ASX hits new 10-year high (CSL, MIN, WES)

WHAT MATTERED TODAY

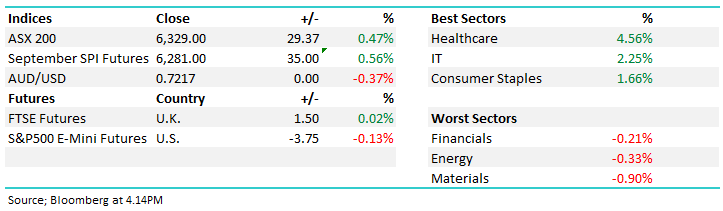

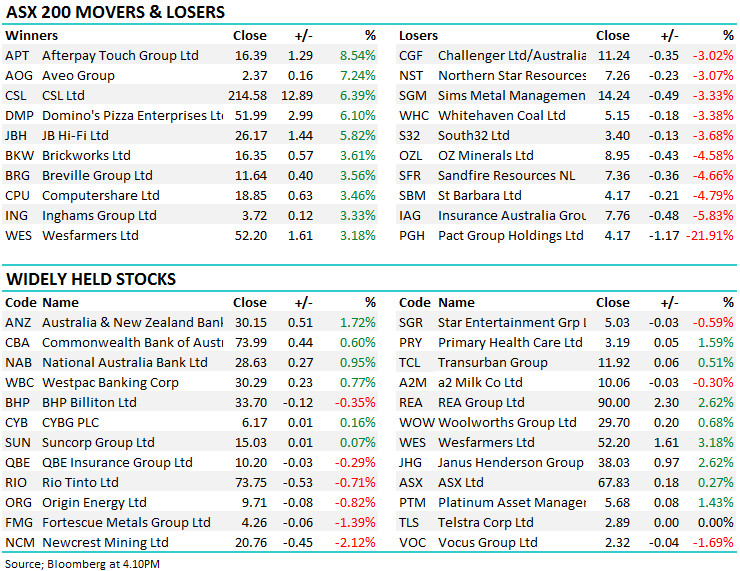

While other markets stutter, the local bourse pushed on higher today on the back of strong banks support – minus a big CBA dividend - and a CSL result with the stock adding +18.9 index points. Reporting season continues to be the biggest driver of volatility. Packaging maker Pact Group lost -21.9% today following a weak guidance, IAG traded -5.83% lower under similar circumstances while CSL (+6.39%) & Computershare (+3.46%) traded higher coming out with reasonable numbers. Today's close is a new 10 year high.

Love continues to flow for the banks after CBA, ANZ and NAB’s recent ‘not bad’ announcements. CBA was down -2.47% / -$1.87 but paid a $2.31 dividend (grossed up to $3.30) - a great ex-div trading result there. Suncorp also paid its $0.40cps + $0.08cps special dividend, holding on to its franking credits. The rotation out of resources was evident again, as materials & energy sunk to the bottom of sector performance.

Overall, the ASX200 added +29 points today or +0.47% to close at 6329– Dow Futures are currently trading down -28pts/-1.1% at the time of writing.

Tomorrow eyes will be on Telstra for their result, along with ASX, CPU, DOW, ILU, ORG, OZL, SHL & SWM. For a full list of company reporting dates – click here

Expectations for Telstra tomorrow - $28.6B revenue, $3.4B profit and an 11c div.

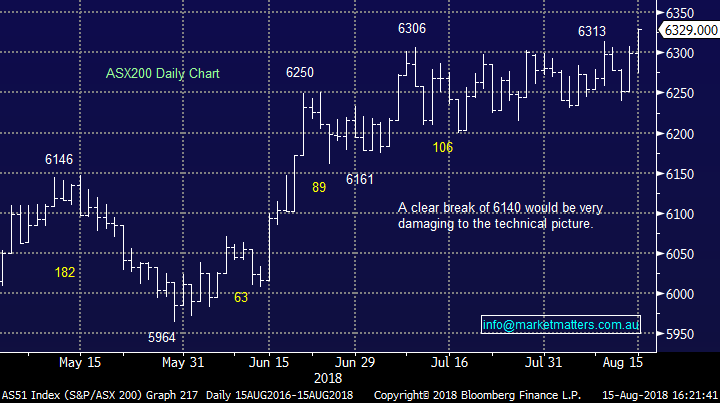

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; Challenger & Dominoes downgraded following poor results – DMP is now trading just 0.8% below its close on Monday before a poor result and guidance. CEO Don Meij looks to be doing a speaking tour, dressing up the result and outlook for the market.

