ASX 200 fights to keep above water (CBA, VEA)

WHAT MATTERED TODAY

A pretty resilient session today really given the slew of negative headlines over the weekend as the vibe starts to change, particularly in the Sydney CBD which was quiet today. After having around 8 weeks at home, we’ve been in the office for the last month or so however today we flicked the switch and are back working remotely for the next few weeks. NSW (and more specifically Sydney) is at a real tipping point which will ultimately have wider ramifications one way or another around the country. I think it’s really important that NSW acts now so we don’t go down the Victorian path. I hope all our subscribers and clients in that part of the world are remaining safe, healthy and as happy as you can be in lockdown.

At a sector level today, the healthcare stocks benefitted from a move into the more defensive areas of the market, CSL a standout today while Materials and even Energy stocks did well, not typically sectors that benefit from a weaker growth outlook. On the flipside, the weakness was squarely in the banks while the retail sector played a supporting role in the sell off to end down -1.55%.

Around the region, Asian stocks were mostly okay, Japan & China both up nicely while US Futures are down a touch.

Overall, the ASX 200 fell -1pts / -0.03% to close at 5926. Dow Futures are trading down -115pts / -0.44%

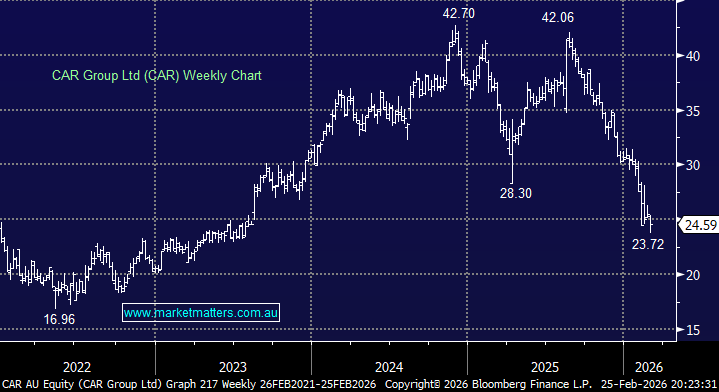

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

Banks: A weak session for the banks today with the big 4 detracting 27points from the ASX 200 to be the weakest link by far. ANZ and NAB the worst of them down more than 4% a piece while CBA fell a ‘relatively’ modest 1.78%. Obviously, stage 4 lockdowns in some parts of Victoria plus more solid action / strong suggestions being rolled out in NSW puts a shadow over our economic recovery which banks are very leveraged to. We have the RBA meeting tomorrow and I read a few things today that suggests a cut of 0.15% could be on the cards taking the benchmark to 0.10% - not sure what / how that would help however lower rates = negative for banks and finally we had weakness in house price data out from CoreLogic saying property values in major cities fell 0.8% last month, led by Sydney and Melbourne. So far, house prices have remained resilient during the pandemic, falling just 1.6% from the most recent peak in April however the outlook is clearly becoming more clouded, hence the sell-off in banks today.

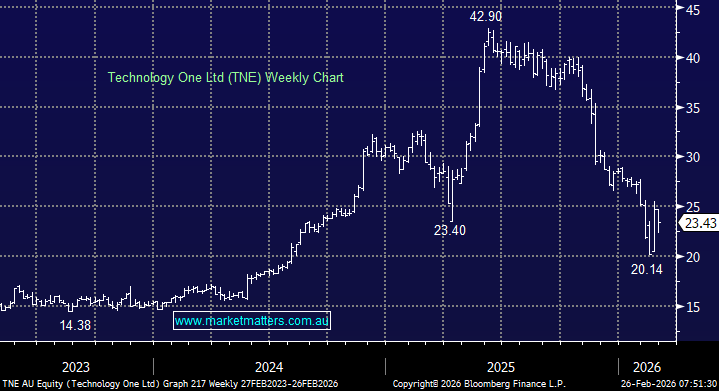

Commonwealth Bank (CBA)

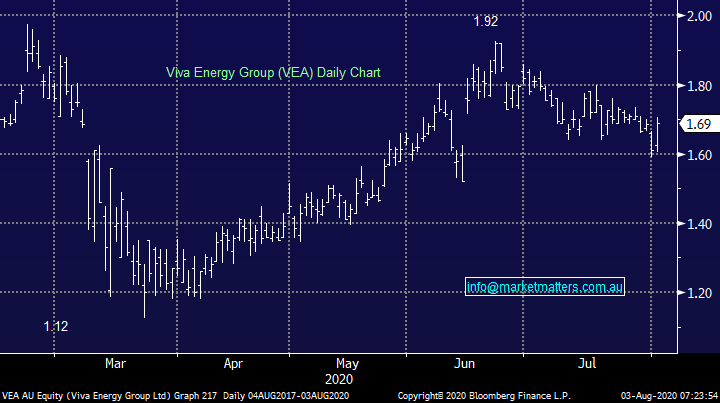

Viva Energy (VEA) +4.97%: gave an update to the market on fuel sales amidst further lockdowns, particularly in Victoria. The petrol station operator saw petrol sales in the state fall 25% in July compared to the same month last year as a result of the stage 3 lockdowns for Melbourne. Fortunately, though total sales were flat on the same period last year with an increase in wholesale and agricultural demand for fuel. They also noted a fall in demand for the rest of Australia which was down around 11%. The updated was better than the market had been expecting with shares in both VEA and competitor Ampol (the old Caltex now trading under ALD) both trading more than 4% better today. Further lockdown measures in Victoria overnight, tightened state borders and outbreaks across the country threaten to weigh on fuel demand for them both though, and with Viva trading only marginally below pre-COVID levels the stock looks full here.

Viva Energy (VEA) Chart

BROKER MOVES:

· Cochlear Raised to Overweight at Wilsons; PT A$208.94

· Orocobre Cut to Hold at Bell Potter; PT A$2.90

· Origin Energy Raised to Add at Morgans Financial Limited

· IOOF Holdings Raised to Buy at Morningstar

· Origin Energy Raised to Buy at Morningstar

· Alumina Raised to Hold at Morningstar

· Sandfire Raised to Buy at Morningstar

· Ampol Raised to Buy at Morningstar

· OceanaGold GDRs Raised to Outperform at Credit Suisse

· Metro Mining Cut to Hold at Argonaut Securities

OUR CALLS

No changes today

Major Movers Today

**Unavailable today**

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.