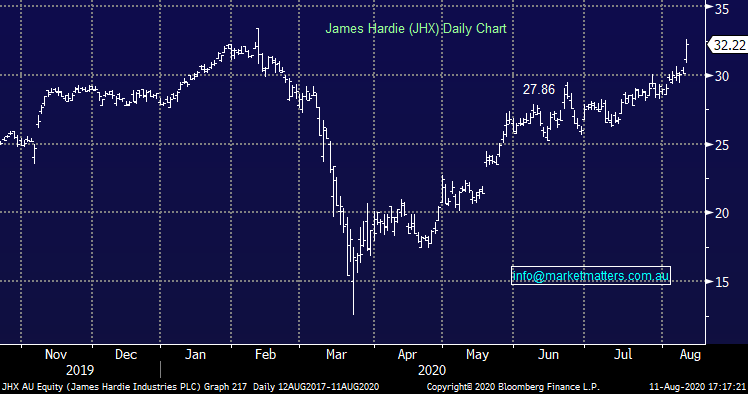

ASX higher ahead of a big day of reporting tomorrow (MSB, JHX, IGL)

WHAT MATTERED TODAY

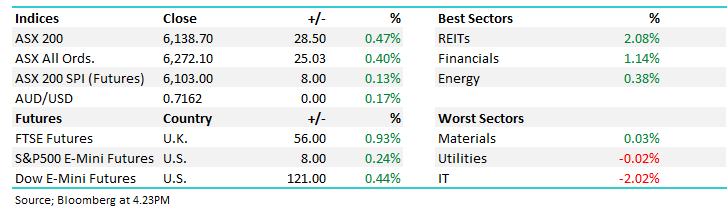

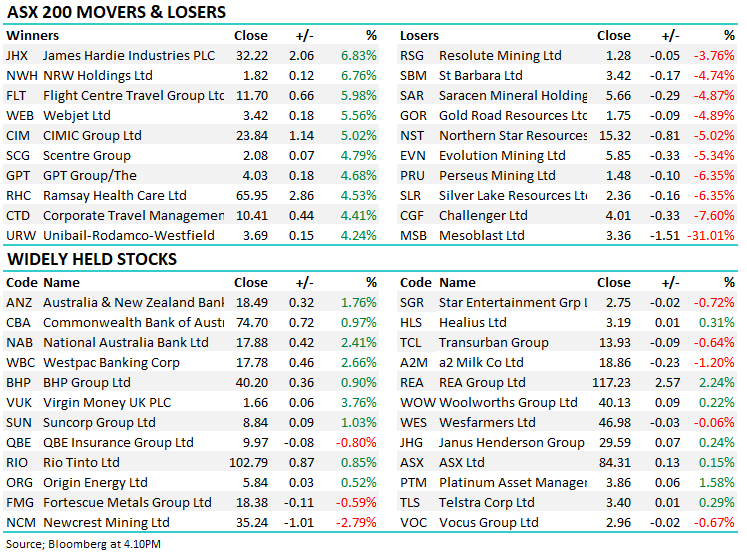

The bulls were out and about this morning with the market peaking around midday at 6186 / +76pts with the previous high of the range being 6198 but alas, the optimism failed, the banks rolled off their highs, ditto for the miners and a bunch of other sectors and by the close, the market had limped just +28pts higher. There’s no doubting the magnetic pull of the 6000 area and while today was a positive one, the close was disappointing. Looking around the market though, it was risk on – the re-opening / vaccine trade did well, Webjet (WEB) +5.56%, Flight Centre (FLT) +5.98%, Qantas (QAN) +3.76% however one area that caught my eye was property, particularly the retail malls as we’re seeing ‘less dire’ outcomes in terms of rent collections during the pandemic. GPT rallied +4.68% after reporting yesterday, Scentre Group (SCG) was strong today up +4.79% - this is an interesting area and we wrote about it a few weeks ago – click here – GPT is back to the $4.00 level we mentioned, its now on our radar for income.

Asian markets were strong today – most up more than 1.5% while US Futures edged higher during our session, even as global virus numbers top 20m

Overall, the ASX 200 added +28pts / +0.47% to close at 6138. Dow Futures are trading up +121pts / +0.44%

In terms of reporting today, we saw CGF, FBU, SCP, which we covered this morning – (click here). A big day tomorrow with CBA, CPU, CSL, DOW, MFG, TCL

LOCAL REPORTING CALENDAR: CLICK HERE **Please note, data sourced from Bloomberg, not all ASX companies are on this list and dates can vary**

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

Fletcher Building (FBU) +1.24%: Missed in terms of FY20 EBIT coming in at $310m v $324m expected / 4.5% miss however they talked about cost reduction with the cost base down $300m in FY21 – mkt liked that. No guidance however the market is currently at $347m for EBIT which implies growth of +12% for the year – a big ask MM thinks!

Challenger Group Financial (CGF) -7.6%: pre-tax profit for FY20 in line with downbeat expectations, $507m v $508m expected however guidance for FY21 the issue. They say we should expect pre-tax profit of $390-$440m and the market was currently at $445m which equates to a 7% downgrade at the midpoint. Stock down 7% today which is about right if we assume no P/E rerate which understandable – its only on ~10x. Margin pressure remains, and we have no interest in CGF.