· 1300 Smiles (ONT AU): Downgraded to Hold at Morgans Financial; PT A$6.85

· Challenger (CGF AU): Downgraded to Neutral at Credit Suisse; PT A$12

· Domino’s Pizza Enterprises (DMP AU): Cut to Underweight at JPMorgan

· Lovisa (LOV AU): Lovisa Downgraded to Sell at Canaccord; PT A$9.11

· Praemium (PPS AU): Rated New Buy at Shaw and Partners; PT A$1.20; Downgraded to Sell at Wilsons; PT A$0.68

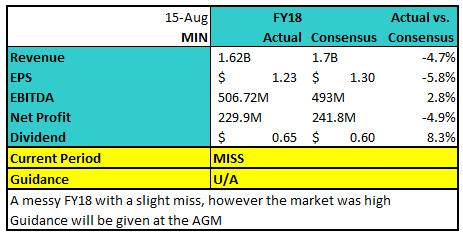

Mineral Resources (MIN) $14.97 / -1.06%; MIN reported their FY18 numbers during trade today, causing messy trading into the close. The stock bounced strongly after returning from the report’s trading halt, however the gains were all lost and the stock ended slightly lower. The result was messy, however they provided some upbeat commentary around their operations and potential – guidance to be given at their AGM.

Mineral Resources (MIN) Chart

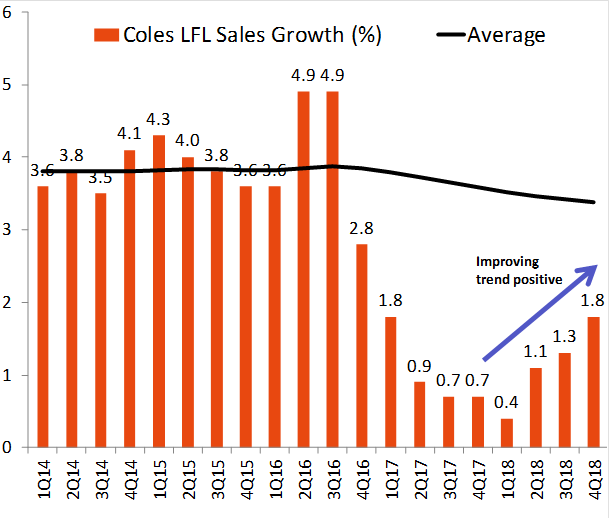

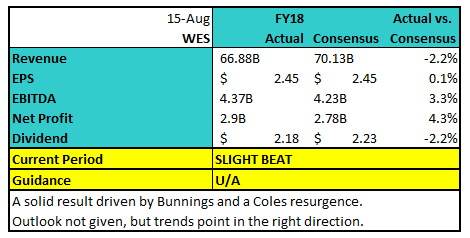

Wesfarmers (WES) $52.20 / +3.18%; A solid result this morning reported by Wesfarmers driven by impressive performance from Bunnings and improving conditions for Coles. Bunnings saw like-for-like sales growth of 7.8%, while EBITDA margins remain at an impressive 12%. Coles also showed signs that supermarket trends are working in their favour, with LFL sales in at 1.8% for the 4th qtr, up from +1.3% in the 3rd qtr, although margins were somewhat weaker.

The Coles performance will be key in the short term for Wesfarmers as it looks to be spun into a separate entity, while Bunnings will have a bigger impact on longer term performance given it will contribute more than half of the group earnings post-Coles. Also important to future value is the Target & Kmart brands. While the cheap option, Kmart, has been helping Wesfarmer’s growth – 5.4% LFL growth for the year – Target continues to hold the company back, although signs of improvement are showing, and the drag is lower than FY17. LFL sales in Target fell -5.1% for the last quarter, which seems bad but is much better than the 2nd quarter in FY17 where it fell -21.9%.

Wesfarmers (WES) Chart

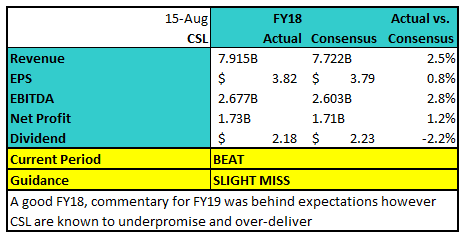

CSL $214.58 / +6.39%; Biotech company CSL once again impressed investors at the full year result this morning, showing another solid year of growth with net profit rising 29%, lifting the dividend 30%. New launches as well as now fully integrated acquisitions contributed to the blood products and vaccines businesses result.

The market didn’t seem to mind a slightly soft guidance with the company known for under promising the year ahead. For the financial year just gone, CSL upgraded guidance twice – the last in march – and still beat the updated numbers. Consensus NPAT was looking for $1,969m in FY19, while the company guided to $1,880 – $1950m, about a 2.7% miss.

CSL Chart

OUR CALLS

No trades across the MM Portfolios today.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 15/08/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here