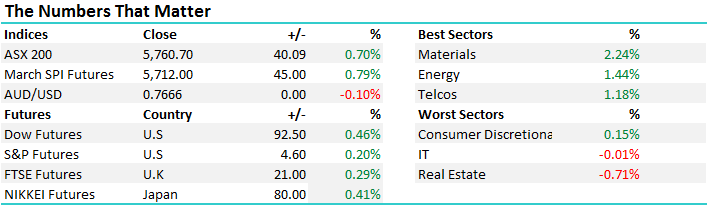

ASX 200 breaks up through resistance – 5800 now in sight

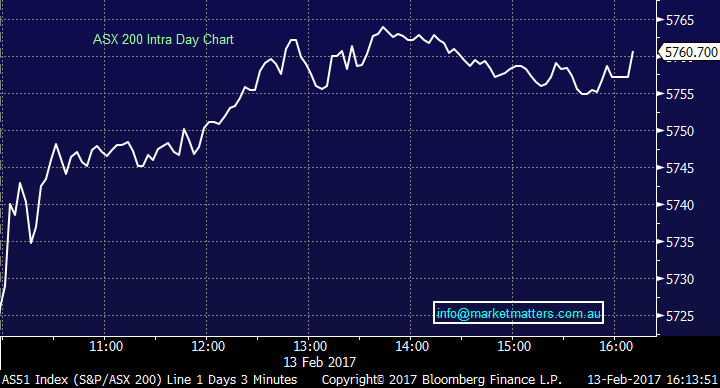

A higher open this morning on the back of decent buying in the resources space and that theme played out most of the day – the market peaked around 2pm but was pretty well supported into the close. We had a range today of +/- 39 points, a high of 5764, a low of 5725 and a close of 5760, up +40pts or +0.70%. Technically, the break of 5735 is bullish and as we’ve been suggesting last week, 5800 is now firmly in play.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

Reporting continues to dominate with around ~60 companies in the ASX 300 reporting results this week. More on that below however here is a recap of three stocks that reported last week in a video I did for Livewire. Discussed is Suncorp (SUN), Henderson (HGG) and Genworth (GMA).

JB Hi-Fi (JBH); A good result and it was broadly above market expectations on the metrics that count, like underlying earnings and comparable sales growth y/y which was +8.7%. The result will likely lead to small upgrades for JBH given their guidance for underlying earnings of $A200-$206m versus $A 197m expected. As we wrote this morning , analysts are optimistic on JBH with strong future performance priced in. Technically JBH looks positive however we think the entrance of Amazon into Australia will have a significant impact on the retail space over time. Conflicting signals here for JB Hi-Fi which makes it too hard for us at present. A strong open before the stock sold off into the close finishing +3.2% higher at $29.38

JB Hi-Fi (JBH) Daily Chart

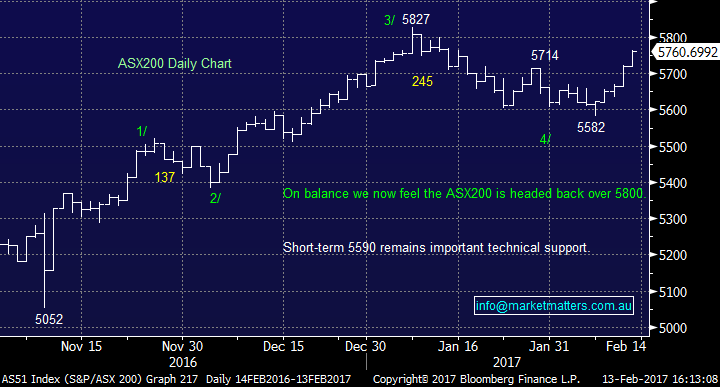

Ansell (ANN); an interesting day of trade today for ANN with the stock ticking below our $21 target level as a BUY but only briefly and very few shares traded at that level (see our TOP TEN for more detail). The result below expectations however the guidance was OK, hence the bounce back after the intial move lower. They said “The second half is expected to see continued progress against the company's strategic goals. Organic growth should benefit from continued momentum of new product sales in Industrial, while Medical should make further progress as it emerges from the capacity constraints of last year and improves operational productivity.” ANN closed down -2.12% to $21.65

Ansell (ANN) Daily Chart

Newcrest Mining (NCM); A good report supporting NCMs big share price move higher over the last 3 months – up around 40%. Both earnings and dividend were inline with expectations and impressively, profit was up 4 fold from this time last year. NCM are enjoying a ~$500/oz cash margin on ~2.5moz gold production ... A very BIG number! We own NCM and the stock up +0.18% to $22.72

Newcrest (NCM) Daily Chart

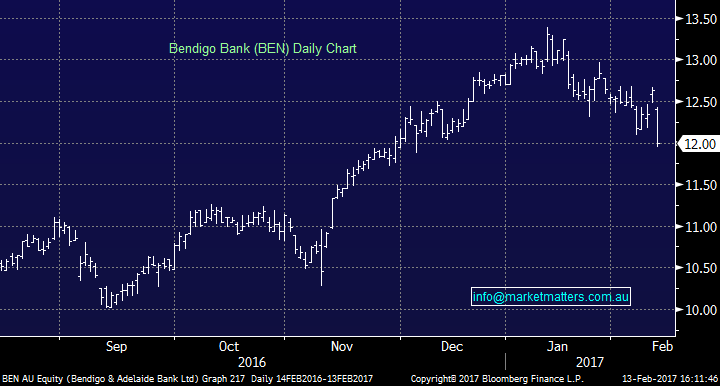

Bendigo Bank (BEN); an inline result with both earnings and dividend broadly in line with expectations, however the quality was poor and not good enough to justify the premium BEN has been trading on to the sector. We’d written a few times about BEN given it looked positive from a technical standpoint, however the underlying quality of its earnings was always questionable. The stock closed down -4.99% to $12.00

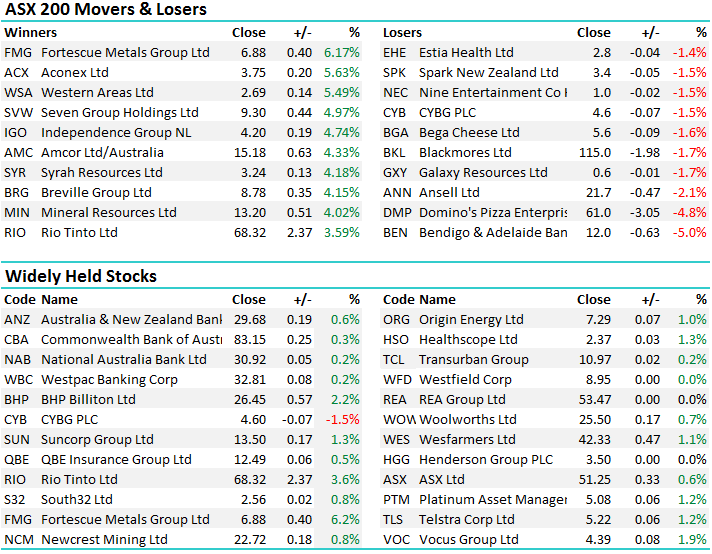

Material stocks clearly the shining light today booking 8 of the TOP 10 spots. A couple of stocks we hold are starting to kick – Platinum (PTM) an example here. Fund Managers have clearly had a very tough time of late however if the mkt kicks to the upside, these sort of stocks that have lagged BUT have very high leverage to the market will start to outperform.

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 13/02/2017. 5.30PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here