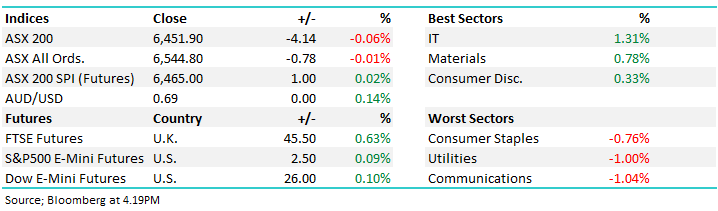

ASX muted ahead of US & UK days off (VOC, WOW, SUN)

WHAT MATTERED TODAY

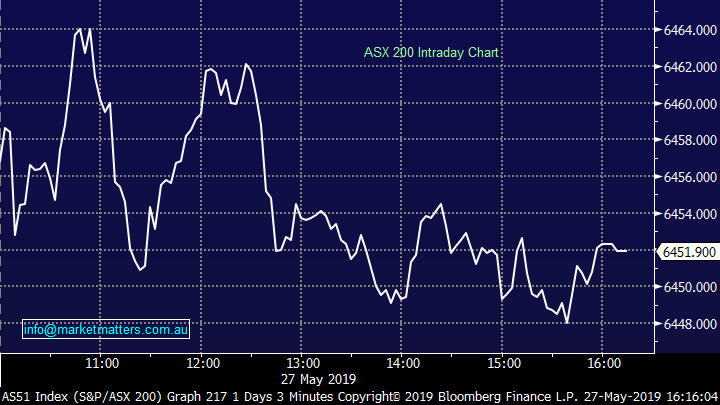

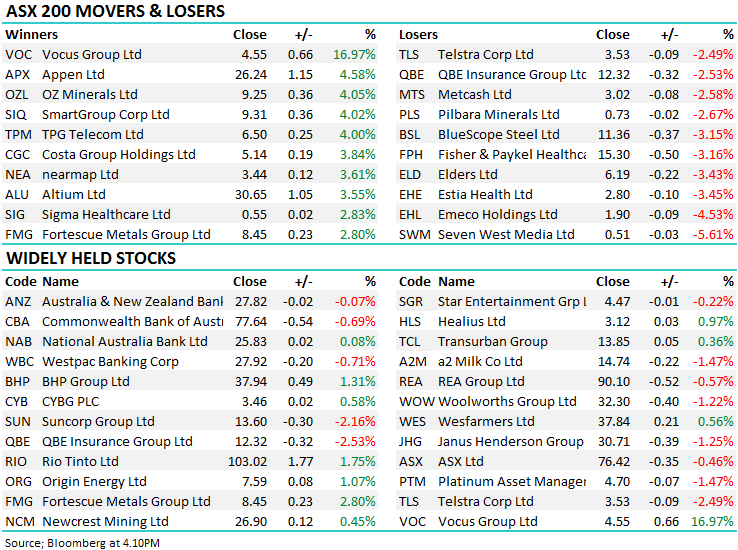

A very subdued day was seen on the ASX200 ahead of holidays in the UK & US which will see the financial markets of both countries closed tonight. The index moved within an extremely tight range of less than 20 points as some softness in the banks was offset by resource names ticking mostly higher. Barring some stock specific news around the market, the rest of the session was about as eventful as the 91st birthday I attended yesterday.

