ASX rallies on despite the virus news (Z1P, OPY, APT, WPL)

WHAT MATTERED TODAY

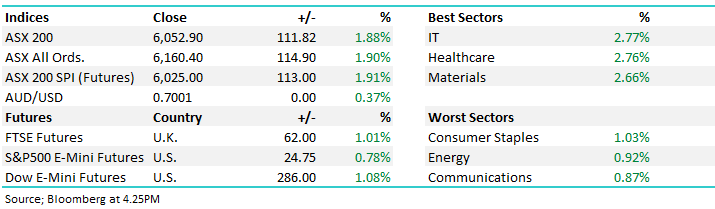

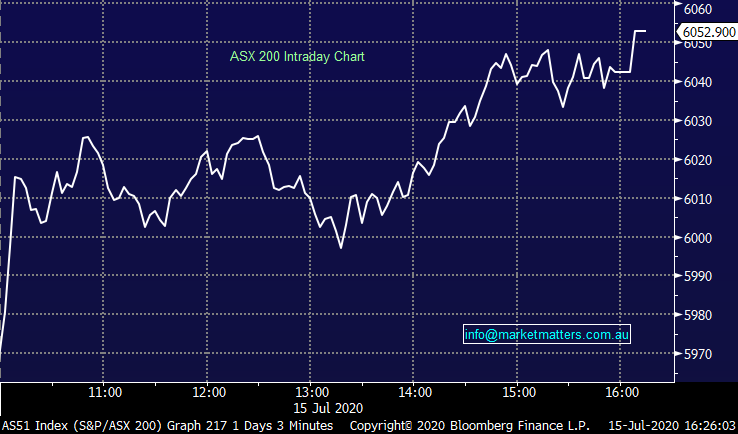

A bullish session for Australian stocks today with a strong rebound across the board, 90% of companies in the ASX 200 closing in the green as all sectors made gains. Stocks popped initially then grinded higher throughout the session. The Iron Ore miners + Copper stocks were again strong today and the reflation trade is certainly building momentum despite the growing headlines on the virus front, particularly in terms of increased lockdowns domestically.

Asian markets had more of a mixed day, the Nikkei in Japan adding more than 1.5% however Hong Kong and China both fell. US Futures were higher early and remained up around 1% for most of our session, having been initially supported by favourable vaccine trial results.

Overall, the ASX 200 added +111pts / +1.88% to close at 6052. Dow Futures are trading up +286pts / 1.08%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

3 payments related stocks with updates today…

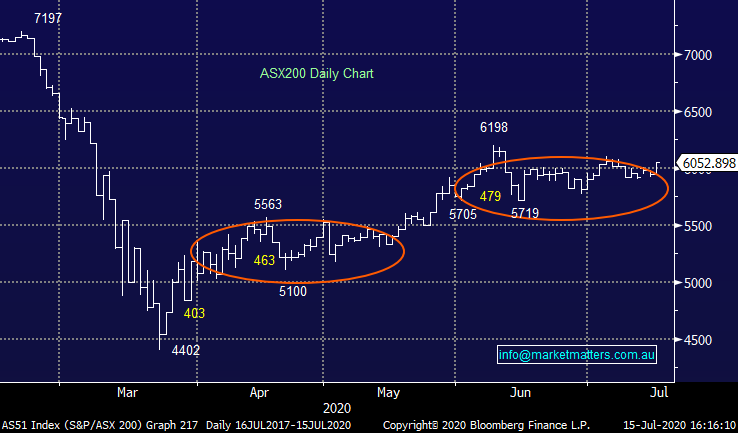

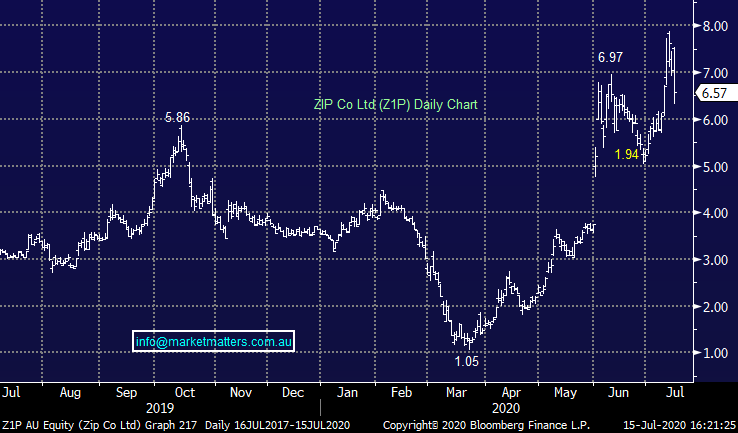

Z1P Co (Z1P) -6.68%: Out with their quarterly this morning and the stock initially popped ~7% higher before closing ~7% lower – a few things at play. COVID-19 has benefitted Zip and caused a structural change/acceleration in the sector. Overall transaction value was strong and ahead of expectations however customer numbers were a tad below some in the market while there was an uptick in bad debts, hence the volatility at the stock level.

