ASX comes off the boil after a stellar run (ALL, TRS, CSR)

WHAT MATTERED TODAY

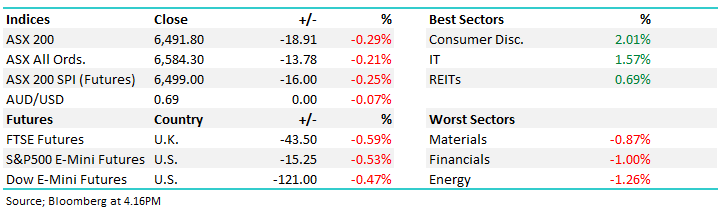

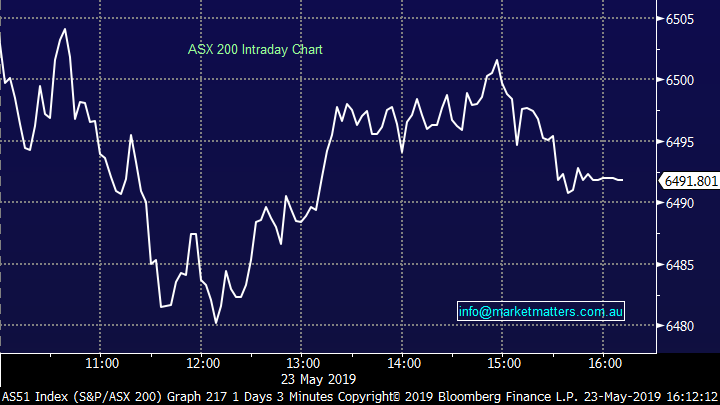

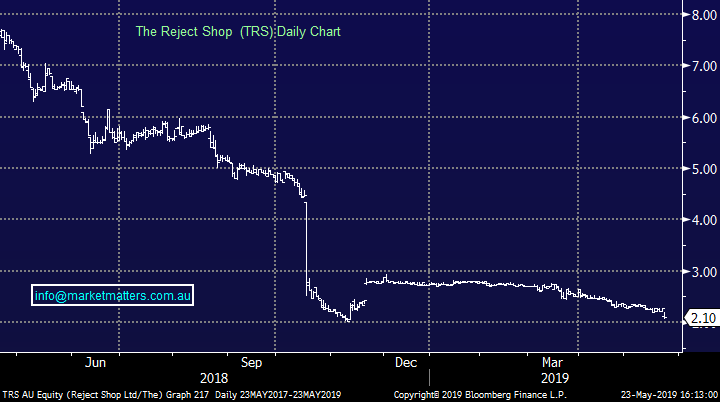

The ASX came off the boil today after a very strong 6 day advance which saw the market rally from a 6203 low to a high yesterday of the 6510 – a 307pt unabated run up led by the influential banking sector. Across the market today, it was the energy stocks that provided most weight at the index level followed closely by the financials while the consumer discretionary stocks brushed off a Reject Shop downgrade to move higher on the session.

US Futures were trading lower throughout our session, down around -100pts on the Dow while Asian markets were also on the back foot, most down around 1%. The move isn’t surprising given the run up in stocks of late, and some short term consolidation is far from a concern. At a technical level, MM remains bullish the ASX200 while the index can hold above 6380.

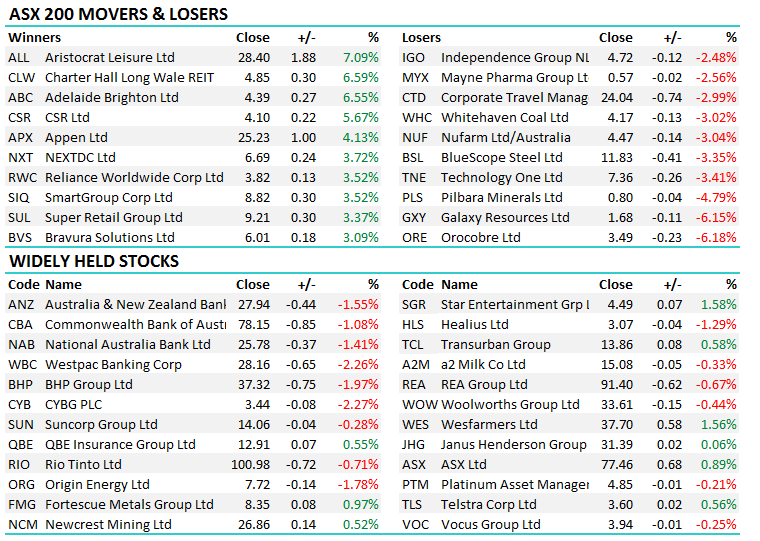

Overall today, the ASX 200 fell by -18 points or -0.29% to 6491. Dow Futures are trading down -104pts / -0.40%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Aristocrat Leisure (ALL) +7.09%; rallied strongly today after the gaming company released a strong first half result. The gambling leveraged play posted a normalized net profit of $422m for the 6 months, up 17% on the same period last year, coming in slightly ahead of estimates for the half. The EBITDA figure of $766.3m was a 19% improvement, and bettered consensus by nearly 5%. The stock is trading 7.8% late in the session today.