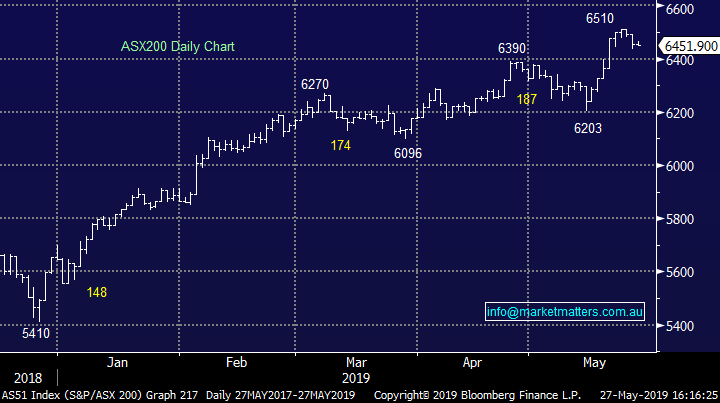

Overall today, the ASX 200 fell by -4 points or -0.06% to 6451. Dow Futures are trading up +26pts / +0.10%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Woolworths (WOW), -1.22%; announced the successful completion of its off-market buyback today. The deal was set at the maximum discount of 14% ($28.94 comprising of $4.79 capital and $24.15 fully franked dividend), and shareholders who submitted shares into the deal will be scaled back a huge 84.68% of their bid – just about expected given less than 5% of shares on issue will be bought back. Shares struggled today, with many analysts suspecting the recent outperformance of the stock can be accredited in-part to the buyback as sellers remained out of market.

Woolworths (WOW) Chart

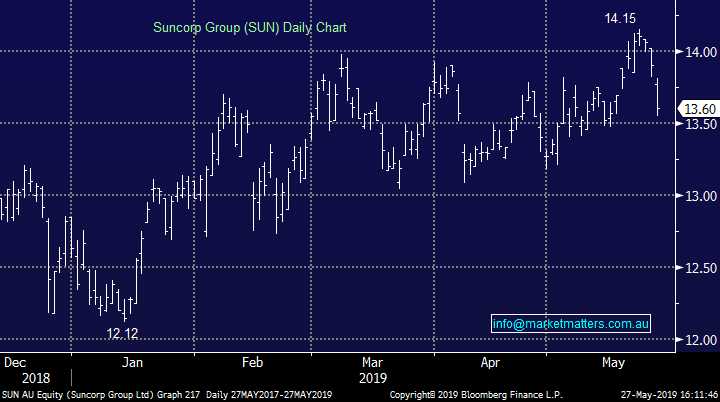

Suncorp (SUN) -2.16%; struggled today after announcing the departure of group CEO Michael Cameron. The news surprised the market coming just weeks from the end of financial year, with CFO Steve Johnston to move into the acting CEO role. The company did try to allay fears the exit comes ahead of a soft result reiterating that FY19 cash earnings will be ‘in line with market expectations.” Michael had guided Suncorp through the sale of its life insurance business earlier this year, as well as beginning of a significant technology investment plan which has greatly increased the company’s digital footprint.

Suncorp (SUN) Chart

Vocus (VOC), +16.97%; the telco exploded out of the gates today following a non-binding takeover proposal from Swedish private equity EQT. The indicative offer of $5.25 is a 35% premium to where shares closed on Friday night which is enough to grant EQT non-exclusive due diligence in the hope of courting a firm bid.

Vocus has been on some ride over the past few years, climbing to the lofty heights above $9 in 2016 while embarking on an aggressive expansion strategy. The stock struggled later that year as it became clear Vocus had stretched the budget on a number of acquisitions, and the stock traded to a low of nearly $2. More recently shares in the internet provider, data centre operator and unified communication business have fared slightly better while the company aimed to cull underperforming segments.

Shares closed part of the gap to the offer price today, yet still closed at a ~15% discount with the market pricing in significant risks in the early stages of the talks. There is no certainty any deal will eventuate however there’s also the chance that one bid may lead to other suitors joining the party.

Vocus (VOC) Chart

Broker moves:

- Estia Health Downgraded to Hold at Moelis & Company; PT A$3.01

- Estia Health Downgraded to Neutral at UBS; PT A$2.85

- Bluescope Downgraded to Neutral at UBS; PT A$13

- CSR Downgraded to Sell at Citi; PT Set to A$4.14

- CSR Downgraded to Sell at Morningstar

- OZ Minerals Upgraded to Add at Morgans Financial; PT A$11.27

- NAB Upgraded to Outperform at Macquarie; PT A$27

- QBE Insurance Cut to Neutral at Credit Suisse; Price Target A$13

OUR CALLS

No changes today

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 27/05/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.