· 4Q-20 TV came in at $570.7m for the group up 62% YoY. June TV was ~$200m or over $2.4Bn annualised and ahead of Zip targets. During every month of COVID Zip volumes have grown.

· Customer numbers were over 2.1m for the core Zip group with the run rate for growth on a per day basis in the last 2 months of the FY averaging ~2,400. During FY20 (excluding Quad) Zip added 820k customers overall

· In terms of the Quad update provided, they now have over 1.8m customers (1.492m at announced acquisition for 3Q20). In the key USA market Quad is adding 3.3-4k customers a day. On a consolidated (Quad + Zip) zip is adding ~6k customers per day currently and has 3.94m customers.

Growth remains strong, it seemed more like a buy the rumour, sell the fact sort of trading performance today.

Z1P Co (Z1P) Chart

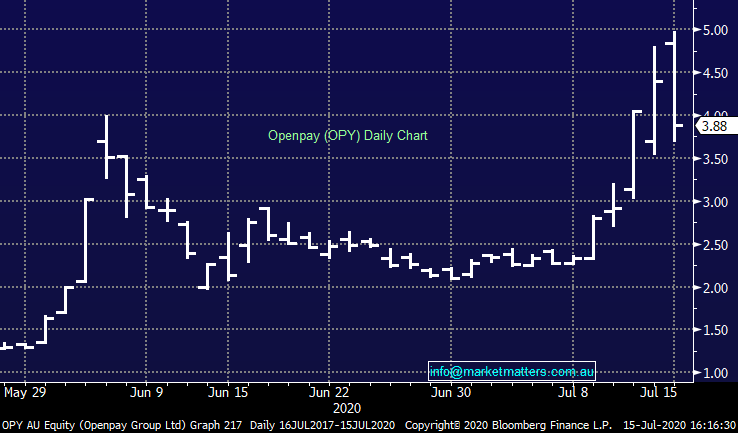

Openpay (OPY) -11.82%: Another BNPL stock that cooled today after a pretty hot few sessions. They too were out with an update this morning and unsurprisingly they booked records across the board. The headlines are obviously impressive and the momentum in the underlying business is strong, however the volumes in this stock show it’s a favourite toy of the short-term day traders. There’s no harm in that, however it will lead to big volatility and we’re certainly seeing that play out. In terms of today’s update, they showed active plans up +229% on pcp, active customers up +141% on pcp and active Merchants +52% relative to pcp which translated into Transaction Value (TV) up 98% to $192.8m. One underwhelming part of the equation was the revenue line, which increased +45% from a very low base to print $4.5m for the quarter and $18m for the full year, about a 16% miss to our analysts’ expectations.

Consistent with other retailers’ commentary, there has been a swift and material shift from physical to online shopping for customers, increasing from 7% 15 months ago to now ~39%. OPY is capped at just ~$350m, its small and could really do anything from here.

All in all, todays update was fine and nothing earth shattering on the conference call either.

Openpay (OPY) Chart

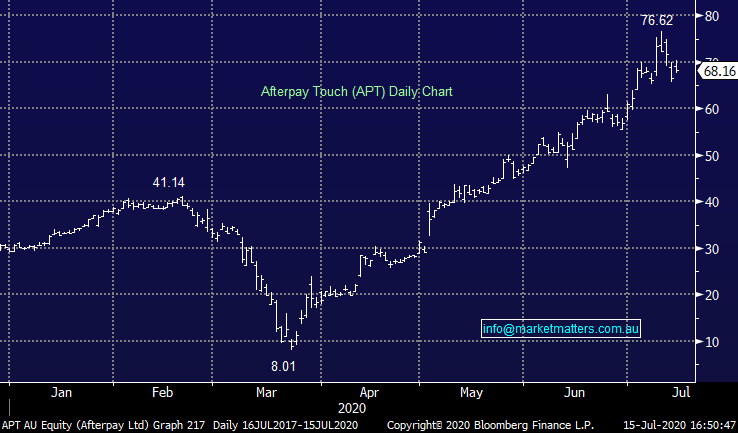

Afterpay (APT) +2.42%: While not as exciting of a session as we have seen in recent days from APT, it wasn’t without some further positive news. The sector leader has partnered with both Google and Apple to integrate their products into the tech giants payment platforms. US and Australian customers will be able to add Afterpay to their respective mobile wallets and use the platform directly in store while Apple Pay customers will be able to use the technology for online purchases as well. The new integration is another step from APT to differentiate themselves from the common credit card with many banks refusing to fully integrate this type of technology for their customers.

