ASX remains resilient – BHP update after CEO meeting (BHP)

WHAT MATTERED TODAY

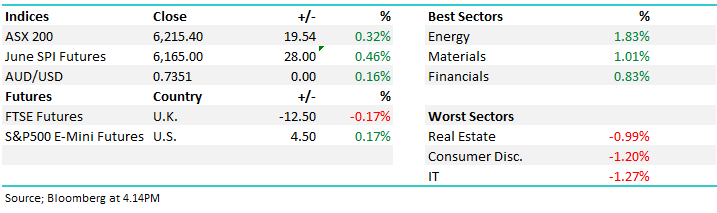

Another session where local stocks looked poised for weakness early on before buyers stepped in and the market bucked the negative overseas leads – grinding higher throughout the day as US Futures ticked up. We mentioned this morning an interesting stat around end of year window dressing and the data supports it, showing that the 4-day period that straddles the financial year end (Last 2-days of FY & first 2-days of FY) is inordinately bullish for Australian equity investors averaging a return of +0.95%, significantly above the average for a time period like that. Why? Because fund managers want to support the market into FY end, particularly when cash levels are reasonable high across FUM land – as they are at the moment.

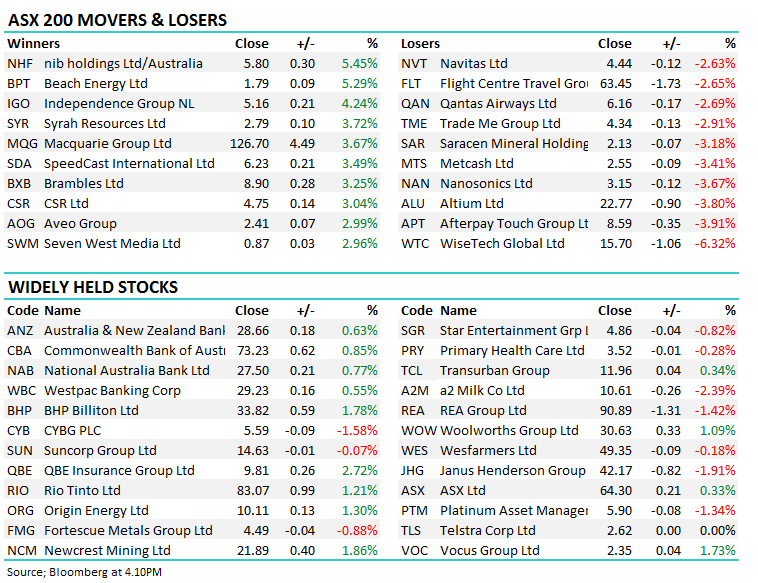

Our market overall actually looks reasonable which is certainly different to what we’re seeing in the U.S where major markets have broken support and money is coming out of the leaders – mainly the tech stocks. That was also a theme on our market today with some of the local tech names hit hard – Wisetech (WTC) down -6.3%, Afterpay (APT) down -3.91% and Altium (ALU) down -3.8% a few examples while the platform provider HUB24 (HUB) was whacked again down to a low of $11 only to bounce back to close at $11.86. Still, the stock’s down from its May high of $15.40 – a 28% shellacking. Another example of why these high growth / high value stocks will present a very big risk to capital if market sentiment turns against them.

It doesn’t really matter the quality of the business or the huge growth runway in front of them hot money is clearly parked in these names and like today – if we see sentiment turn on some perceived risk (in terms of HUB it’s about changing regulation for platforms) – then these can move hard to the downside. Again, it’s not a reflection of the business, but simply market sentiment. If the NASDAQ does what we expect it to do – fall another ~10%, these stocks are in for some pain in the short term.

Overall, the ASX 200 added 19pts or +0.31% to close at 6215 – Not a bad result given the Dow Jones fell -452pts from its session high last night ending the session off -165pts by the close. At time of writing, Dow Futures are up +54pts.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; A lot of activity again today across the broker world today – Morgan Stanley seems late to the party ending their long standing preference for Chinese equities over Australia (after the Chinese mkt has tanked 20%!). They cut China to equal-weight from overweight after they adjusted their country model. They also reckon we should avoid the Hospitals’ in Australia’s August Earnings Season with ‘No compelling reason’ to hold Healthscope pre-new hospital open.

