Asian markets lead the region higher (SSM, JHG, COL, NCK)

WHAT MATTERED TODAY

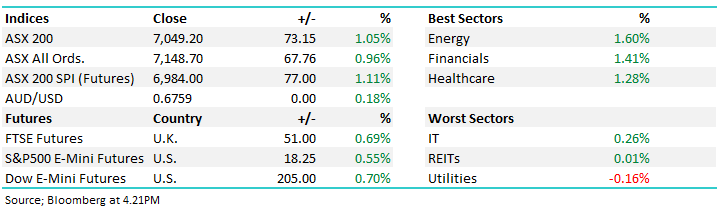

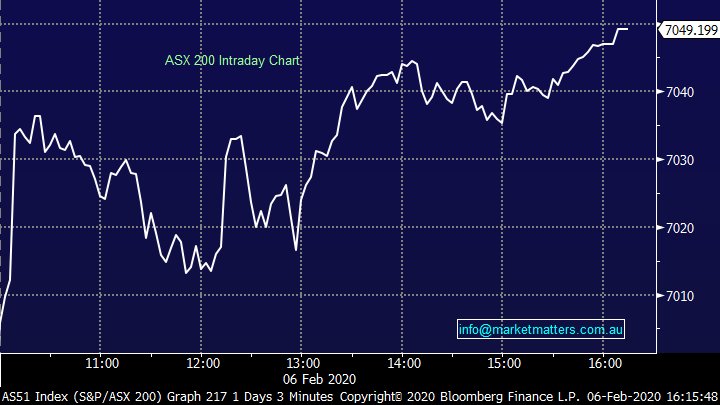

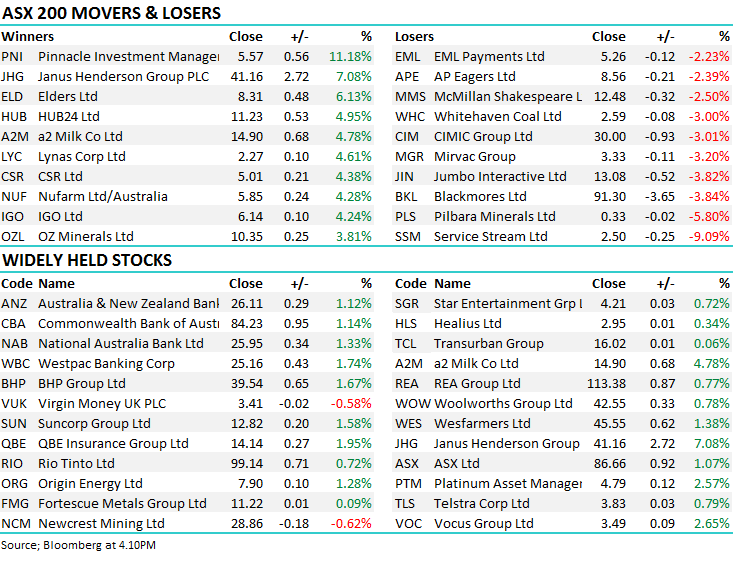

A good session today across the board off the back of another good session overseas, plus Asian markets were strong, Japan up nearly +3% while Hong Kong & China were both up around 2%. US futures also rallied another ~0.6% during our time zone setting up a positive start to trade tonight. Given that optimistic backdrop the ASX ‘only’ rallying by ~1% seems underdone, the AUD moving up to 67.59c probably didn’t help. At a sector level, most support came for the recently weak areas, Energy & Materials were strong which suits the MM stance at the moment, Oz Minerals (OZL) added nearly 4% while UBS upgraded the building material stocks which all rallied. Nick Scali (NCK) a standout on the upside thanks to a strong report while Service Stream (SSM) went the other way, we cover that below.

Reporting season kicking up locally with a reporting schedule available: CLICK HERE

Tomorrow we have reports from MGR, NWS, REA.

Overall, the ASX 200 added +27pts / +0.39% today to close at 6976. Dow Futures are trading lower by -48pts/-0.18%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

Service Stream (SSM) -9.09%: The essential network services provider reported after market yesterday and today they’ve been hit hard, down around 9.09%. The result was a decent one, inline with prior guidance however it seemed the market had gotten slightly ahead of itself. Macquarie put out a bullish note a few days ago initiating coverage with an outperform and $3.19 price target, v the $2.62 the stock was trading at the time. They pencilled in adjusted net profit for the year of $67.6m and today SSM printed $32.3m for the 1H, and guided for a similar outcome for the 2H, which implies $64.6m for the year, a 4.4% miss. They did increase the dividend to 4cps which was up 14% on prior period. We own in the Growth Portfolio.

Service Stream (SSM) Chart

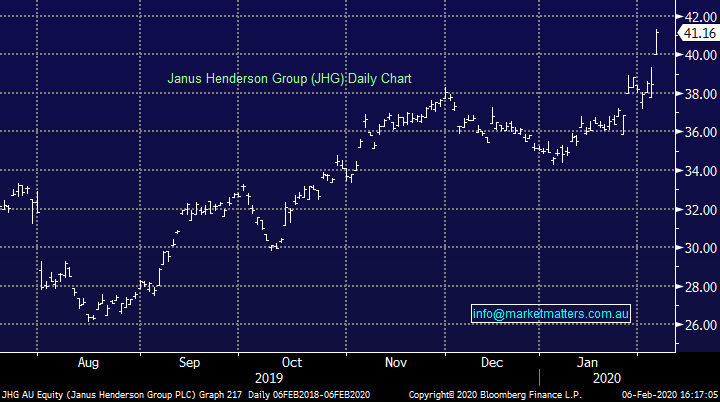

Janus Henderson (JHG) +7.08%: good run today following their results earlier in the week. The initial reaction to the results when they came out was a negative one, although clearer heads have now prevailed. They did lose FUM, however as we suggested at the time, it was mainly from one big low margin mandate, while there was somewhat of a revival from retail land. Performance also improved. Macquarie upgraded the stock post the result to Outperform with a $42.80 price target (up from $34.50), they’re on the same page as us given stock still on 10x FY20. Laf at Bells is the No 1 rated analyst on the stock with a $48 PT. The stock closed today at $41.16. We own in the Growth Portfolio

