ASX cracks the record (TLS, CKF, EHL)

WHAT MATTERED TODAY

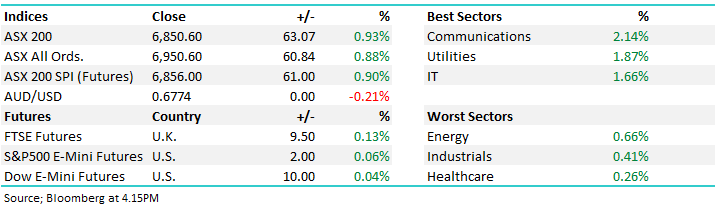

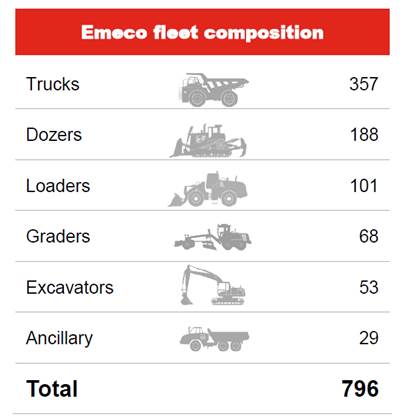

Big intra-day buying today highlighted the dry powder hanging around the market now being forced the chase stocks higher. The Aussie dollar falling further encouraged the equity bulls taking the ASX200 to a new record close at 6850.6, just marginally behind the day’s high. The Aussie battler was thrown around by increasing bets on further rate cuts as well as hope for a return of QE on the back of a speech from RBA Governor Philip Lowe overnight. He talked to rates falling to 0.25% if needed as well as launching a Government bond buying program if the economy warranted a cash injection – more money sloshing around the economy will naturally mean higher equity prices. Westpac was out today confirming they are expecting two cuts and QE next year.

All sectors finished in the black today but communications copped the most buying but heavy weight Telstra (TLS) doing the bulk of the work – more on them below. Healthcare was the laggard today.

Overall, the ASX 200 gained +63pts /+0.93% today to close at 6850. Dow Futures are trading marginally higher by 10pts/0.04%

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Collins Foods (CKF) +6.58%; Australians are out buying plenty of fried chicken according to the half year result from the largest franchisee of KFC stores in the country. Collins saw profit up 9% with same store sales adding nearly 5% on the first half of last financial year, boosted by the introduction of Deliveroo. CKF also run 10 battling Sizzlers sites which it is looking to transition and has recently launched 7 Taco Bell sites in Queensland which have been received well. Shares were up strongly on the back of the result. The company also talked to solid growth across the business segments into the second half, while targeting an additional 13 Taco Bell sites by the financial year end.

Collins Foods (CKF) Chart

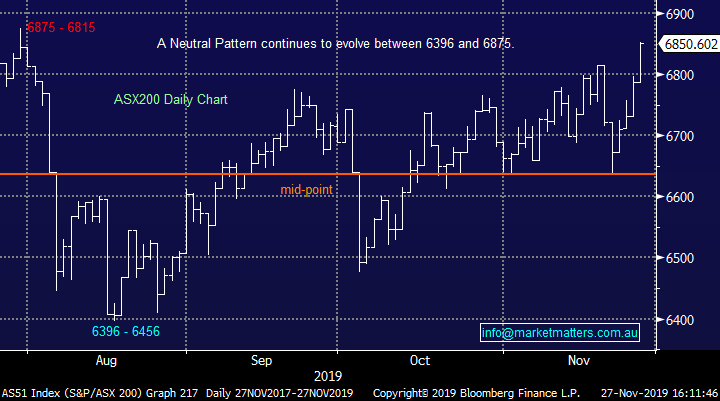

Telstra (TLS) +2.77%; A good day for the telco rallying on the back of their investor update. They maintained guidance for underlying EBITDA of $7.4-$7.9bn on the back of revenue of $25.3-$27.3bn. Cost guidance was also in focus and the guided for further reductions in their operating expenditure to the tune of $2.5bn by FY22. All up, no real surprises in the update however the share price had been drifting from yearly highs above $4 in August. Today’s update a solid one.

