ASX 200 showing signs of exhaustion around 5900 (SGM, FMG)

WHAT MATTERED TODAY

Some selling crept into the market today from early morning highs, particularly in the stocks that have led the recent advance from the December lows. Afterpay (ASX:APT) for instance rallied hard early before sellers locked in gains – the stock hitting a $16.97 high before closing at $15.25, a big +/-10% range for the day while Appen (ASX:APX),a stock we still own broke out from its trading range above ~$16.00 before closing back at $15.53, down -0.38% on the day. As one switch on client suggested today, CBA has been a big driver in the recent advance trading from below $66.00 to a $73.55 high today, although it closed down (-0.25%) on the session at $73.05.

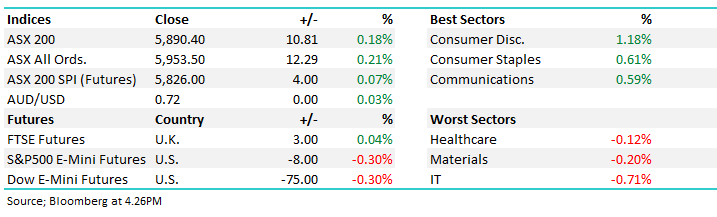

We’d targeted the 5950 region as major resistance and today the market traded to a 5911 high, before selling off fairly aggressively on the close in spite of a bullish lead from US markets on Friday. Asian markets were higher today while US Futures opened okay, before tracking lower throughout the session. No trade in the US tonight, closed for Martin Luther King Jr Day

Overall, the ASX 200 closed up +10points or +0.18% to 5890. Dow Futures are currently trading down -82pts or -0.33%.

ASX 200 Chart – weakness from early highs today – looks like short term exhaustion

ASX 200 Chart

CATCHING OUR EYE;

China Data; Lots of anticipation around todays data dump from China and it was pretty much inline – GDP smack on at 6.6% which was only a tad below prior number. Mkt initially rallied before selling off thereafter.

Broker Moves; Some more bullish rhetoric coming out on Australian banks recently with analysts suggesting that Commonwealth Bank might buy back ~A$3.5b in FY20 or unveil an A$1.5b special dividend in FY19 before completing a A$2b buyback the following year after recent asset sales – however Morgan Stanley are on the other side of that trade saying that CBA shouldn’t trade at such a premium to the others –suggesting a ~20% premium is too high.

ELSEWHERE:

