ASX pulls back from recent highs (WES, S32, AD8)

WHAT MATTERED TODAY

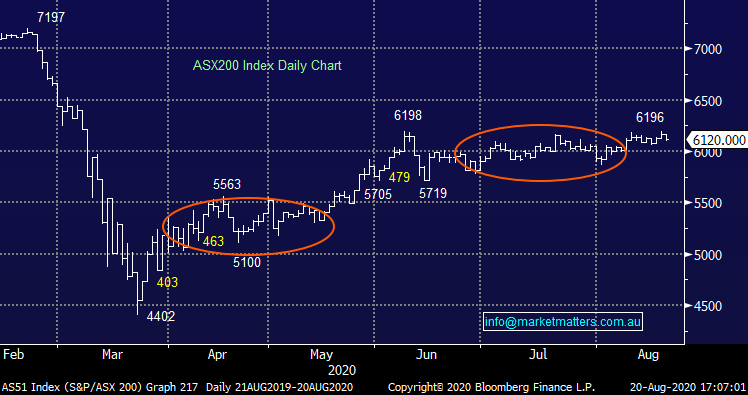

Weakness filtered into the local market today thanks to softness overseas, a mixed bag of results and some exhaustion after a decent run. Overseas markets were softer overnight + US Futures were down during our time zone as the momentum ‘tech trade’ loses some steam, however important to remember, that’s how trends work and evolve over time. A higher proportion of stocks locally fell today however it was the energy sector that really felt the brunt. Oil and other commodities lower overnight saw the sector down more than 3% today, while Healthcare snapped a two-day winning streak as CSL declined by nearly ~4%.

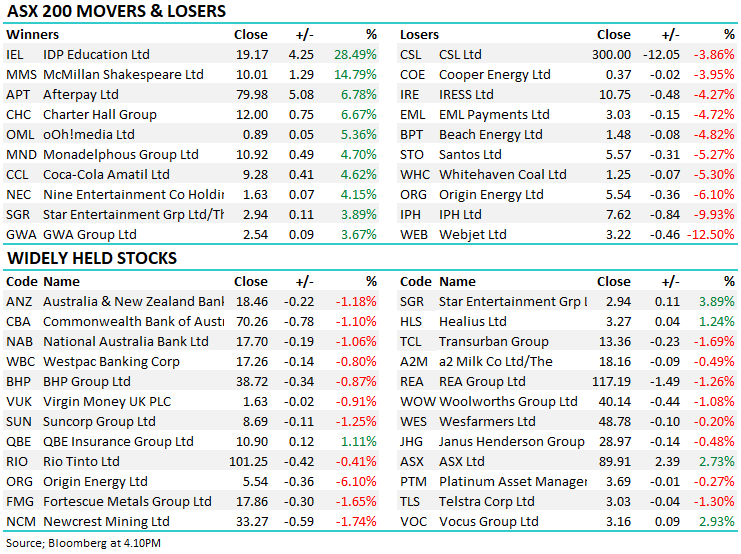

Reporting again was big and that drove some significant moves in stocks, IDP Education (IEL) a clear standout putting on 28% - Harry covers off below, while McMillan (MMS) and Afterpay (APT) rounded out the top three today, we covered APT in the morning note today with their positive update flowing across the wider sector, Z1P up +4.65% to close at $6.53.

Overall, the ASX 200 lost -47pts / -0.77% to close at 6120. Dow Futures are trading down -134pts/-0.48%

LOCAL REPORTING CALENDAR: CLICK HERE **Please note, data sourced from Bloomberg, not all ASX companies are on this list and dates can vary**

I ran through some results this morning at 11.00am on Ausbiz – click here or the image below – no logins required. Stocks discussed, WES, DHG, ORG, QAN, APT,

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

Wesfarmers (WES) -0.20%: A good result out of WES today and although the stock finished slightly lower that should be viewed against the backdrop of the stock trading at all-time highs. When looking at WES, the EBIT line in the critical one and todays result was inline, however the highlight was Bunnings which delivered FY20 LFL sales growth of +14.7% (1H20 +4.7% vs. 2H20 +25.8%). Outlook expected to “moderate” but an incredible number none-the-less.