Elsewhere…

· NIB Holdings Upgraded to Buy at Deutsche Bank; PT Set to A$6.55

· CSR Upgraded to Hold at Deutsche Bank; PT Set to A$4.88

· QBE Insurance Upgraded to Hold at Deutsche Bank; PT Set to A$10

· Suncorp Downgraded to Hold at Deutsche Bank; PT Set to A$14.50

· Auckland Airport Rated New Sell at Insight Investment Research

BHP Billiton (BHP) $33.82 / +1.78%; Shaw’s v’good Resource Analyst Peter O’Connor who I’ve interviewed a few times – last one here – had a meeting with BHP’s CEO today, Andrew McKenzie. He’s what Rocky had to say….

It’s always good to meet (and interrogate) company executives not least because these interactions are invariably a barometer of the company’s current positioning and performance … we always walk away with key points, some new some reinforced but all worthwhile debating. In this regard for the latest meeting with BHP’s CEO we took away (i) Prepared remarks (spin if you will) x6, (ii) No comments x6 (iii) President Xi meeting summary (last week) for 1 hour including 2 questions for 2 minutes (last week) – in sporting parlance that would be 2 for 60? - and (iv) a bunch of other minutiae …

And the guts of it.

No comments x5. Shale, copper, potash, DLC, iron ore port capacity

US shale divestment – “No comment on sale process because it is in the most delicate part of the sale process …” Also there are NO distractions from other potential divestments – “the whole company focus is on the shale sale …” These comments we take as a good sign of progress ü

Potash - “Nothing more to add …” But added the following remarks nonetheless …still looking for a partner. Need to finish shafts, have now reached the orebody. Not in hurry to make a decision. There is still high risk in this project. Have dealt with the politics of Jansen (no use it or lose it provisions). Key risk form here is the market. And lastly added “not into shareholder polling!?!”

Capital management and shale proceeds. The process of distributing the US shale divestment proceeds (~US$10bn – remember the CFO said “it won’t touch the sides.”) including the inclusion of some/all of BHP’s franking credit pile) = “This process/decision has to go to the board first so NO comment.”

Escondida labour negotiations –“ZERO comment …” Seems like a labour agreement is close. Good for Escondida but NOT for copper supply and price.

DLC structure – “No further comments.” We do see the case for simplification but conditions are not favourable today … uncertainty is large and requisite returns are not high enough. But return element could change …

Iron ore shenanigans (Port Hedland port capacity) - regarding the current AGO/FMG/MIN/Hancock imbroglio which is potentially an important issue for BHP being the largest user of PH. Anyway, “No comment, it’s too early to tell.”

Prepared remarks x6 bookended the meeting

The “messages” delivered at both ends of the meeting – essentially a roadmap for the positioning of BHP against the current inflationary backdrop - broadly encompassed the following 6 areas (i) Operating model changed (again?), (ii) Maintenance, (iii) Technology, (iv) Capital management & latent capacity, (v) CULTURE change and (vi) (De)bureaucratize BHP. The last two comments really piqued our interest.

BHP CEO met with President Xi – key takeaways

Within the context of a one hour meeting the BHP CEO snuck in 2 questions for a total of 2 minutes covering – (i) protection and tariffs and (ii) partnerships with western companies.

President Xi feedback …

Very strong focus on environment and these may take priority potentially over commercial issues … But there could be a reduction in Chinese growth on this agenda and a number of 5-6% as opposed to >6%. Good strength in Chinese economy and they don’t see disruption from tariffs (yet). Geopolitical harmony - very strong on China opening up … WTO access has been a success. They will cover loopholes in IP theft and believe the world is one village and China wants to be a leading villager!!

Rocky’s view – use weakness to buy BHP – fits in with our thinking, although we’re looking for a sub $30 price tag for now.

BHP Chart

OUR CALLS

No trades in the MM Portfolios today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 28/6/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here