ASX 200 adds 2.34% for the month (DHG, CGC, NCM, SEK, ORI)

WHAT MATTERED TODAY

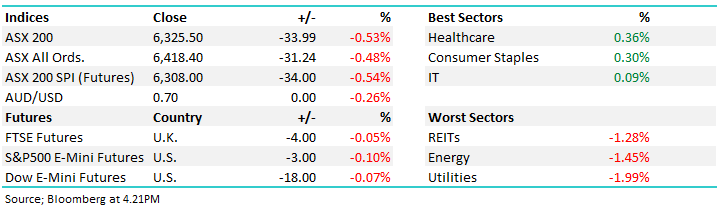

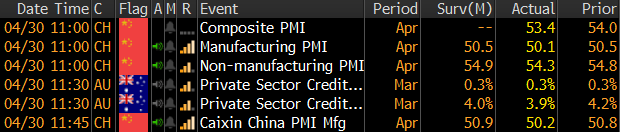

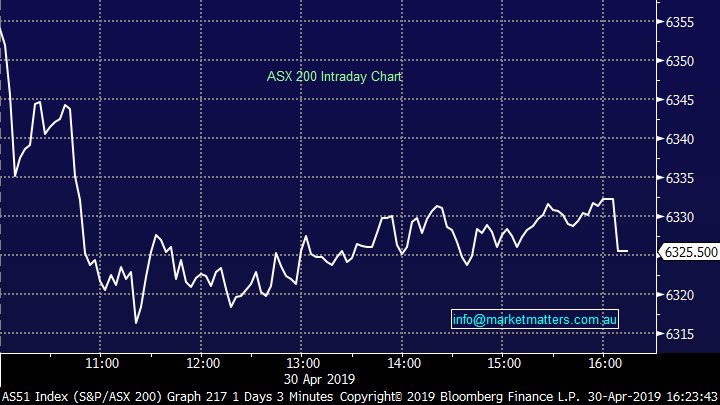

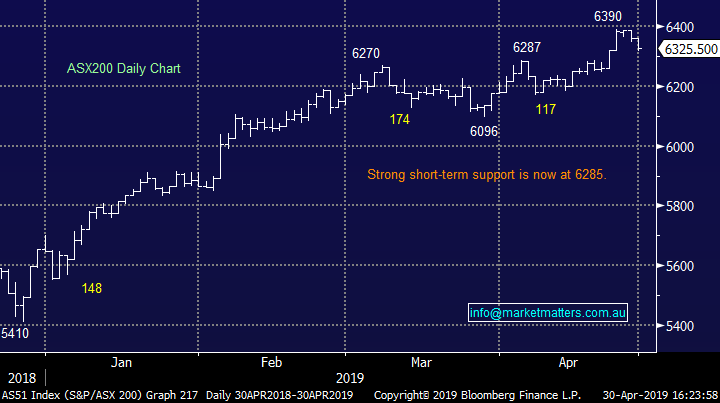

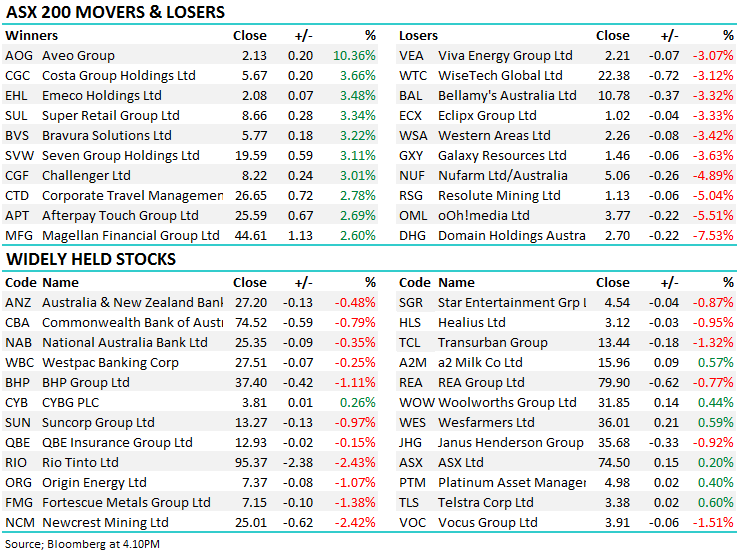

Another day where sellers took the gong - the index traded down however there was a lot happening under the hood with the Macquarie Equities Conference underway – more on that below. Most selling happened in the morning on the back of weaker than expected Chinese Manufacturing data – the mkt + resources hit fairly hard on the news although recovered from their lows.

