ASX bounces from oversold levels (BSL, LLC, NHF, BPT, SIQ)

WHAT MATTERED TODAY

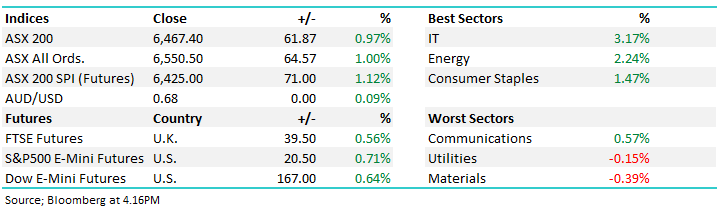

A better day for Aussie stocks with most sectors finishing higher following a more bullish session overseas. The high beta IT stocks did best with the likes of Appen (APX) +6.42%, Z1P Co (Z1P) +7.5% & Jumbo Interactive (JIN) +10% bouncing back from recent weakness. Asian markets enjoyed the more peaceful protests in Hong Kong over the weekend while US Futures were also higher during our time zone.

The biggest weight from the local market came from the Gold sector which is now pulling back after a solid run, Newcrest (NCM) down -3.01% and Saracens (SAR) down -5.12% to $3.71 – we continue to remain cautious gold in the short term, but will once again be buyers of protracted weakness.

Around 10 companies out with results today, around 15 out tomorrow then a big 2 days Wednesday / Thursday. BHP out tomorrow which is obviously of interest. Underlying profit expected to rise 11% to $9.9 billion.

A quick rundown on companies that reported today: BSL, SIQ, LLC, NHF,

Overall, the ASX 200 added +62pts today or +0.97% to 6467. Dow Futures are now trading up +180pts /+0.69%.

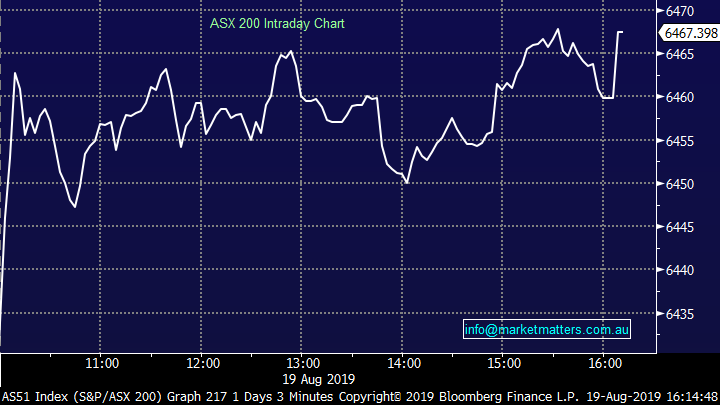

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

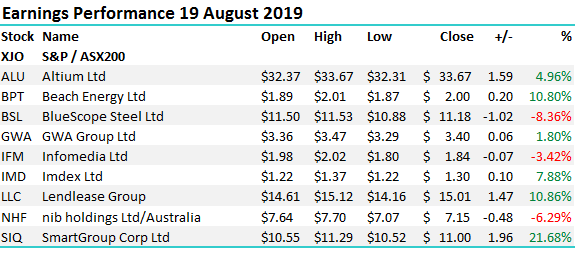

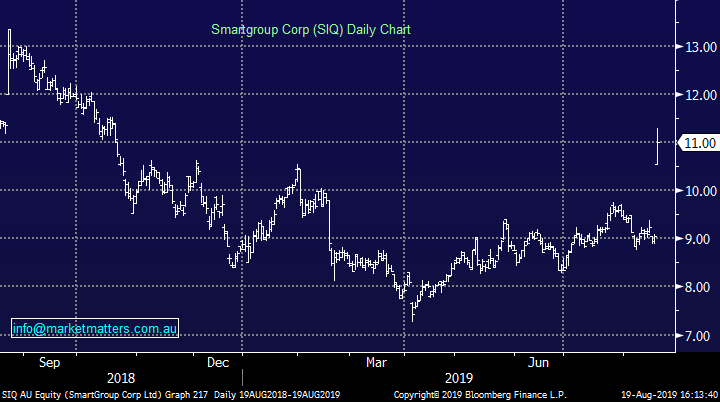

Stocks today: The table below looks at the share price performance of those companies that reported today. A mixed bag although more beats than misses overall.

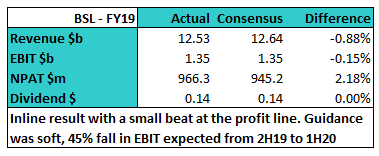

Bluescope (BSL) -8.36%: While the FY19 result was in line with NPAT coming in marginally ahead of expectations investors seem to be spooked by the outlook statement provided for FY20 which implies a decent miss to current consensus expectations.

