ASX now just 3% below all-time highs (MFG)

WHAT MATTERED TODAY

The market latched onto an improving dialogue between the US & China overnight ahead of the G20 meeting in Japan next week – President Trump saying that he had talked to President Xi Jinping confirming the leaders would meet at the G20 + they would send their respective teams to begin discussions beforehand. This is obviously another positive development for the market and when combined with the expectations of lower interest rates, it’s easy to comprehend markets testing all-time highs – now just ~200 points away.

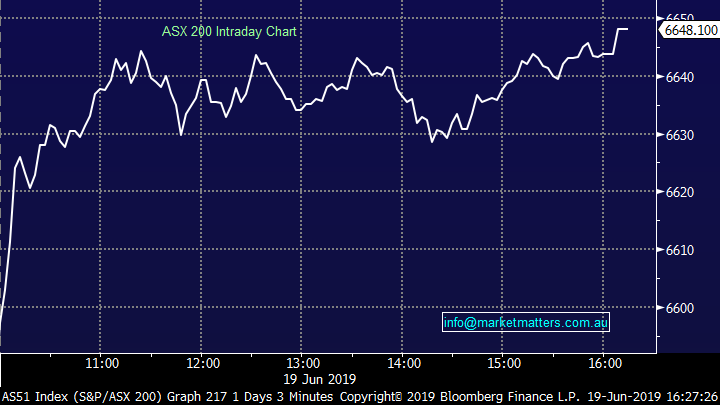

However, when I sat down with Steve Jacobs last week he made an interesting point that if trade tensions were not playing out, he doubted that the Fed would be contemplating rate cuts which are now being priced into the bond market. The consensus call is clearly that a trade deal = market higher, however if markets are focussed on interest rates, a trade deal could ultimately be a market negative given the investors are positioned aggressively for rate cuts. Market reactions are never as a straight forward as one might expect however, and once again this might prove to be a buy the rumour sell the fact sort of occasion. Anyway, a very bullish days trade in Australia with the index closing on its highs led by Energy stocks.

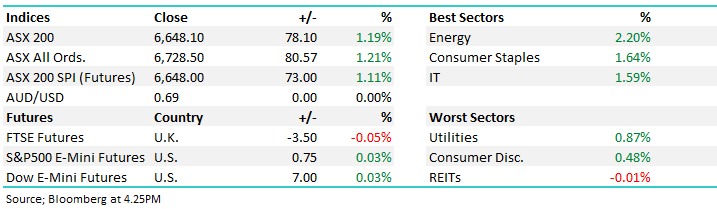

Overall, the ASX 200 added +78 points or +1.19% to 6648. Dow Futures are trading up +5pts / +0.02%.

ASX 200 Chart

ASX 200 Chart

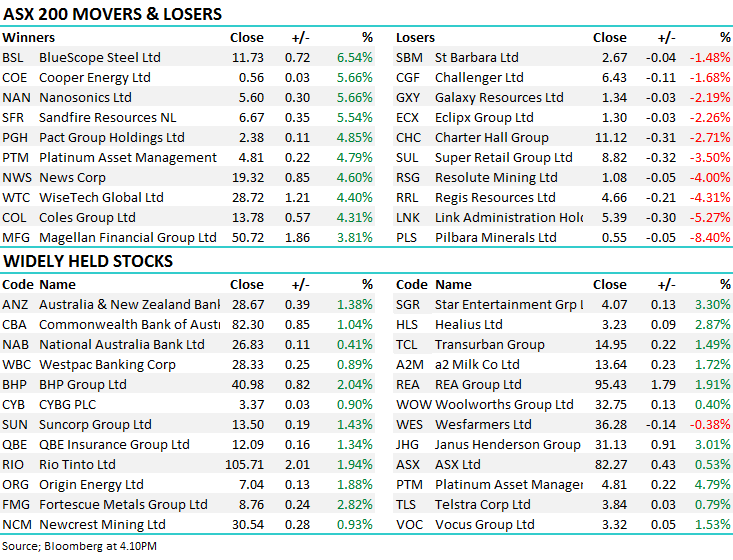

CATCHING OUR EYE;

Fund Managers; caught a bid today as money continues to find its way back into the market. With the local index just a little over 200 points, or ~3% off all-time highs, the fundies have caught a tailwind. FUM has seen significant natural growth so far this year with the market’s rally helping the cause. Platinum (PTM) added 4.79% today – the strongest performer, while Magellan (MFG) added +3.81%, the share price has more than doubled year to date. There is some value in this sector, however momentum is probably more important, and MFG has this in spades.

Magellan (MFG) Chart

Broker moves: Emeco Rated New Buy at Bell Potter Amid Improving Sector Demand - Company as profitable as it has ever been they say. We own EHL

· AGL Energy Resumed at Deutsche Bank With Hold

· Mt Gibson Raised to Outperform at Macquarie; Price Target A$1.10

· Afterpay Touch Rated New Add at CIMB; PT A$23.43

· 3P Learning Cut to Equal-weight at Morgan Stanley; PT A$1.10

· PWR Holdings Downgraded to Hold at Bell Potter; PT A$4.85

· Charter Hall Education Rated New Neutral at JPMorgan

OUR CALLS

No changes today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 19/06/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.