The China Data was the main event and that was a miss while private sector credit came in pretty much inline.

A good month in April for the market with the index trading up +2.34% on the month – more in terms of sectors / stocks below.

Overall today, the ASX 200 fell by -34 points or -0.53% to 6325. Dow Futures are trading down -9pts / -0.03%

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

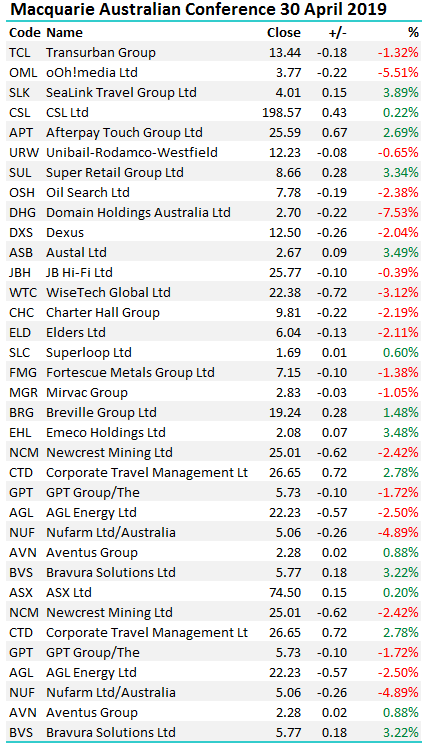

Macquarie Conference – A few interesting themes played out today at the Macquarie conference. The retailers that presented did okay with sales growth better than perhaps the markets downbeat expectations . Supercheap (SUL) and JB Hi-Fi (JBH) headlined and were fine.

In the property space, Stockland (SGP) reiterated FY19 guidance and said they were on track to settle over 6,000 residential lots which is largely in line with market expectations, Mirvac (MGR) also reaffirmed FY19 earnings per share (eps) guidance of 16.9-17.1cps which is in line with expectations, and they’re on track to hit over 2,500 residential lot sales, importantly, defaults remain at less than 2%. Vicinity (VCX) - FY19 guidance reiterated and ditto for Dexus (DXS) who confirmed FY 19 guidance which was for Dividend growth of ~5%. All in all, the doom and gloom in property, especially in the residential sector hasn’t really yet started to bite.

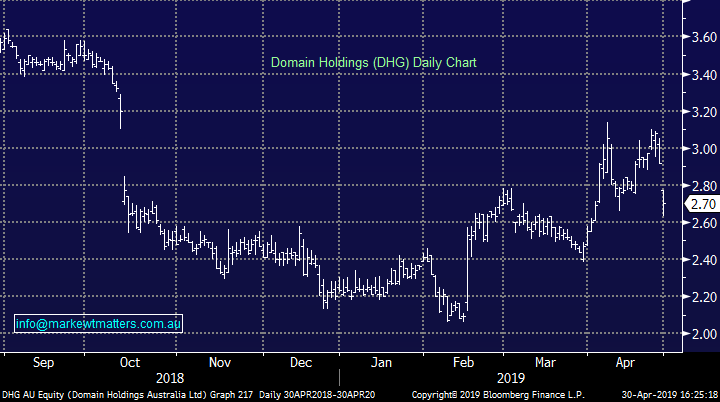

It was less rosy for Domain (DHG) which fell around 7% today with revenue down 6% for the March quarter. The mkt wasn’t expecting a lot but a 6% decline in revenue for the quarter is a slap in the face – hence the stock was hit today after a reasonable run up from the lows…

Domain (DHG) Chart

Here’s a look at how all companies performed that presented today:

Tomorrows agenda as follows….

9.30am – The A2 Milk Company (A2M), Mineral Resources (MIN), ARB Corporation (ARB)

10.30am – Origin Energy (ORG), NIB Holdings (NHF), Service Stream (SSM), Northern Star Resources (NST)

11.15am – APA Group (APA), Speedcast (SDA), Lifestyle Communities (LIC), Evolution Mining (EVN)

12.00pm – Aurizon (AZJ), IDP Education (IEL), ReadyTech (RDY), Regis Resources (RRL)

1.30pm – Suncorp Group (SUN), Bingo Industries (BIN), HUB24 (HUB), Saracen Mineral (SAR)

2.15pm – Rio Tinto (RIO), Steadfast Group (SDF), The Citadel Group (CTD), Resolute Mining (RSG)

3.00pm – Nine Entertainment Co (NEC), Perpetual (PPT), SG Fleet Group (SGF), Beach Energy (BPT)

4.00pm – Skycity Entertainment Group (SKC), NextDC (NXT), Vista Group International (VGL), St Barbara (SBM)

4.45pm – Coca-Cola Amatil (CCL), Nearmap (NEA), Starpharma (SPL), OceanaGold (OGC)

Two stocks we hold positions in caught my eye… Emeco (EHL) +3.48% today while Costa Group (CGC) +3.66% also had a good session – both stocks are starting to look good here in terms of their price action – worth keeping on the radar if you don’t own.