· Charter Hall Upgraded to Overweight at JPMorgan; PT A$8.25

· Dexus Downgraded to Underweight at JPMorgan; PT A$10.60

· Mirvac Group Downgraded to Neutral at JPMorgan; PT A$2.50

· SCA Property Upgraded to Overweight at JPMorgan; PT A$2.75

· Scentre Group Cut to Neutral at JPMorgan; Price Target A$4.50

· Cromwell Property Upgraded to Overweight at JPMorgan; PT A$1.10

· Altium Downgraded to Hold at Bell Potter; PT A$25

· Kathmandu Upgraded to Outperform at First NZ Capital; PT NZ$2.90

· Rio Tinto Downgraded to Hold at Morgans Financial; PT A$82.55

· McMillan Shakespeare Downgraded to Hold at Morningstar

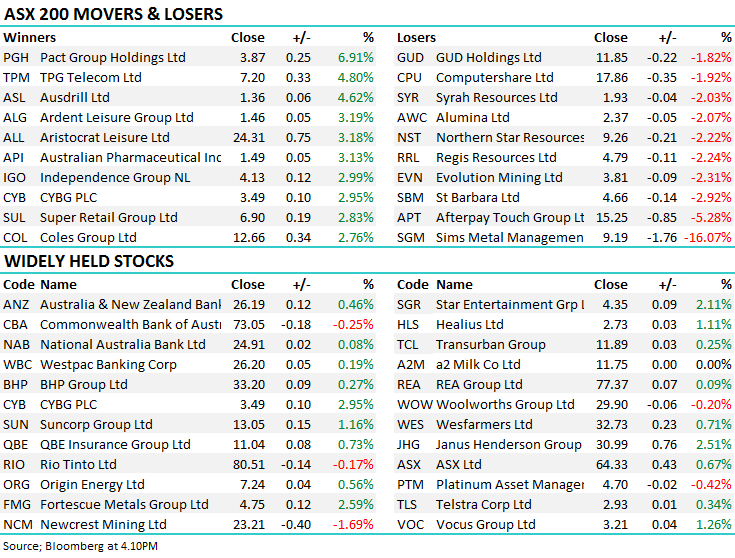

Sims Metal (ASX: SGM) $9.19 / -16.07%; Recycled metals company Sims Metal Management (ASX: SGM) has been whacked to new 2 year lows today on an earnings update the company released to the market this morning. The company announced expected EBIT for the first half of FY19 at around $110m which compares to a 1H18 figure of $125m or a 12.2% fall on the previous comparable period (pcp).

Much of the soft result has been driven by poor European trading conditions which has resulted in an 88% fall in the company’s EBIT generation from the region. Potentially even more concerning for the company is not the poor trading for the 6 months just gone, but the outlook for the remainder of the year. Consensus EBIT for the 2019 Financial Year is currently at $271.6m, with current operating run rate landing at $220m for the year, this is -18% short of expectations. Over FY18, EBIT was split 45/55 first half vs second. If this trend continues, FY19 EBIT will be ~$244m, or still 10% short of the markets current forecast.

The CEO & MD Alistair Field noted that “the first half has been challenging for all recycling companies globally and will continue to be so for the near future… I am confident that our strategy of producing high quality products that better meet the needs of our customers is key to our long term success.” Not a very promising outlook for the current shareholder. Consensus had EBIT growing at ~5.5% in FY20, and ~2.7% in FY21 which will be far too high if these trends continue. Stocks with weak earnings momentum are ones we will be looking to avoid in 2019.

Sims Metal (ASX:SGM) Chart

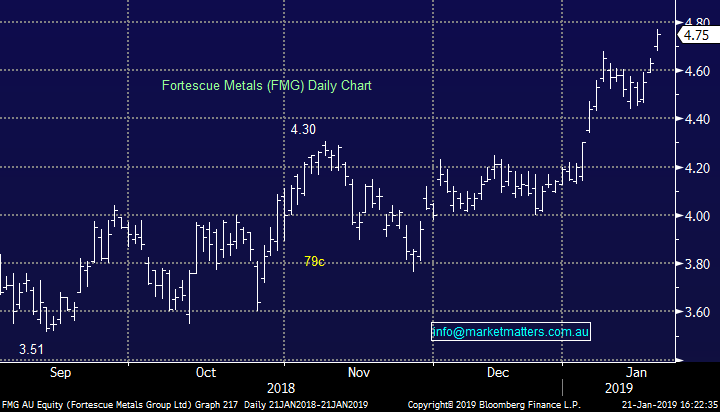

Fortescue Metals (ASX:FMG) $4.75 / 2.59%;Has been on a tear in recent times on the back of a resurgence in the Iron Ore price, however more importantly, we’ve seen a significant closure in the gap between high quality and lower quality Iron Ore. The concern was a few months ago that because of environment issues, there was a structural shift away from lower quality ore, or at least that’s what the majors were saying. The latest price print of 58% grade vs benchmark 62% grade – highlights a continued closing of the gap with the discount now at 23.2% having got as low as 22.3% (Or ~77% in terms of price realisation). Fortescue are the major beneficiary of that closure and have outperformed the other miners in recent times, although that is after a long period of underperformance. FMG remains bullish targeting ~$5.00

Fortescue Metals (ASX:FMG) Chart

OUR CALLS

We removed Suncorp (ASX:SUN) from the Income Portfolio today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 21/01/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.