ASX higher as buyers re-emerge from the clouds of negativity (DDR, WEB)

WHAT MATTERED TODAY

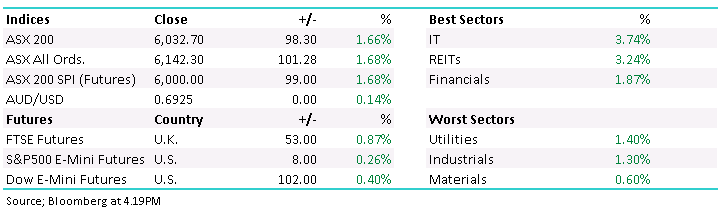

Bottom left to top right went the intra-day chart of the ASX today as the bulls recaptured control and pushed the index back up through 6000. The period of consolidation we’ve been highlighting on the daily chart below has now given way and buying momentum has accelerated, as we’ve suggested in recent notes, with such negativity across the market right now with concerns ranging from COVID-19 to excessive valuations, even bubbles in some parts of the market as the AFR speculated today when referring to the Buy Now Pay Later (BNPL) space, it still seems to me the direction of most pain is likely up and we squeeze higher into a FOMO style top.

All sectors ended the session higher today with the risk on IT names doing best led by the Afterpay (APT) juggernaut which is now knocking on the door of $70 putting it on a current market cap of more than $18bn, not bad for a company that listed in 2016 valued at ~$165m. Other stocks in the IT space also shone, our recent buy of Bravura Solution (BVS) added 4.84% while it was also nice to see Lend Lease (LLC) up 6% after their market update yesterday which saw the stock open sharply lower. While I didn’t get a chance to cover LLC yesterday, the update was confirmation of a few things we felt were likely (and already priced in) – we remain bullish the stock from here!

Gold remains a focus for us and although we’re still only holding a small exposure through Oz Minerals (OZL), Newcrest (NCM) is now threatening to break out of its recent range and remains on our radar, cash a slight problem for us at the moment with the domestic portfolio ‘s pretty much fully invested.

Overall, the ASX 200 added +98pts / +1.66% today to close at 6032 - Dow Futures are trading up +102pts/ 0.40%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

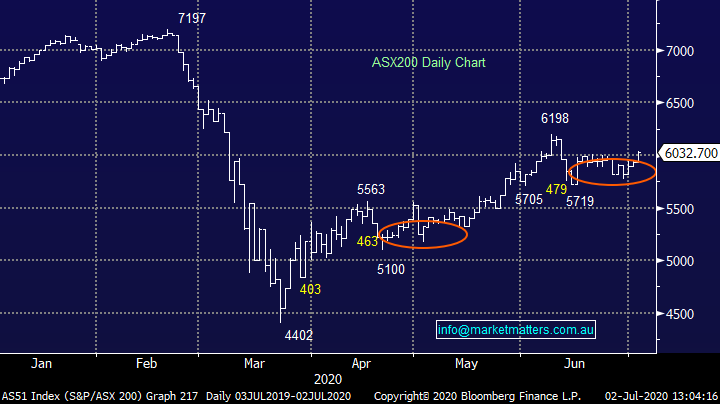

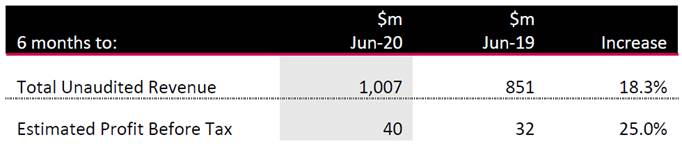

Dicker Data (DDR) +9%: A good session for the IT distributor after updating the market on 1H20 run rates, with a big +18% increase in revenue dropping down to a pre-tax profit increase of 25%. While they’ll put more meat on the bones at their upcoming AGM on the 23rd July, the numbers below put it on a solid run rate to smash current market expectations for the full year (FY revenue exp of $1.87bn), although this stock doesn’t have a lot of analyst coverage. All in all, a good update and the stock looks bullish for new highs.

Dicker Data (DDR) Chart

Webjet (WEB) -2.8%: the rest of the travel stocks were broadly higher today, but Webjet slipped from the pack, falling nearly 3% after pricing up a €100m convertible note deal. The proceeds will be used to reduce debt stress on the balance sheet, with $50m of near term debt repaid and the remaining facility extended out to 2022. The deal was on the cheap side for Webjet at just 2.50% out to 2027, but it continues to raise concerns about the ongoing viability of the company while travel remains under pressure given they raised equity just a few months ago. We prefer other names in the space to get leverage to an “early” reopening of travel.

Webjet (WEB) chart

BROKER MOVES:

- Freedom Foods Cut to Neutral at Goldman; PT A$2.60

- Newcrest Cut to Sell at Morningstar

- Magellan Financial Cut to Sell at Morningstar

- Orora Raised to Buy at Morningstar

- Magellan Financial Raised to Neutral at Credit Suisse; PT A$55

- Saracen Mineral Cut to Neutral at JPMorgan; PT A$5.40

- Suncorp Cut to Hold at Morgans Financial Limited; PT A$9.40

- Star Entertainment Cut to Neutral at Credit Suisse; PT A$3.40

- Paladin Reinstated Buy at Shaw and Partners

- Suncorp Cut to Underperform at Credit Suisse; PT A$8.75

OUR CALLS

Nothing today

Major Movers Today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.