ASX drifts lower into EOFY (PGH, APT)

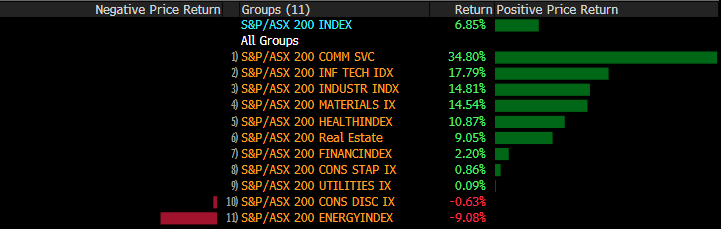

WHAT MATTERED TODAY

Firstly, thank you to all who generously contributed today to our fundraising efforts the assist the Apex Foundation . After sending an email to the MM community this morning we’ve now raised $4,455 for a great cause – phenomenal effort in a day and I’m now confident we can get to at least $10,000 by August. With the help of the Shaw & Partners Foundation this could see us contributing $15,000 to a wonderful cause. Click Here to donate

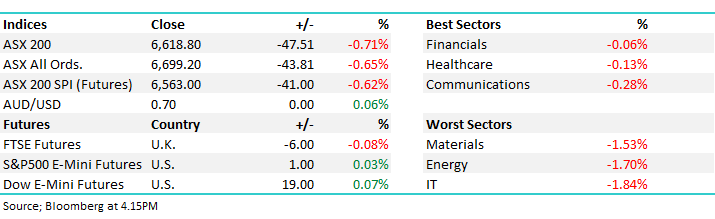

The last trading day of the financial year and the market came off the boil into the close – dropping -47pts points and finishing on the session lows in the process . Asian markets were weaker today, but only marginally so while US Futures were up smalls throughout the session .

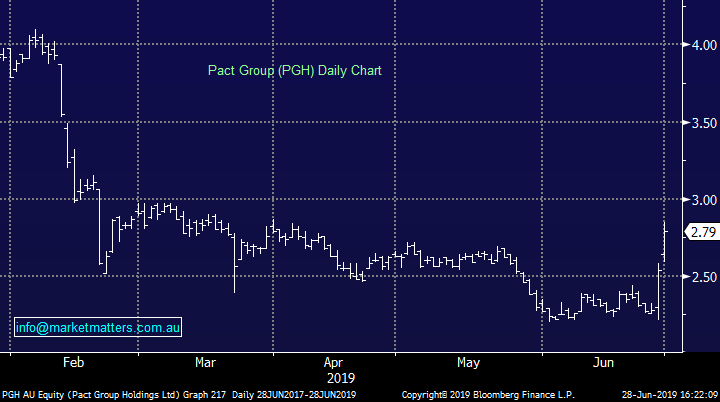

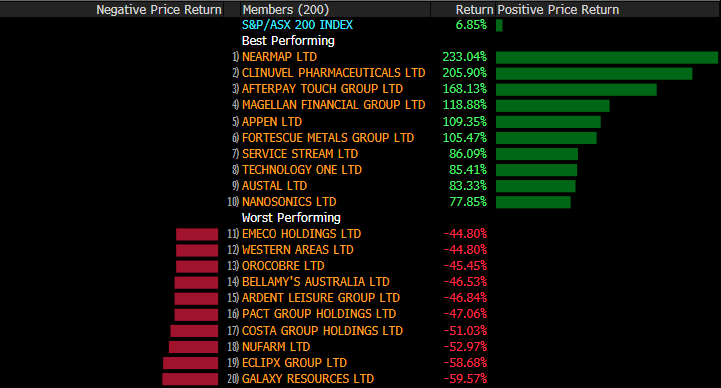

For the Financial Year, the ASX 200 has put on +6.85% however the volatility of the market over the past 12 months has been significant, with a ~21% range playing out between 5410 at the lows, and 6691 at the highs. We’ll look at sector and stocks performances at the extremes below

Overall today, the ASX 200 closed down -47pts or -0.71% at 6618. Dow Futures are trading up +32 points or 0.11%

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE:

