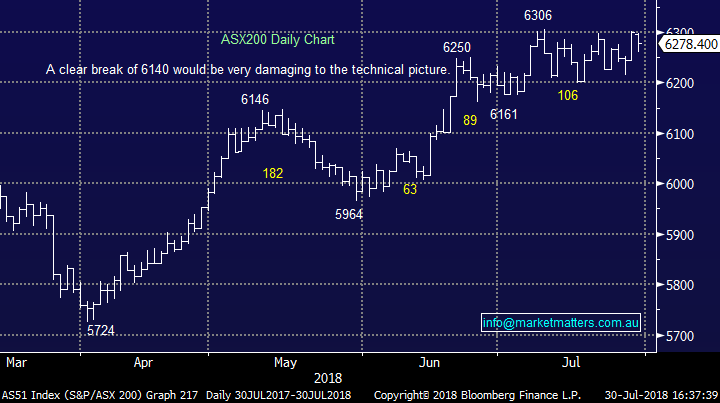

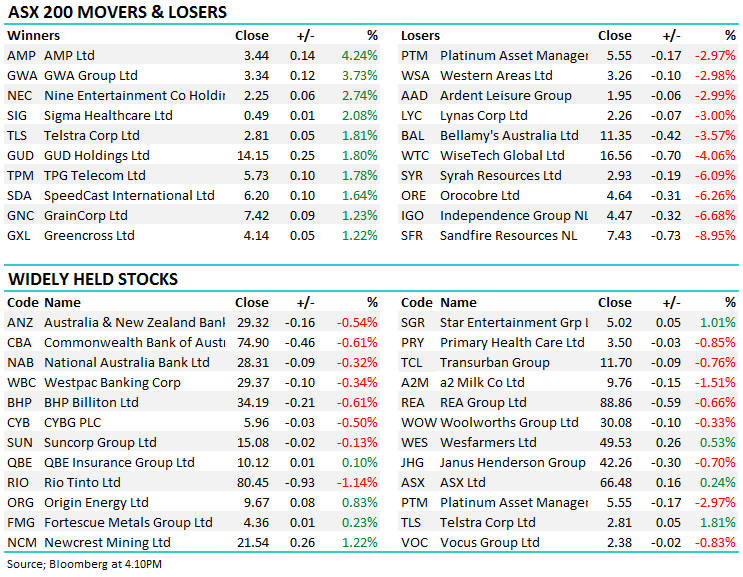

Early weakness across the board this morning thanks to a combination of factors over the weekend which sent Asian markets lower and had US Futures trade for most of the session in the red, however there was some tentative buying in the afternoon that saw the index trade up from earlier lows to settle about mid-range for the day. Some of the sectors that have struggled recently did better with Telcos supported by a good move in TLS which closed up +1.81% to $2.81 offsetting that, some of the $US earners continued to struggle – Resmed (RMD) for instance looks bearish short term as does CSL, the former down -2.92% while the later was off 0.89% to close at $197.54.

The Lithium names are clearly struggling at the moment, most down somewhere between 2% & 7% today - as the Lithium sector globally comes under pressure on continuing concerns around a gap between growing supplies and ultimate demand in the near term.

Elsewhere, a number of production reports across the ticker today, Syrah (SYR) released some weak numbers and the stock was sold fairly hard – down -6.09% – the shorts will be waving the flag on this one as they continue to have teething problems ramping up production while Independence Group (IGO) snuck out a weaker production print after market on Friday (not a good look) and the market digested that this morning selling the stock off by -6.68% to close at $4.47.

Overall, the ASX200 lost -21points today or -0.35% to close at 6278 – Dow Futures are currently trading down 42pts. We remain neutral here, with the trigger to turn more bearish at 6140 on the XJO.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; Some mixed calls on AMP out today with Credit Suisse saying that AMP May Shed A$15b in Assets Managed to End 2019 however they go onto say that fees are market leading and they won’t require a substantial cut to the dividend…I’m confused! Elsewhere, Bells was less opaque slapping a $2.75 PT on the struggling wealth manager, while JP Morgan upgraded it to overweight - the market seemed to throw more weight behind the CS call – the stock adding 4.24% to lead the ASX 200 higher.

Broker calls - AMP

Some of the mid cap base metals producers have started to struggle in recent session, and UBS had this to say recently….base metal producers likely to feel trade war impact more acutely than other miners, could respond by curtailing some operations and reducing capital expenditure. Producers of metals including copper, zinc, lead, nickel and aluminum are exposed as there’s more trade in the materials between U.S. and China than bulk commodities, and the metals won’t win the same boost from any rise in Chinese infrastructure spending

Elsewhere…

· Amcor Upgraded to Overweight at Morgan Stanley; PT A$15.80

· Trade Me Rated New Neutral at UBS; PT NZ$4.75

· AMP Upgraded to Overweight at JPMorgan; PT A$3.90

· Aristocrat Downgraded to Sell at Morningstar

· Beach Energy Upgraded to Hold at Morningstar

· Netwealth Group Cut to Underperform at Credit Suisse; PT A$7.35

· Sandfire Downgraded to Sector Perform at RBC; Price Target A$9

Syrah Resources (SYR) $2.93 / -6.09%; The graphite miner disappointed the market this morning with their June quarter production report that saw a poor start to life at their Balama mine. Now six months in to production, the mine has struggled to hit the expected run rate, and production guidance has been lowered over 15% - they now expect 135,000 to 145,0000 tonnes of graphite for 2018. Investors are also concerned about pricing for Syrah’s product. It’s Balama mine is regarded as one of the highest grade and largest graphite deposits, however Syrah has seen output sold at a discount to the market benchmark blamed on “product mix, prioritised shipments to key customers.”

As of last week Syrah was the second highest shorted company on the ASX, and the shorts may be looking for more blood as Syrah’s cash balance continues to fall – the cash balance has already halved this year to $US 57mil, another $US 17mil is expected to go out the door during the September quarter while the company also expects to spend a further $US 40 mil on a Battery Anode Material (BAM) plant in Louisiana. This now looks to be cum-raise!

Syrah Resources (SYR) Chart

Healthscope (HSO) $2.21 / -0.9%; This morning HSO announced the sale of its Asian Pathology business to private equity group TPG for just under A$300m. The deal includes 39 pathology labs in Singapore, Malaysia and Vietnam and exits HSO from the pathology sub-sector in Asia. The price was weaker than perhaps the market had expected transacting on 15.3x EBITDA, the bulk of Asian healthcare trading around the 20x mark, however to achieve that they would have needed some strategic industry players to remain in the race at the pointy end of the bidding process, but alas, it was a battle between Private Equity players with the deal being done on a lower multiple.

The pathology business accounted for $18.2m of HSO’s earnings in 2017 or around 4% of the group while the hospital operator will book a gain on the transaction of $165m in their 2018/19 results. HSO has had a tough time recently in terms of their domestic hospital operations, however there have been a number of potential acquirers knocking on the door in recent times - the sale of the Pathology Division could be another reason for them to come back into the fray.

This is a fascinating corporate play at the moment with a number of suitors circling the private healthcare operator, the latest of which offered $2.50 per share. The market is expecting EBITDA of $398.1m for FY18 when they report later in August on revenue of $2.419b, dropping down to a profit of $165.2m down from $180m last year. The dividend is expected to come in at 3.2cps, which is down from the 3.5cps they paid this time last year. We like the stocks at current levels.

Healthscope (HSO) Chart

OUR CALLS

No trades across the MM portfolios today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 30/07/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here