ASX hits early high, then slides into the close (A2M, MQG, SGP) *Buy NFLX.US*

WHAT MATTERED TODAY

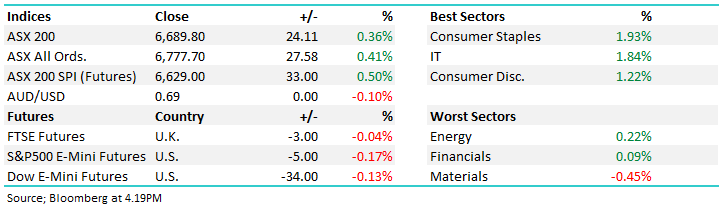

A volatile session for Aussie stocks today with strong buying in the morning session hitting a crescendo around 11.30am before sellers emerged / or more accurately, the buyer departed. It reminded me of a day where one big overseas whale was in the market, initially in the futures which then spilled over into the cash for a few hours in the AM. When they stepped away, stocks lost their support and grinded lower. The market peaked this morning at 6718 just as we were finishing the income note and traded down to a 6669 low. A fairly bearish move overall today even though the market finished +24pts up on the session.

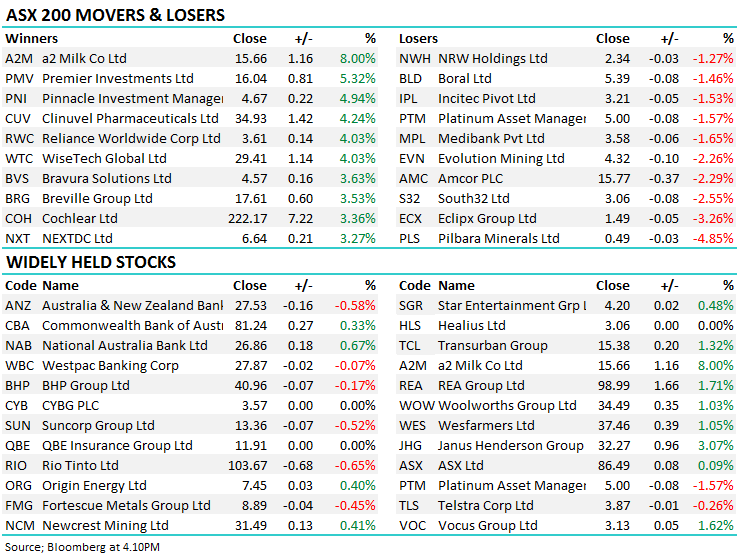

At a sector level, resources underperformed with BHP, RIO & FMG all finishing in the red while the consumer staples were strong led by Coles (COL) which traded to a new all-time post listing high.

Overall, the ASX 200 added +24pts today or +0.36% to 6689. Dow Futures are trading down -48pts / -0.18%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

a2 Milk (A2M) +8%: Had a strong day, posting an index leading 8% gain thanks to a UBS upgrade. The bulge bracket investment bank pushed their PT up 25% to NZ$17.50 and moved from their hold equivalent to a buy on stock – shares on the New Zealand exchanged closed at NZ$16.25, adding 6.56% today, 7.7% below the PT. The stock was a market darling until earlier this year when its meteoric rise came to a halt on trade war and China regulatory fears.

UBS have confidence in the company’s ability to penetrate the China market by diversifying their sales channels despite the lingering risks around regulation disrupting the daigou channels – they are forecasting an 11% market share in what is the most profitable infant milk formula market. Brokers are spread on A2M, with 6 buys, 4 holds and 4 sells – the right call here could prove extremely beneficial. The stock has picked up some momentum heading into the result, making us cautious of an over-exuberant market position.

A2 Milk Chart

Macquarie Group (MQG) +0.21%: This is a chart which is prompting us to be more cautious in the market at current levels. While the fundamental picture for MQG looks string, the technicals tells us we’ll be able to buy it at lower levels. Never forget, MQG is a mkt linked play and very much exposed to the markets appetite for risk. We took profit on our MQG position earlier in the week . MM is now bearish MQG.

