ASX seasonality – what can we expect from the market in October?

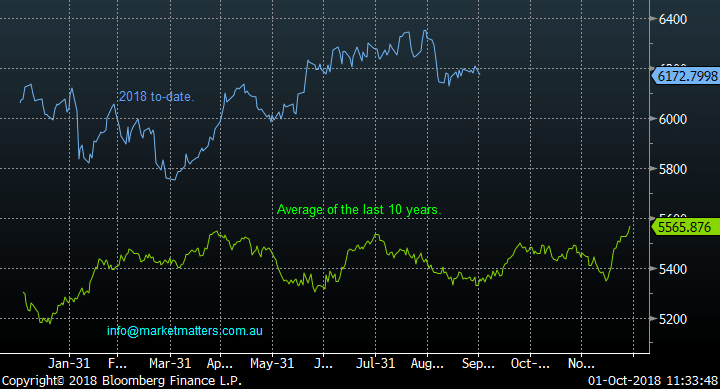

The ASX200 has theoretically left behind one of the weakest periods of the calendar and entered a far more upbeat time of the year. Many more seasoned investors can be forgiven for becoming nervous on the mention of October having witnessed the 20% plunge in 1987 but the statistics tell an overall different tale, whether we go back 10 or 50-years. Over the last 10-years, basically since the GFC:

- In August & September the combined average loss for the ASX is over -2%, in 2018 we saw a decline of -1.58% i.e. not a dramatic variation.

- Conversely October is usually strong rallying on average just under 1%, assisted by investors ploughing some of their dividends back into the market – this year almost $19bn is being paid out to loyal investors.

- Moving forward November is usually a poor month falling -1.83% while December usually rallies nicely into Christmas up +1.56%.