The result was driven by some growth out of the company’s America arm, however the performance of the digital arm has been hailed as the reason for the pop in the share price. At the full year announcement last year, the market sold the stock fearing the digital investment would struggle to meet forecasted returns however stable growth over the half has eased the concern.

Aristocrat also expects incremental gains out of the American arm, seen as an integral part to the company’s current valuation. Positive commentary here has certainly assisted the stock jump today. We own ALL in the Growth Portfolio

Aristocrat Leisure (ALL) Chart

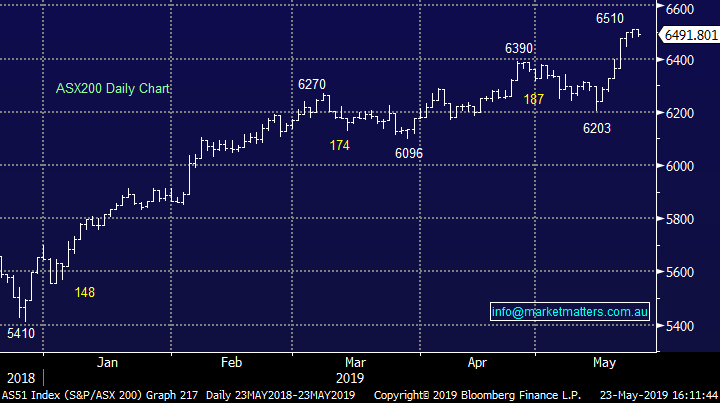

The Reject Shop (TRS) –7.49%; A big downgrade to earnings expectations today from the discount retailer resulting in the CEO Ross Sudano falling on his sword. TRS now expect a loss for the year ending 30 June of $1-2m compared to guidance for a $3.1 - $4.2m profit (market expectations were at $3.5m profit). TRS have been doing it tough for some time, tracking from a market capitalisation of $194m a year ago to ~$60m today. They did have a takeover offer on the table from Allensford at $2.70 a share, well above Reject Shop's current share price of $2.11 - Allensford failed to gain control of the retailer before the offer closed, and now own 18.99% of the company.

The departure of the CEO is clearly a kneejerk reaction, given they’ll now have an interim CEO in place until they find someone else. Falling sales + falling margins is not a good combination – cost cutting now the main focus as they look to turn around / reposition the business with the help of KPMG. We have no interest in TRS.

The Reject Shop (TRS) Chart

Broker moves:

CSR +6.19% rallied strongly today on a very bullish note from Macquarie, upgrading the stock to outperform with a $4.70 price target. We added CSR to the income portfolio last week at $3.37 and today the stock traded to a $4.17 high. As outlined yesterday in the MM income note, we had been targeting $4.20, however with the dividend of 13cps only a week away + we want the franking credits, we’ll likely hold.

CSR Chart

· Technology One Downgraded to Sell at UBS; PT A$7

· Sonic Healthcare Downgraded to Sell at UBS; PT A$24.90

· AGL Energy Downgraded to Sell at UBS; PT A$21

· Adelaide Brighton Upgraded to Outperform at Macquarie; PT A$4.80

· CSR Upgraded to Outperform at Macquarie; PT A$4.70

· Helloworld Upgraded to Buy at Bell Potter; PT A$5.50

· Computershare Upgraded to Buy at Morningstar

· Stockland Downgraded to Sell at Morningstar

· GWA Group Downgraded to Sell at Morningstar

· Harvey Norman Downgraded to Sell at Morningstar

· Credit Corp Downgraded to Sell at Morningstar

· oOh!media Downgraded to Hold at Morningstar

· Domain Holdings Downgraded to Sell at Morningstar

· Super Retail Upgraded to Overweight at Morgan Stanley; PT A$10

· Fortescue Downgraded to Hold at Renaissance Capital; PT A$8

· Rio Tinto Upgraded to Hold at SocGen

· Northern Star Downgraded to Neutral at JPMorgan

· Evolution Downgraded to Neutral at JPMorgan

· Charter Hall Long Upgraded to Overweight at JPMorgan; PT A$5.25

· Reliance Worldwide Rated New Overweight at Morgan Stanley

OUR CALLS

No changes today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 23/05/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.