Afterpay (APT) Chart

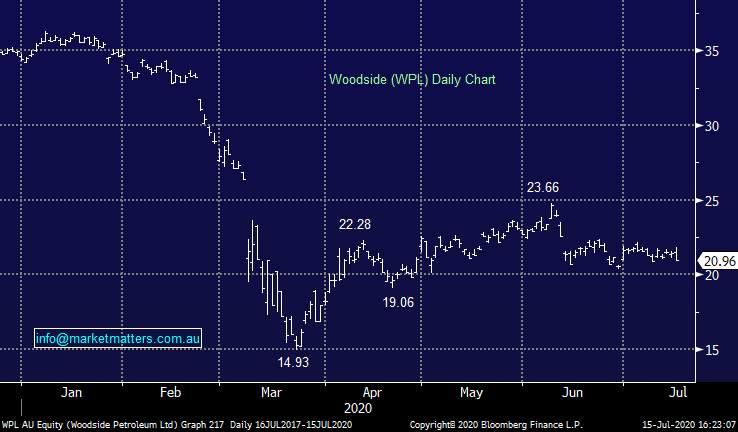

Woodside (WPL) -2.15%: today they announced a quarterly update plus they took the knife to the carrying value of their assets following a review. The write-downs totalled US$4.5b post tax, a large number and it does have some impact on the balance sheet as gearing moves up to 19% but something the market was prepared for given the review was well known, and a number of peers had similar levels of write-downs as the energy names update their future price expectations. The Pluto reserve downgrade saw Woodside shave around 120mmboe off the asset with the company essentially telling the market that they do not plan to develop the lower quality and harder to develop sections of the deposit – a smart move when trying to firstly conserve capex, and secondly keep a lid on production costs.

The quarterly itself was a little better to read from shareholders – production was up 7% but revenue down nearly 30% on a 40% drop in average realised price. Exploration expenditure was cut by nearly 3 quarters to just $US63m as WPL looks to stay lean. More detail will come at the half year result, but they remain in a decent position to pay a dividend. A commodity tailwind over the medium term is most important for Woodside – they have plenty of liquification assets in WA that they will want to see utilized. A higher price will be needed to re-incentivise investment and a Brent price of $US60/bbl is the magic number to do just that.

Woodside (WPL) Chart

BROKER MOVES:

- Challenger Raised to Hold at Bell Potter; PT A$4.30

- TPG Telecom Raised to Overweight at Morgan Stanley; PT A$10

- Monadelphous Raised to Buy at Morningstar

- Orora Cut to Hold at Jefferies; PT A$2.75

- IDP Education Raised to Buy at Blue Ocean; PT A$17

OUR CALLS

No changes today

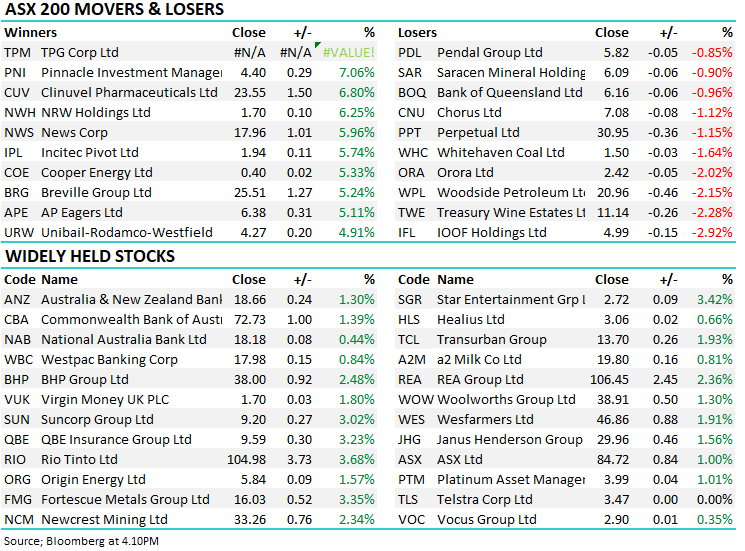

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.