ASX hit on virus, drops below 7000 (RWC, GEM, NHF)

WHAT MATTERED TODAY

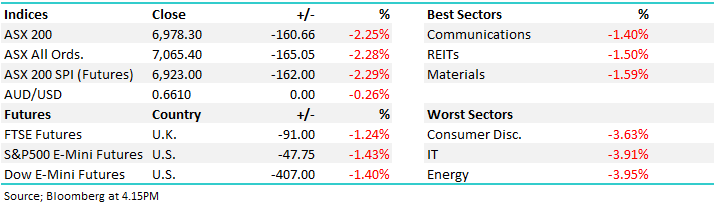

The market was hit today, and hit fairly hard being the first major market to soak up the coronavirus news over the weekend. The Aussie market is often used as a place to hedge exposures pre-US open when US Futures are getting sold off, today they were down another ~1.4% during our time zone. That put added pressure on our market and we saw the higher beta sectors hit hardest. The Energy sector was weakest today, however Woodside did trade ex-dividend so stripping out that influence the IT stocks were worst on ground.

Some big moves playing out there with EML Payments (EML) down another ~10.15% taking its pullback since reporting to ~27% while others in that high growth, priced for perfection basket have also felt the pinch, Altium (ALU) off another 4.48% today taking its decline from recent highs to more than 20%, even Xero (XRO) which has been a bell-weather for the sector saw a -4.35% decline today to close at $83.50, a stock that looks interesting around ~$80.

Obviously weakness in US Futures during our time zone however Asian markets were also hit, but to a lesser degree. Japan only down smalls, China off around ~0.20% on stimulus expectations while Hong Kong stocks lost around 1.70% - not a bad effort given we were off 2.25%.

We saw weakness in companies that reported today, Reliance Worldwide (RWC) took the cake down 26% on a weak update and guidance, while Bluescope, NiB and G8 Education also struggled. Gold stocks the only real place to hide today, most of them doing very well led by Ramelius (RMS) which added +14% and Saracens which put on 7%, even Newcrest (NCM) closed +5% higher.

Reporting schedule available here: CLICK HERE

Overall, the ASX 200 lost -160pts / -2.25% today to close at 6978. Dow Futures are trading down -407pts/-1.40%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

Reliance Worldwide (RWC) -26.45%: A tough day for the plumbing supply business which reported a softer than expected 1H20 result plus they downgraded full year guidance. They delivered underlying NPAT of $63.7m versus ~$75m expected while printing underlying like-for-like sales growth of +4.2%. Guidance here was also downgraded for the full year, although even the downgraded numbers come with a bunch of caveats. Adjusted NPAT was to come in between $150-$165m, however now they say it will be $140-$150m. The market was at $157m so at the midpoint of the revised guidance it’s an ~8% downgrade, however I get the vide that confidence in meeting that number is low. A lot of work to do for RWC in the 2nd half to get close, hence the big decline in SP today. We have no interest here.

Reliance Worldwide (RWC) Chart

G8 Education (GEM) -5.21%: The childcare operator delivered a reasonable set of 1H20 numbers today relative to where the share price is trading. Conditions have been tough in childcare with rising costs and falling occupancy, however todays result showed a slight improvement in occupancy at least. They delivered underlying EBIT of $132.5m for the half which was inline with recent guidance. Occupancy increased by +1.1% at the group level, and now sits at 75.9% (up from 74.8% in 2018). That number is still too low and they also said that the start of calendar 2020 has been tough, a bunch of external factors, bushfires, virus’s are having an impact, and that makes guidance difficult. More information due out at their May AGM, however its hard to get excited about this stock until then.

G8 Education (GEM) Chart

NiB Holdings (NHF) -7.13%: Todays 1H20 update from private health insurer NiB showed that just 44.1% of Australians now have private hospital cover, the lowest level since 2007. That’s clearly a difficult backdrop for the insurers particularly when it’s the younger demographic dropping off (they essentially fund the older members’ higher claims expense). Today NHF reported an underlying operating profit of $83.2 and reconfirmed they would meet their recently downgraded guidance of FY underlying operating profit of $170m.

It seemed like it was a frustrating period for the insurer, they managed to grow the top line with revenue up 6.4% however the costs of servicing claims was a real headwind. A break below $4.65 would start to look interesting technically.

NiB Holdings (NHF) Chart

Elsewhere in reporting:

Bluecope (BSL) -7.88%: Steel spreads still a major issue for BSL and while this was a known issue, there seems to be no respite in sight. (tighter spreads a result of higher input costs and lower steel prices). They talked about the coronavirus significantly impacting their Asian operations with uncertainty the main takeaway. They did extend their share buy back which was a positive. BSL is at the pointy end of global growth, when growth stabilises and China (potentially) stimulates this will be a stock that bounces hard.

Audinate (AD8)-14.38%: Another high value growth stock that blamed 1. The trade war then 2. the coronavirus for missing the mark today. That said, on quick read through of their numbers it seems their core business is still doing okay, and the impact should be shorter term in nature (if indeed it is simply a macro driven slowdown). This is a stock we like (I owned it at the IPO but sold too soon). Now on the radar again.

MMA Offshore (MRM) +6.67%: Was hard to find a stock that beat and traded higher today however MRM did just that after releasing 1H20 EBITDA of $18.9m, +50% on pcp and well above expectations for around $16m. This is a highly indebted business however they are in a turnaround phase, and if they can continue to grow earnings, they should be able to pay down their mountain of debt which sits at $275m, scary versus its market cap $138m. In terms of outlook they said “Expect continued growth in EBITDA through 2H FY2020”, which they need and its all dependent on the utilisation of their vessels. Worth watching if you like cheap turnaround plays!

Broker Moves: Interesting moves in Inghams (ING) post their results last week.

· Infigen Cut to Neutral at Macquarie; PT 77 Australian cents

· Australian Finance Raised to Add at Morgans Financial Limited

· Bravura Cut to Market-Weight at Wilsons; PT A$5.67

· Carsales.com Raised to Hold at Morningstar

· Iress Raised to Hold at Morningstar

· New Hope Raised to Buy at Morningstar

· Boral Cut to Hold at Morningstar

· Mayne Pharma Cut to Hold at Morningstar; PT 41 Australian cents

· Inghams Raised to Outperform at Credit Suisse; PT A$4

· Inghams Raised to Buy at Goldman; PT A$4

· Village Roadshow Cut to Neutral at JPMorgan; PT A$4

· Sandfire Resources Raised to Buy at Bell Potter; PT A$6.02

· Senex Raised to Outperform at Credit Suisse

· MyState Raised to Buy at Bell Potter; PT A$6.10

· Select Harvests Cut to Hold at Bell Potter; PT A$8.75

· City Chic Collective Ltd Raised to Buy at Baillieu Ltd

OUR CALLS

No trades today.

Major Movers Today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.