ASX rallies from early low – closes flat (WPL, HUB, JBH) **International Equities Portfolio – Buy XOM US + Global ETF Portfolio – Buy QQQ US**

WHAT MATTERED TODAY

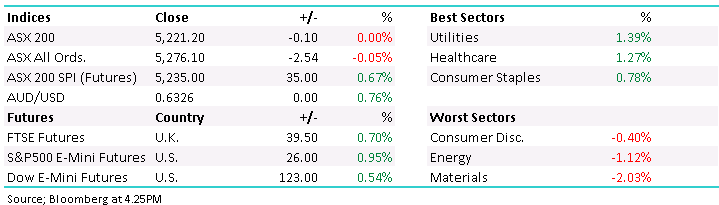

A very resilient market today with the index rallying +130pts from the early session lows. Obviously, weakness overseas weighed early, as did the Oil price + the negative headlines don’t help however when markets rally, as the local index did today against the odds it’s a sign of underlying strength. From a technical perspective, pullbacks are part of trend formation and while the weakness we’ve seen in March was extreme, the bounce has also been aggressive one.

As suggested this morning, we regard this current retracement as a correction to the sharp rally from March’s 4402 low with technical targets at 5120 and 5000. We had a preference for 5000 in this mornings note however we’ve bounced from the 5100 level today putting on a quick +120pts.

Today the ASX 200 finished flat at 5221 - Dow Futures are trading up +123pts/+0.54%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

Ramsay Healthcare (RHC) – Trading Halt - Quick discussion – click here

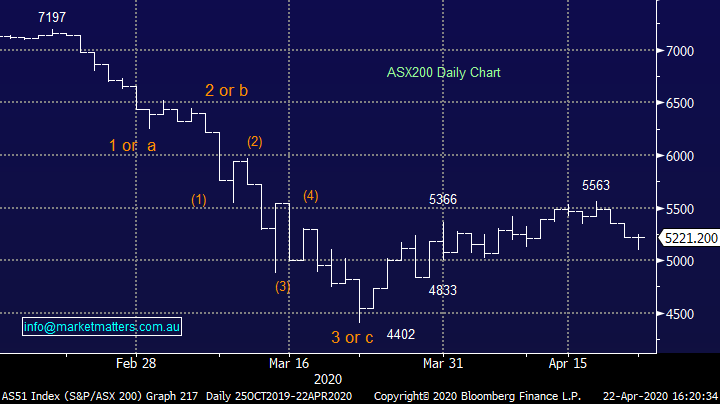

Oil Equities: A lot of airtime at the moment being given to the Oil price and rightly so given the unprecedented dynamics playing out in the sector, but also the investment products that are exposed to it. Oil ETFs in the spotlight for the wrong reasons and it highlights that playing an ETF can have unintended consequences.

We looked at the OOO from Betashares a number of times as a way of getting exposure to the oil price, however ETFs like this do not give a direct exposure to spot oil markets. It is an exposure to the oil futures curve, which is already pricing a big rise in the oil price over the next year. The problem with having exposure to the futures curve became apparent this week - as the monthly contracts roll forward in a weak demand environment, the near-term contract collapses.

WTI futures contracts expire on the third business day prior to the 25th of the month and therefore need to be rolled to maintain exposure. OOO’s Index gradually rolls the current contract over a five-day period commencing on the fifth business day of the month. OOO needs to roll forward the contracts into the next month at a significantly higher price - that is a big cost to the fund and the NAV of the fund will drop. Betashares themselves have been very transparent in this, and kudos to them, while we keep using the word ‘unprecedented’ it certainly does best describe this scenario.

When a commodity is in such strong contango (futures price higher than spot price) - it is difficult to gain long exposure to the underlying commodity. If it were easy, the contango wouldn't exist. In our view the best way to gain exposure is via oil equities or via an ETF that holds the underlying oil equities, hence our purchase today of FUEL on the ASX for the MM Macro ETF Portfolio.

We also discussed WPL this morning which we hold in the Income Portfolio, the stock down 1.46% today which given the backdrop of Oil prices is a reasonable outcome.

Woodside (WPL) Chart

The understatement of the day:Fitch downgraded Virgin Australia's credit rating today saying "Fitch believes Virgin Australia's balance sheet will undergo inevitable restructuring and creditors will likely have to take a haircut on outstanding debt”…..not the hardest call when voluntary administrators have been appointed.