Janus Henderson (JHG) Chart

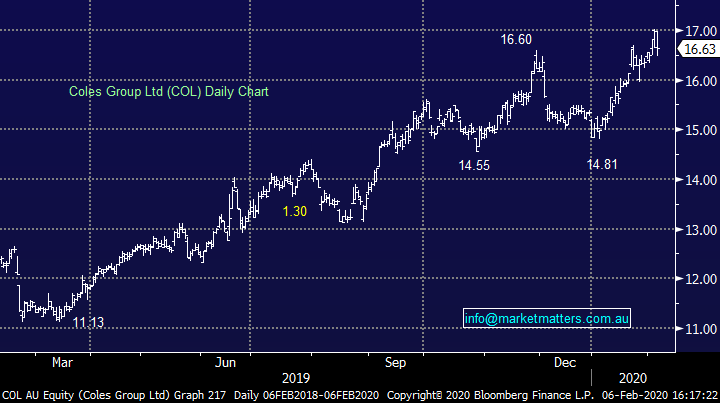

Coles (COL) -0.12%; provided the market with a trading update this morning ahead of their official half year numbers due out in a fortnight. The update was a positive one for Coles’ supermarkets, showing 3.6% same store sales growth for the second quarter with the Christmas trade period exceeding expectations. The strong supermarket numbers were backed up by sales growth of 2.1% in liquor, and 5.1% in Coles’ express stores for the second quarter of the year. The plastic bag ban and lower flybuys promotional activity are expected to provide a one off boost to EBIT margins in the 1st half of the year. Liquor, though, will see margin pressure as clearance and promotional activity increased with what the company called ”strategic range views.” It’s surprising the stock wasn’t stronger today given what looked like a reasonable update. It likely shows that there is too much good news baked into the stock, not something that encourages buyers. We don’t own

Coles (COL) Chart

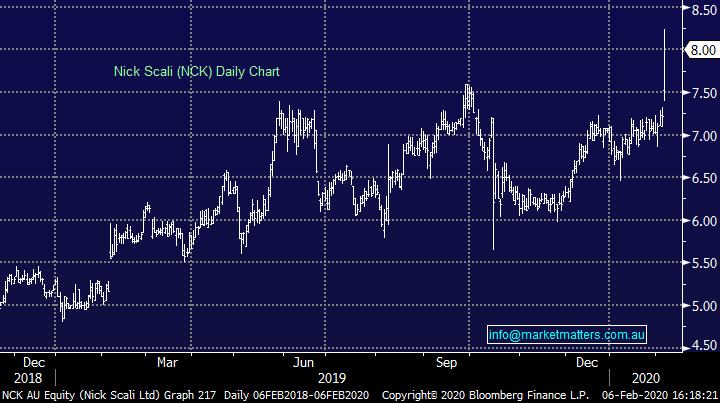

Nick Scali (NCK) +10.80%; shot to new 52-week highs today despite falling sales in both LFL and overall metrics as well as falling margins. Nick Scali noted a slip in sales back in October last year, blaming slowing housing sales and renovations for a drop in foot traffic, and subsequently guided the market lower. Today though, the guidance appeared to be conservative with a small rebound in the 2Q helping the half beat the subdued expectations. Sales were down 2.6%, while on a LFL basis, sales were off 7.5%. Margins were squeezed 60bps to 62.2% however NPAT came in at $20.3m for the half, down on 1H19 but nearly 13% above the midpoint of guidance. The company didn’t provide guidance for the full year (which is standard), but they did talk down expectations on lower consumer confidence while January has seen orders down 1.7% on the January of last year. NCK will pay a first half dividend of 25c, a yield of around 6% annualized on where the stock closed today. We like Nick Scali, but would be keen to buy on the back foot, particularly for the income portfolio.

Nick Scali (NCK) Chart

Broker moves; UBS upgraded building material stocks BLD, ABC & CSR + Morgan upgraded ABC. Another decent session for BLD breaking out above $5.20 resistance. We own BLD

- SCA Property Cut to Sell at Moelis & Company; PT A$2.64

- Bank of Queensland Raised to Neutral at Citi; PT A$7.75

- CSR Raised to Buy at UBS; PT A$5.24

- Boral Raised to Buy at UBS; PT A$6

- Adelaide Brighton Raised to Buy at UBS; PT A$3.85

- Janus Henderson GDRs Raised to Outperform at Macquarie

- Genworth Australia Raised to Outperform at Macquarie; PT A$4.30

- Cimic Cut to Hold at Morningstar

- GPT Group Cut to Sell at Morningstar

- New Hope Cut to Hold at Morningstar

- Seven West Raised to Neutral at Goldman; PT 28 Australian cents

- Adelaide Brighton Rated New Hold at Morgans Financial Limited

- Seek Raised to Outperform at Credit Suisse; PT A$23.80

- HT&E Cut to Neutral at Credit Suisse; PT A$1.65

- Aurizon Raised to Buy at Jefferies; PT A$6.19

- Alacer Gold GDRs Raised to Outperform at Credit Suisse

- Panoramic Resources Cut to Sell at Baillieu Ltd

OUR CALLS

No amendments today

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.