For FY19 all metrics were as per expected and shareholders will get a 14c full year dividend with income for FY19 in line with FY18. The company’s large cash balance is also being put to work in supporting the stock with buybacks currently in place. Despite all this, the stock has dropped more than 9% today. While the market was already downbeat FY20 earnings for BSL pricing in a decline of 40% at the EBIT line, they have guided to a 45% fall in EBIT from the 6 months just passed for the 1st half of 2020. The significant fall will be driven by tightening steel spreads for the first half and falling volumes.

BSL do see a reasonable 40/60 skew in earnings towards the second half. With FY20 consensus EBIT sitting at $803m and applying the 40/60 1H / 2H skew to those numbers, guidance now implies a number closer to $700m for the year, or a 12% miss versus current expectations. It also seems like the selloff is being amplified by a headline grabbing $1b expansion of the North Star mill in the US which will add 850kt of capacity by 2023. The big CAPEX spend will hurt in the short term however it is an amount the balance sheet can handle even while the company continues to buy back stock and pay healthy dividends. An inline result for FY19 while the markets bearish expectations for FY20 where not bearish enough. With the stock trading on just 10x FY20 earnings, it’s hard to be too negative BSL at this juncture. We bought recently below $12 and remain buyers more than sellers of the dip.

BlueScope (BSL) Chart

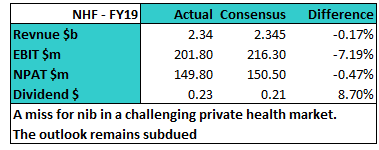

NiB Holdings (NHF) -6.29%; It’s been a difficult reporting season for MM thus far however a stock we did own and booked a nice ~47% profit in July is private health insurer NiB Holdings (NHF). Today they traded down -6.29% after reporting a result that was broadly inline with expectations. While the result was decent, the sell-off would have been further amplified by the strong share price gains of recent times. Guidance as is generally the case with NHF was tepid and for a stock trading on 21x low single digit growth is hardly exciting. The post-election bump in price seems to be wearing off. Our $8.10 sale price looking better than our BSL buy.