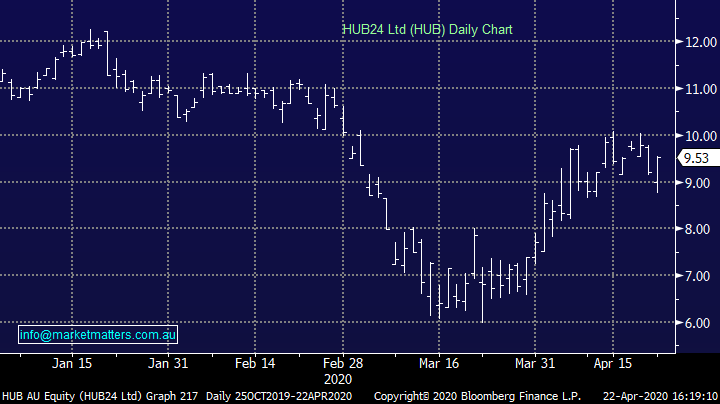

HUB24 (HUB) +3.59%: bucked early weakness and traded strongly off the lows to fare better than the index after a reasonable 3rd quarter update. While not providing financials, the update showed a 5% hit to FUA against the backdrop of a 24% hit to the ASX in the same period as falling investment values were offset by net inflows. Hub seems to be getting the run on its peers in a tightly contested space, managing to attract a good portion of financial advisers moving to independent set ups.

Market share was up 0.5% quarter on quarter which likely see earnings grow despite the hit to financial markets. Interest rate cuts though continue to detract from margins with the RBA effectively moving to 0% taking HUB’s margin over the cash balances to near nothing. Still though, Hub is winning the fight at the moment, and seems reasonably priced vs peers. One to keep an eye on.

HUB24 (HUB) Chart

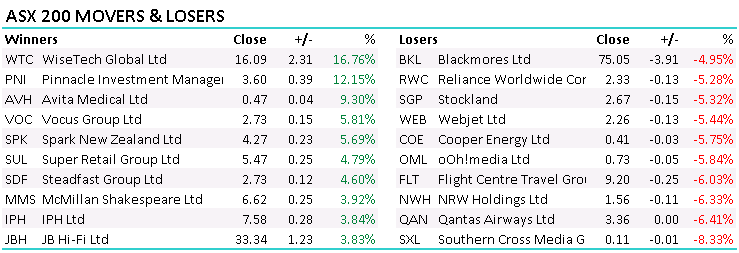

JB Hi-Fi (JBH) +3.83%; A good session from JBH and the retailers more generally following a strong retail sales print for March as people stockpiled. According to the ABS, retail sales rose 8.2% in March from February, the strongest ever gain. While the result can be put down to toilet paper and beer, and April figures will be a reality check, the retailers did well off the back of it today. We remain bullish JBH

JB Hi-Fi (JBH) Chart

BROKER MOVES:

- Gold Road Cut to Neutral at Macquarie; PT A$1.60

- Evolution Resumed Neutral at Goldman; PT A$4.40

- Mirvac Group Raised to Buy at Jefferies; PT A$2.47

- Autosports Cut to Market-Weight at Wilsons

- Alliance Aviation Raised to Overweight at Wilsons; PT A$1.87

- Adairs Cut to Market-Weight at Wilsons; PT 75 Australian cents

- Vocus Raised to Buy at Morningstar

- APA Group Cut to Hold at Morgans Financial Limited; PT A$10.81

- Oil Search Raised to Neutral at Credit Suisse; PT A$2.45

- Orica Raised to Neutral at JPMorgan; PT A$17.80

- Incitec Raised to Overweight at JPMorgan; PT A$2.95

- ARQ Group Ltd Cut to Speculative Sell at Bell Potter

- Cooper Energy Cut to Hold at Bell Potter

- Magellan Financial Cut to Hold at Ord Minnett; PT A$48.60

- Village Roadshow Cut to Hold at EL & C Baillieu; PT A$2

OUR CALLS

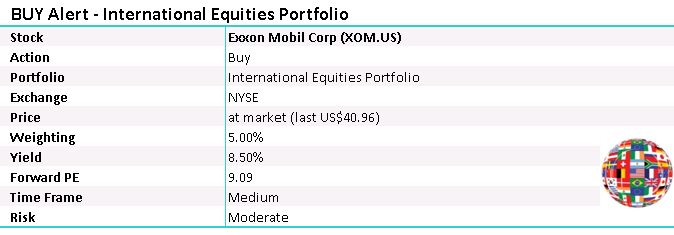

International Equities Portfolio

We are adding Exxon Mobil (XOM US) to the International Equities Portfolio as discussed, this morning

Exxon Mobil Corp (XOM US) Chart

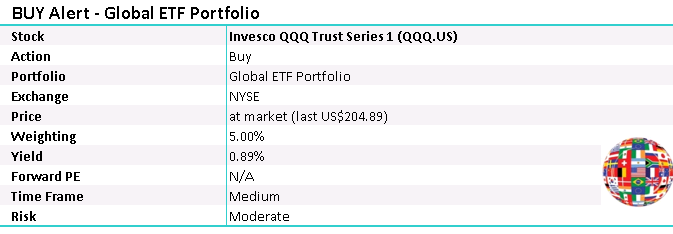

Global ETF Portfolio: Today we added FUEL to the Global ETF portfolio.

We are also adding the Nasdaq ETF as outlined below with an initial 5% weighting which we will increase further in time. This is listed overseas and is leveraged. For unlevered exposure listed on the ASX, the Betashares NASDAQ 100 ETF (NDQ) is the go.

Invesco QQQ Trust (QQQ US) Chart

Major Movers Today

Widely held stocks unavailable today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.