Elsewhere, Kmart was mixed while Target is still a struggle. Officeworks doesn’t get enough love or attention, but performance is mostly rock solid – and again in FY20 with EBIT +14% and sales growth of 20%. The final dividend of 77cps was in line with expectations while they also declared a special dividend of 18cps. WES has a strong balance sheet with no debt and cash of $471m while their outlook statement was – as per usual – generic with little of substance. We remain happy holders in the income portfolio.

Wesfarmers (WES) Chart

South32 (S32) -0.47%: full year result was pretty poor vs last year but reasonable to what the market was after. EBIT was down nearly 70% but landed around 4% ahead of the market, they paid a 1USc dividend and extended the current buyback by 12 months – it has been paused but they plan to “re-commence the program as COVID-19 related operational risks subside and our financial performance improves.” The presentation wasn’t overly bullish with the company focussing on cost cutting to protect against volatile pricing. They are in the midst of offloading a number of assets. This looks to be near to the lows for the main commodities S32 deals in – we like it.

South 32 (S32) Chart

Audinate (AD8) -6.85%: took a hit today on downbeat outlook expectations. The audio hardware into software company had pre-released the result for the large part given it raised equity in July, so a $4m loss was not surprising. The company said that while revenue run-rate had improved, it had not rebounded sufficiently enough” to generate revenue growth” in the current year and hence the market began to re-rate the stock. While the tech offering and market position of Audinate is great, it does need to start showing momentum while a sizable capital raise heading into a light result screen poorly. This looks bearish

Audinate (AD8) Chart

Qantas (QAN) unch: a pretty important result for the airline, a $647m 2H pre-tax loss in the second half saw the full year come in at $124m was around what the market had pencilled in. Costs are in focus given the airline will struggle to get revenue going for the medium term. The easy cost cut was fuel which fell 25% while they spent $640m in restructuring & redundancy costs as they aim for $15b in savings over the next 3 years. Domestic is progressively starting to rebound as boarders reopen though internal state routes remain the most in demand. The recent raising means they have $3.5b in cash available, plenty of flexibility based on the current timeline of the return of travel, though this remains clouded.

IDP Education (IEL) +28.49%: standout performer today, came in with a stronger 2nd half despite COVID clearly interrupting their ability to place students. Revenue was down 2% but adj. NPAT was up 3% to $70.4m, nearly 50% better than expected. They noted an increase in students enquiring about opportunities dropping down to 31% increase in applications. 74% of students with offers in place did not plan to make changes despite and while paper forms of English testing remains around 50% lower than pre-COVID, online tests are currently averaging higher than the start of the year. A good result

BROKER MOVES

· InvoCare Cut to Neutral at Citi; PT A$11

· Domino's Pizza Enterprises Cut to Neutral at Goldman

· a2 Milk Co Ltd/The Cut to Sell at Citi

· Northern Star Raised to Outperform at Credit Suisse; PT A$15.65

· McMillan Shakespeare Raised to Outperform at Credit Suisse

· Treasury Wine Cut to Market Perform at Bernstein; PT A$10.50

· Webjet Cut to Sector Perform at RBC; PT A$3.80

· Treasury Wine Raised to Buy at Morningstar

· CSL Cut to Sell at Morningstar; PT A$254

· Vicinity Centres Cut to Underperform at Jefferies; PT A$1.05

· WiseTech Cut to Neutral at Credit Suisse; PT A$28

· Tabcorp Raised to Outperform at Credit Suisse; PT A$4.30

· Webjet Cut to Neutral at JPMorgan; PT A$3.70

· SmartGroup Cut to Hold at Morgans Financial Limited; PT A$6.75

· Silver Lake Raised to Buy at Canaccord; PT A$2.50

· EML Payments Cut to Sector Perform at RBC; PT A$3.75

· Corporate Travel Cut to Hold at Morgans Financial Limited

· Silver Lake Raised to Outperform at RBC; PT A$2.75

· Bapcor Rated New Buy at Jefferies; PT A$8.10

· Saracen Mineral Raised to Buy at Canaccord; PT A$6.20

· OZ Minerals Cut to Hold at Bell Potter; PT A$13.84

OUR CALLS

No changes today

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.