NiB Holding (NHF) Chart

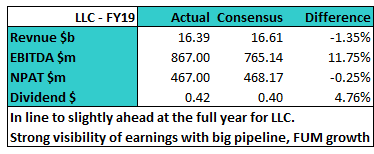

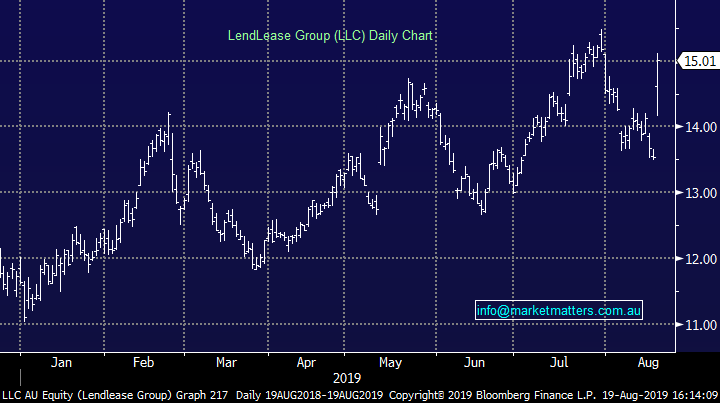

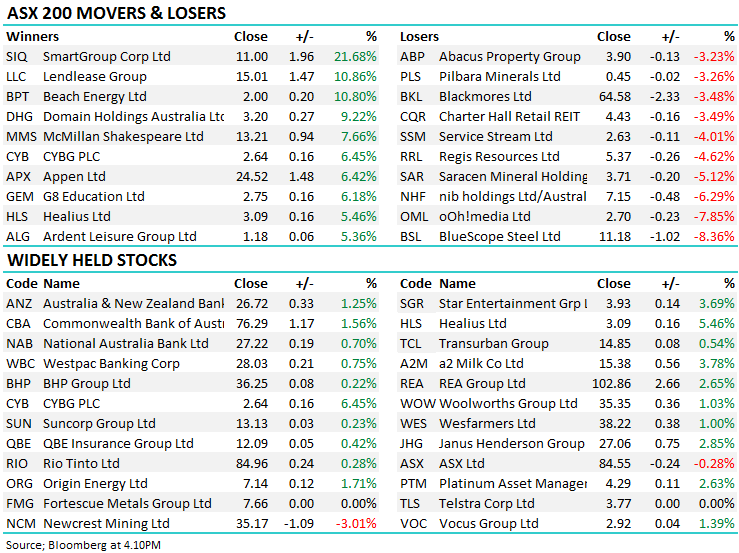

Lend Lease (LLC) +10.86%; A nice bump in share price today thanks to a beat at the EBITDA line and a lack of any material surprises. The ‘core’ business is performing well while the engineering business, which has now been deemed, non-core continues to struggle. They talked about visibility in earnings and a substantial ‘near $100bn development pipeline’. The core business did profit after tax of $804m while the non-core business which includes engineering & services lost $337m, they say a sale is now underway for this business – something the market clearly took well.

Lead Lease (LLC) Chart

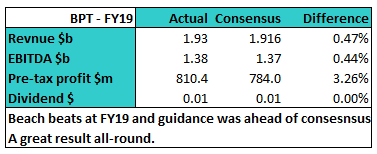

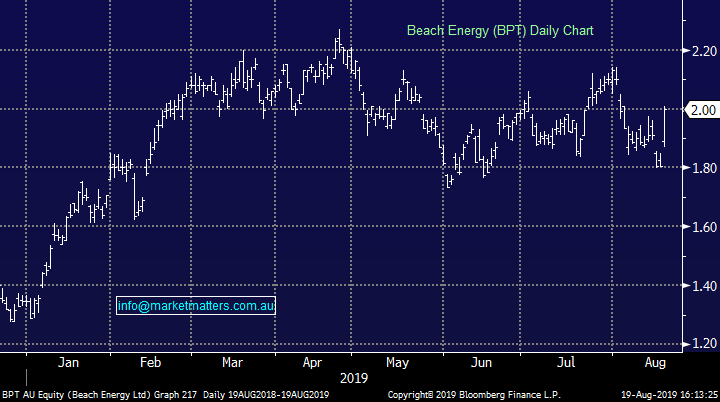

Beach Energy (BPT) +10.80%; Beach rallied back above $2 today on a solid full year. Pre-tax profit of $810m was ahead of expectations, helped by a strong start from their Lattice acquisition integration. Shareholders won’t see much of the income yet despite the company swinging into net cash, increasing CAPEX in a bid to lift production by ~30% in the medium term. Guidance for FY20 was ahead expectations as well and shareholders welcomed the exploration and development push.

Beach Energy (BPT) Chart

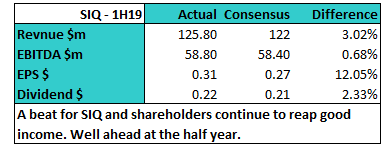

Smartgroup (SIQ) +21.68%: A very strong day for the salary packaging business, one we’ve talked about at MM and held off due to volume issues. They reported 1H19 beats across the board with top line revenue coming in +3% better than expected while all other metrics followed suit. Importantly, the momentum year on year was reasonably strong and the market is now factoring in decent momentum for their December year end FY results. A decent numbers in a low volume stock and the price has rallied strongly.

Smart Group (SIQ) Chart

Broker moves;

- oOh!media Downgraded to Hold at Canaccord; PT A$3.10

- SmartGroup Upgraded to Add at Morgans Financial; PT A$10.15

- SmartGroup Upgraded to Outperform at Credit Suisse; PT A$9.80

- InvoCare Downgraded to Sell at UBS; PT A$12.70

- Domain Holdings Upgraded to Neutral at UBS; PT A$3

- Domain Holdings Raised to Neutral at Evans & Partners; PT A$2.56

- Orora Downgraded to Neutral at UBS; PT A$2.85

- Newcrest Downgraded to Sell at Citi; PT A$31.05

- Credit Corp Downgraded to Hold at Morgans Financial; PT A$28.80

- Aristocrat Upgraded to Buy at Wilsons; PT A$32.69

- Breville Downgraded to Sell at Wilsons; PT A$13.28

- Blackmores Upgraded to Buy at Morningstar

- Southern Cross Media Upgraded to Buy at Morningstar

- Charter Hall Retail Upgraded to Hold at Morningstar

- Star Entertainment Upgraded to Buy at Morningstar

- Star Entertainment Cut to Neutral at Credit Suisse; PT A$3.75

- Star Entertainment Raised to Positive at Evans & Partners

- Abacus Property Cut to Neutral at Credit Suisse; PT A$3.87

OUR CALLS

No changes today

Major Movers Today

Have a great night

James, Harry the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.