Silverlake Resource (SLR) -6.35%: Typical of weakness in gold today as the precious metal dropped back below $US2000/oz. Saracens (SAR) down -4.87%. Newcrest (NCM) -2.79% as hot money came out of the sector. We’re likely buyers of further declines as the weak longs pull stumps

Sydney Airports (SYD) Halt: Trading halt today as they raise $2bn in fresh equity at a 15.4% discount to the market. The raise was widely tipped and is being underwritten by UBS with a price of $4.56 – the stock has been as low at $4.37 in March. We own in the MM Income Portfolio and will cover in tomorrow’s income note – we’ll take up the raise.

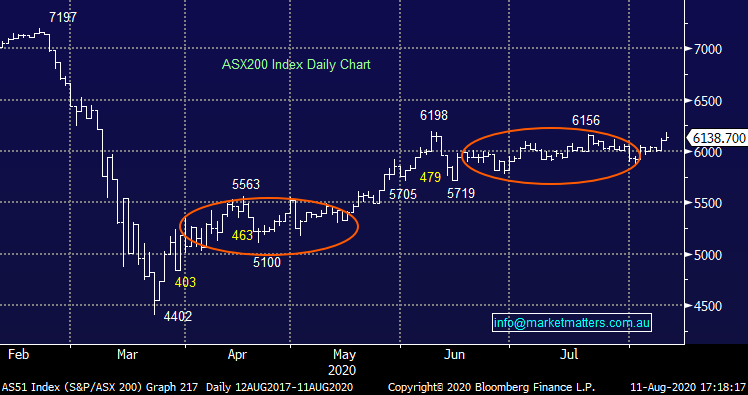

Mesoblast (MSB) -31.01%: The biotech announced that the FDA was scrutinising the companies RYONCIL development which looks to treat graft vs host disease in younger patients of bone marrow transplants. The treatment was touted as a gamechanger of which there is no alternative, but the FDA are questioning the effectiveness based on two previous trials. The drug is already in use in other countries, but it looks set for further scrutiny and delays by the FDA. The hearing is set for August 13 and could mean Mesoblast will be forced into another round of trials – a coin toss.

Mesoblast (MSB) Chart

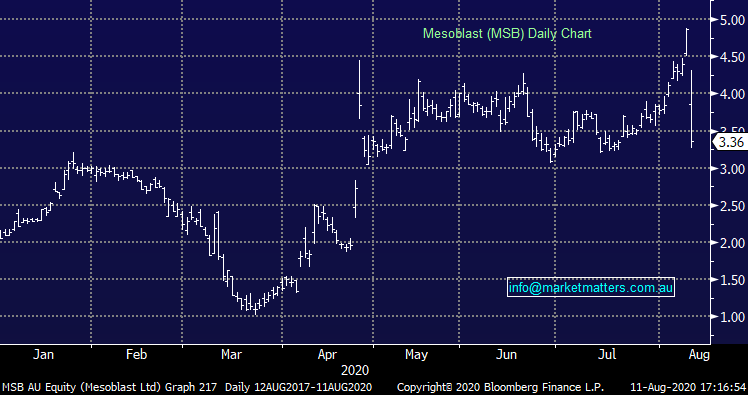

James Hardie (JHX) +6.83%: one of the top performers today, James Hardie impressed the market with a “better than feared” first quarter, along with supportive outlook statements despite the headwind’s construction is seeing. While sales slipped just 5%, first quarter profit was down nearly 90% on last year to just $US9.4m. The company expects a recovery to kick in from the 2nd quarter helped by continued ability to gain market share. Key to the market’s positive take on the result was guidance which came in at $US330-390m which would mean just a 6.5% fall on FY19 at worst. Some certainty around earnings where others are backing away from any forward looking statements was refreshing.

James Hardie (JHX) Chart

Ive Group (IGL) -21.88%: The hits keep coming for IVE Group with Coles scaling back the use of weekly catalogues. This is an obvious negative to IGL and when viewed against high leverage and an uncertain operating environment it’s a hard one to stomach. Coles today said that from September 2020 they will cease distribution of weekly catalogues - these catalogues are distributed to 7m households weekly. While they’ll increase in store magazines the hit to IGL is around ~$35-$40m which is ~5-6% of current revenues. They report on 25th August and will provide an update on the full impact then. A slight positive is the company saying that it moved quickly and sees the company in a position to mitigate revenue declines, however that’s a bit of a stretch. Overall, the announcement light on detail, particularly given this contract underpinned further capital expenditure on new assets plus this contract helped to underpin the investment thesis for buying Salmat. We’ll hold in the MM Income Portfolio for the result – we’ve felt a heap of pain already and the position is less meaningful in terms of portfolio performance from here.

Ive Group (IGL) Chart

BROKER MOVES:

· Charter Hall Long WALE Cut to Hold at Ord Minnett; PT A$4.73

· Domain Holdings Cut to Sell at Morningstar

· Breville Cut to Neutral at Credit Suisse; PT A$26.81

OUR CALLS

No changes today

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.