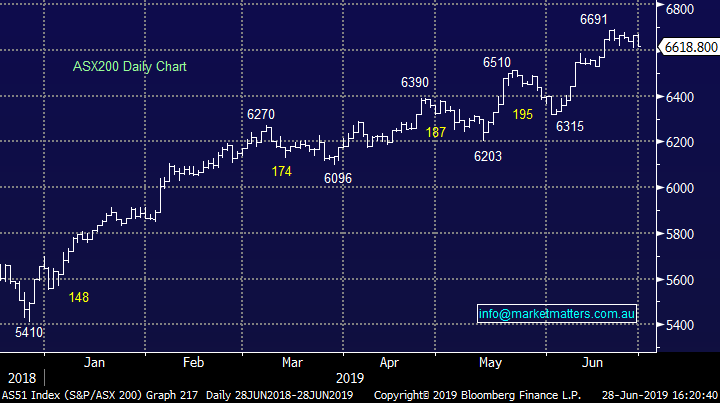

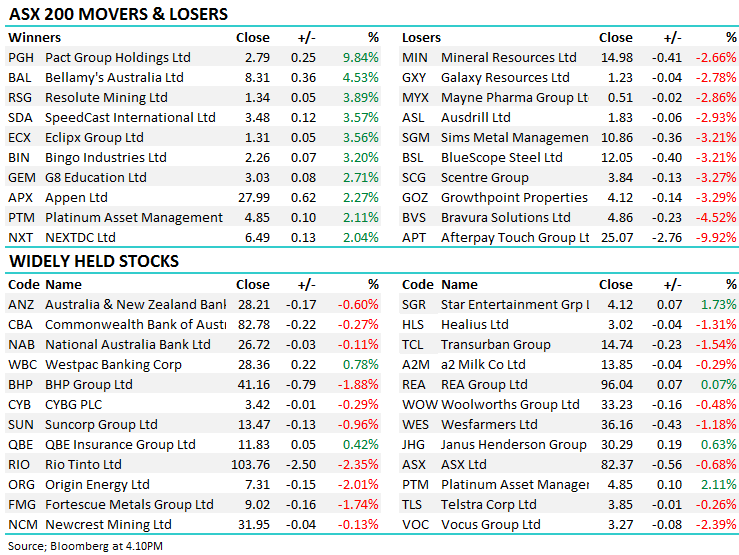

Pact Group (PGH) +9.84%: We added to PGH yesterday and it rallied another ~9% today as more brokers upgraded the stock following yesterday’s announcement around earnings and debt. The mkt is negative this stock – todays buying was a clear sign of that and we now expect higher prices to persist from here. We are bullish PGH

Pact Group (PGH) Chart

Afterpay (APT) -9.92%: had a volatile session, hitting then pulling back from all-time highs to close down ~10% on the session following news that Visa will launch a buy now, pay later program similar to APT. Here’s what they said…

Visa is making it easier to provide shoppers the ability to choose how they pay before, during or after purchase with the introduction of a suite of Visa’s installment solutions APIs. Through a pilot program, participating issuers and merchants will be able to offer their customers an installment payment experience at checkout using a Visa card they already have in their wallet. With Visa’s installment solutions, Visa cardholders will have the option to divide their total purchase amount into smaller, equal payments over a defined time period on qualifying purchases, at the store and online or while traveling abroad…sounds very much like APT to us!

Afterpay Touch (APT) Chart

Sectors this Financial Year:

Stocks this Financial Year:

Broker Moves;

· GWA Group Downgraded to Hold at CCZ Statton; Price Target A$3.50

· Mirvac Group Resumed at Macquarie With Outperform; PT A$3.46

· Perseus Downgraded to Neutral at Credit Suisse; PT A$0.59

· Independence Group Cut to Underperform at Credit Suisse; PT A$4

· GDI Property Upgraded to Buy at Moelis & Company; PT A$1.50

· Galaxy Resources Upgraded to Neutral at Macquarie; PT A$1.30

· Pact Group Upgraded to Neutral at Macquarie; PT A$2.81

· Pact Group Upgraded to Buy at Goldman; Price Target A$3.02

· GTN Ltd Downgraded to Hold at Canaccord; PT A$0.95

· OFX Rated New Market Perform at KBW; PT A$1.70

· Vocus Upgraded to Buy at UBS; PT Set to A$3.85

· Pacific Energy Cut to Accumulate at Hartleys Ltd; PT A$0.76

OUR CALLS

No changes today

Watch out for the weekend report. Have a great night.

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here . Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 28/06/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.