Telstra (TLS) Chart

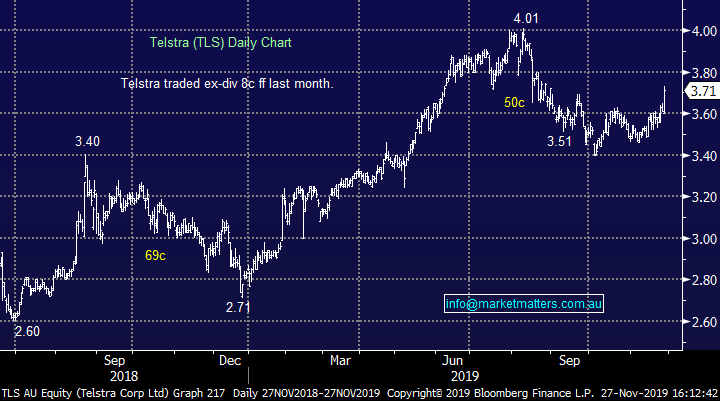

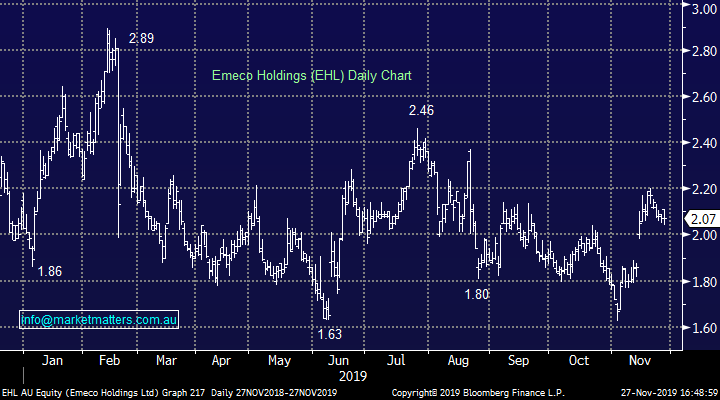

Emeco (EHL) unchanged; Had an investor conference today recapping FY19 and providing guidance for FY20, although it was the same numbers, they put out two weeks ago, so no new news. Growth in the 2H20 to continue and they are well positioned to at least meet market expectations (FY EBITDA of $243m). We own EHL as a value play in the Growth Portfolio believing that deleveraging of the business while still showing decent growth will lead to a re-rate on their currently depressed trading multiple of 8x FY20 numbers. For those interested in trucks and graders etc, here is a quick look at the Emeco fleet of equipment!

Emeco (EHL) Chart

Broker moves;

· Silver Lake Reinstated Outperform at Macquarie; PT A$1.40

· Panoramic Resources Cut to Neutral at Macquarie

· Scentre Group Rated New Hold at Jefferies; PT A$3.94

· Bravura Raised to Buy at Goldman; PT A$5.06

· Westpac Raised to Neutral at UBS; PT A$24.50

· Sydney Airport Cut to Hold at Morgans Financial Limited

· McMillan Shakespeare Cut to Neutral at Credit Suisse

· Bank of Queensland Raised to Neutral at Goldman; PT A$8.36

· Caltex Australia Raised to Hold at Shaw and Partners

OUR CALLS

No changes to the portfolios today.

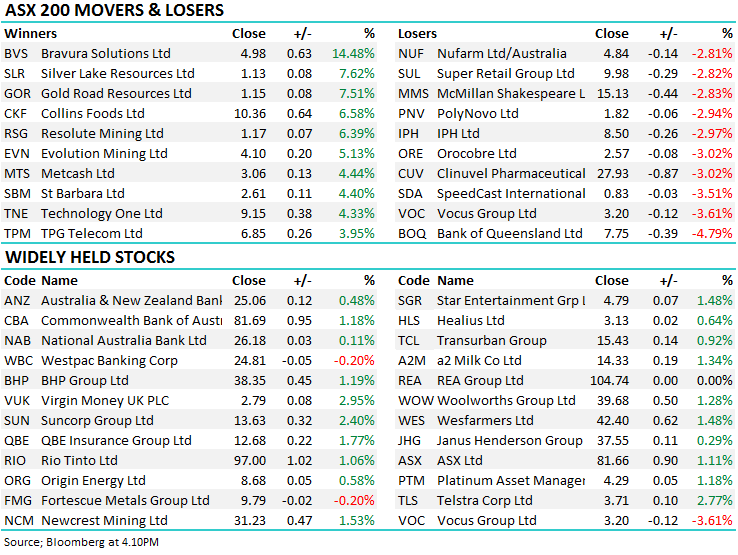

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.