Macquarie Group (MQG) Chart

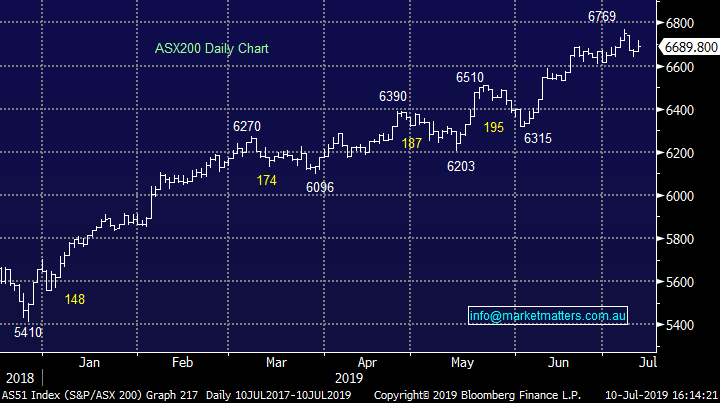

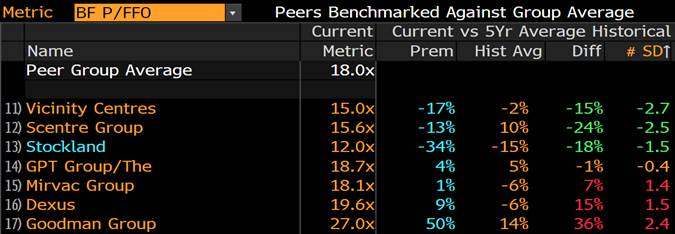

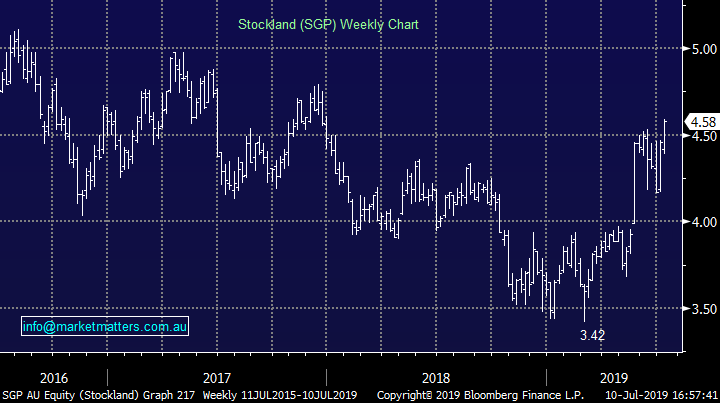

Stockand (SGP) +2.46%:We added the property company to the MM Income Portfolio today with a 3% initial weighting. It’s trading on 0.9x price to book having just sold a meaningful development asset in QLD at a 30% premium to book value. Trading on 12x, and +6% yield the stock screens well relative to peers.

Stockland benchmarked again peers

First technical target on the stock is ~$4.80

Stockland (SGP) Chart

Broker moves;

- Johns Lyng Rated New Buy at Moelis & Company; PT A$1.67

- A2 Milk Co Upgraded to Buy at UBS; PT NZ$17.50

- Alumina Rated New Overweight at Morgan Stanley; PT A$3

- Medibank Private Cut to Underperform at Macquarie; PT A$3.05

- Spark Infra Downgraded to Underperform at RBC; PT A$2.25

OUR CALLS

In the Growth Portfolio we sold BHP and bought Domino’s as a shorter term trade. In the income Portfolio we sold BOQ, reduced CBAPF, reduced MXT, bought SGP & TAH while adding to NBI overall through the right issue.

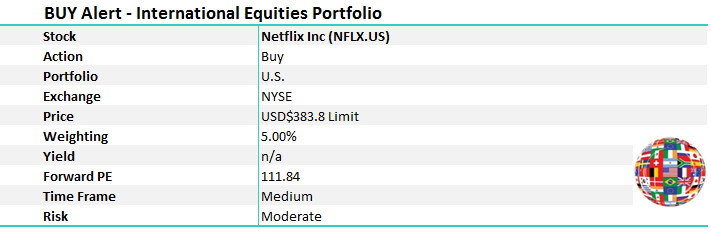

**International Alert**

Major Movers Today – Janus Henderson (JHG) +3%...stop it! A thorn in our side for some time is starting to show some form. Cochlear (COH hit an all-time high today & Reliance (RWC) bounced back from recent weakness.

Have a great night

James, Harry the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 10/07/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.