ASX ends a choppy week on the right foot (PLS, FMG, PPT)

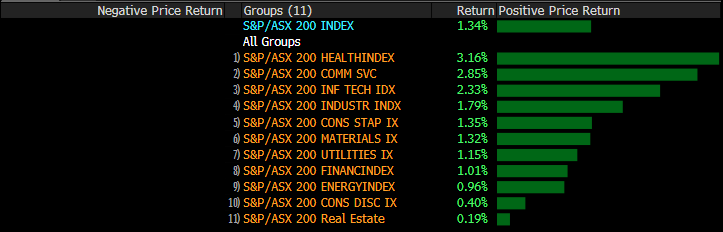

WHAT MATTERED TODAY

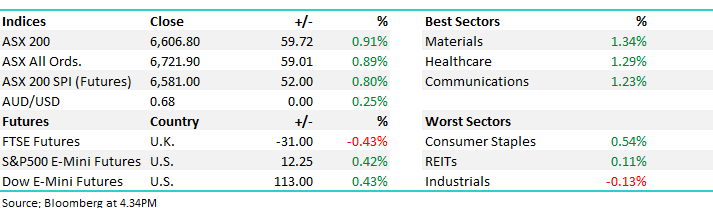

A good session for local stocks to finish the week thanks mostly to some improving rumours out of the US-China trade talks. Reports are now indicating a partial deal is expected to be struck before the weekend Trump meeting the Chinese Vice Premier tonight. Some reasonable chatter out of the UK overnight also helped markets higher with talks progressing regarding the Ireland back stop issue – one of the main sticking points in the BREXIT mess. The news sent both bond yields and equities higher.

Today resource names were well bid with oil and iron ore rallying well overnight. Yield names lagged on the rally in bonds with utilities the only sector that was weaker today. The market finished 1.38% higher for the 5 sessions, rebounding from last week’s freefall.

Overall today, the ASX 200 closed up +57pts or +0.88% to 6606. Dow Futures are trading up +113 points or +0.43%

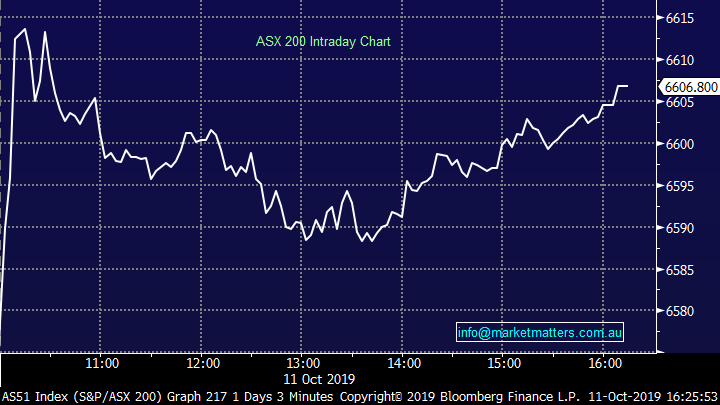

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE:

**VIDEO** Current Portfolio Positioning – James Gerrish & Harrison Watt – CLICK HERE – stocks discussed include: ORI, PGH, NCM, EVN, WSA, OZL

**Correction – Pilbara (PLS)** In yesterday’s morning note (click here) we mentioned the Pilbara Mineral (PLS) share purchase plan writing that under the SPP, holders could purchase stock at the lower price of 30cps or a 10% discount to the 5 day VWAP during the offer period (which closed this afternoon). In fact, it should have read a 1.0% discount, not a 10% discount. The pricing period closed this afternoon with the 5 day VWAP being 30.55c, hence we would expect the SPP to be priced at 30.25c

Perpetual (PPT) –0.56%; fell today – a rarity for money managers when the market rallies, however Perpetual came out with some poor FUM flows for the September quarter. Despite reasonable investment performance, the firm saw net outflows of $1.8b offset in part by appreciation adding $700m. All withdrawals were seen in their Australian equity portfolios while the bulk of it stemmed from institutional redemptions. The draw down is around 10% of their Aus equities, and ~7% of total FUM. Performance in the funds has generally been behind the market which has led to net redemptions in each quarter since July 2017. We own PPT in the Income Portfolio – and still like it given its low multiple and solid yield although flows are concerning.

Perpetual (PPT) Chart

Fortescue (FMG) +4.14%; was strongly higher today thanks in part to the iron ore price, but also in news it has extended the buy-back program it started in 2018. $500m program was set to end this month with the company buying less than $140m worth of shares to date with average price below $4 compared to the current share price which is more than double. Understandably the company didn’t want to chase the stock as the share price moved, and have now giving themselves at least another 12 months to utilize the facility which will provide reasonable support in the stock in the event of a pull back. We like FMG, and own it in the Growth portfolio

Fortescue (FMG) Chart

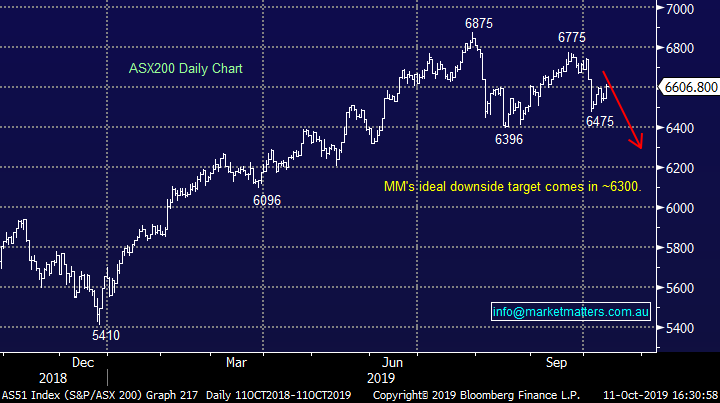

Sectors this week:

Stocks this week:

Broker Moves;

- PolyNovo Cut to Sell at Baillieu Ltd; PT A$2

- Netwealth Cut to Sell at UBS; PT A$7.50

- Netwealth Downgraded to Underperform at Credit Suisse; PT A$7.60

- Domino’s Pizza Enterprises Cut to Neutral at Macquarie

- Cleanaway Rated New Buy at Citi; PT A$2.40

- Bingo Industries Rated New Neutral at Citi; PT A$2.40

- Sky Network TV Cut to Underperform at Macquarie; PT NZD0.88

- Orora Rated New Buy at Jefferies; PT A$3.50

- Orora Raised to Outperform at Credit Suisse; PT A$3.40

- Orora Downgraded to Neutral at JPMorgan; PT A$3.25

- Centuria Rated New Neutral at Credit Suisse; PT A$2.83

- Sundance Energy ADRs Downgraded to Neutral at Seaport

- Western Areas Downgraded to Neutral at JPMorgan

- Independence Group Cut to Underweight at JPMorgan

- South32 Upgraded to Neutral at Goldman; PT A$2.40

- Alumina Downgraded to Neutral at Goldman; PT A$2.40

- Brambles Upgraded to Neutral at Credit Suisse; PT A$11.20

OUR CALLS

No changes today

Watch out for the weekend report.

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.