Costa Group (CGC) Chart

Newcrest (NCM) -2.42% - Down today on a weaker set of production numbers which showed Gold production 623koz vs quarter-ago 655koz, Copper production 25.3kt vs quarter-ago 26.8kt, AISC $738/oz. vs quarter-ago $720/oz. Year-to-date gold and copper production up 7% and 33% respectively compared to prior year and Year-to-date AISC of $744/oz., 12% lower compared to prior year. Worth noting the December QTR was a record + they had planned maintenance during the period.

Guidance maintained for the full year – stock traded down sub $25 and it starting to look interesting.

Newcrest (NCM) Chart

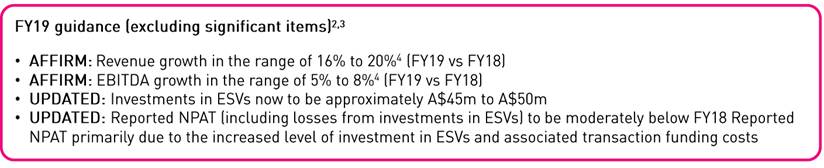

Seek (SEK) -0.65%; After mkt and ahead of their Macquarie conference presentation on Thursday, SEK was out with updated guidance with NPAT now expected to be moderately below FY18 reported profit. The market was set for a flat result at the profit line in FY19 so this guidance is effectively a downgrade and the magnitude is dependent upon what the term moderately means – generally I think its 5% so assuming that’s correct, and applying a PE re-rate given the stock trades on 32x with no growth, and a 10% fall tomorrow is on the cards…

From the announcement…

Seek (SEK) Chart

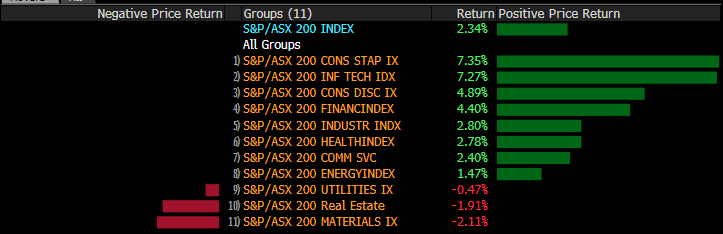

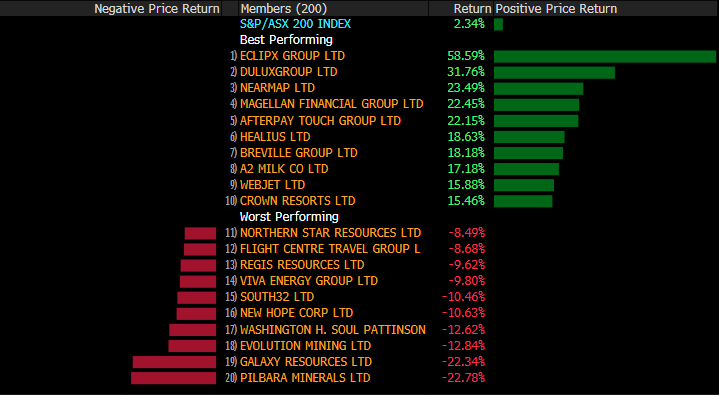

Month End…it didn’t really feel like a month end sort of day however April was another good one for equities. Here’s the stats in terms of Stocks & Sectors

Sectors – Materials have come off the boil with the overall mkt did well adding another +2.34%

Plus best and worst stocks – we own Healius (HLS) that did well and no stocks in the bottom group.

Broker moves:

Orica (ORI) -1.12% - hit early on this downgrade but recovered from the lows – we hold in the Growth Portfolio and remain comfortable with the position.

Orica (ORI) Chart

· Orica Downgraded to Neutral at UBS; PT A$19.20

· A2 Milk Co Downgraded to Sell at Morningstar

· Domain Holdings Downgraded to Neutral at JPMorgan; PT A$3.15

· REA Group Downgraded to Underweight at JPMorgan; PT A$74

· Flight Centre Downgraded to Sector Perform at RBC; PT A$42

· Pilbara Minerals Upgraded to Neutral at JPMorgan; PT A$0.65

OUR CALLS

No moves today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 30/04/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.