APRA extends loan leniency (AWC, NST)

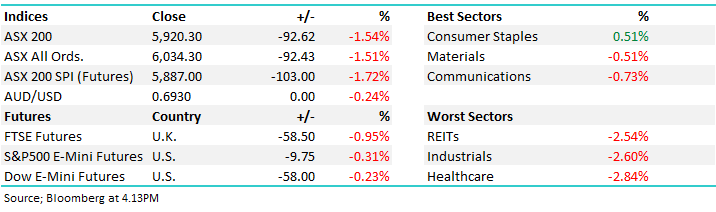

WHAT MATTERED TODAY

The Aussie market eventually gave in to the selling pressure today, coming well off the high in similar fashion to yesterday. There were small pockets of strength seen – the supermarkets which we discussed in today’s Income note were in the black, so were gold and telcos – but for the most part equities were broadly lower. The selling came on the back of further lockdown fears with economists rushing to amend numbers lower following the shutdown of Australia’s second largest city.

Banks were the main drag on news APRA would allow a further 4 months of leniency for borrowers looking to defer payments. The original offer was to defer payments through to September, but it had been widely accepted that some measures would be extended. On current data around 10% of mortgage holders have been approved for deferrals which is the equivalent of circa $50b in each of CBA & WBC’s loan books. Business loans have seen around 15% the total outstanding amounts offered repayment leniency.

Afterpay (APT) returned to the screens today and closed at $66 – the same price as they managed to get the raise/sell-down away at. Northern Star was the latest gold name to jump on production updates while Alumina was hit on the back of the ATO chasing additional taxes.

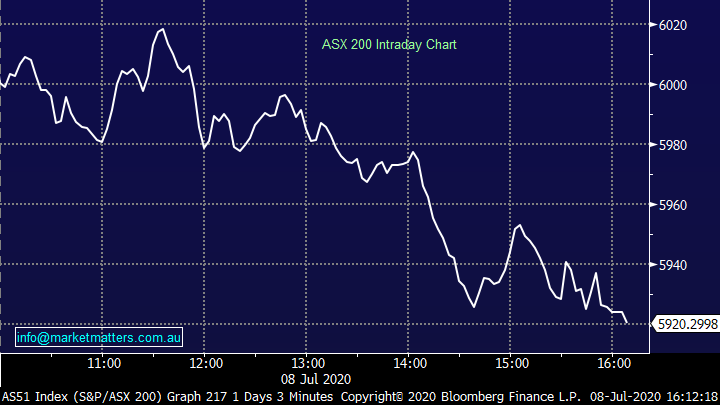

Overall, the ASX 200 ended down -92pt / -1.54% today to close at 6012 - Dow Futures are trading down -58pts / -0.23%

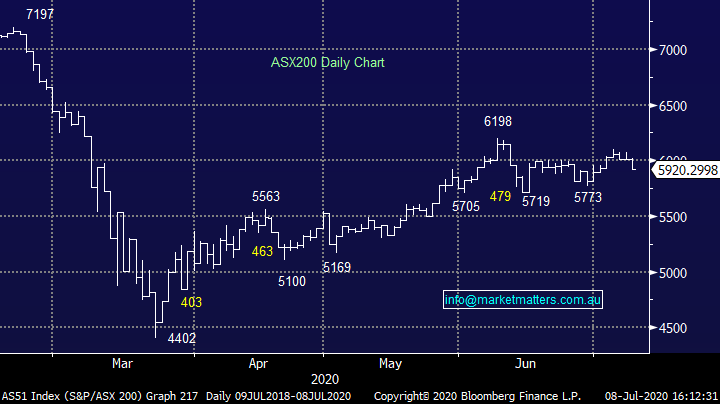

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

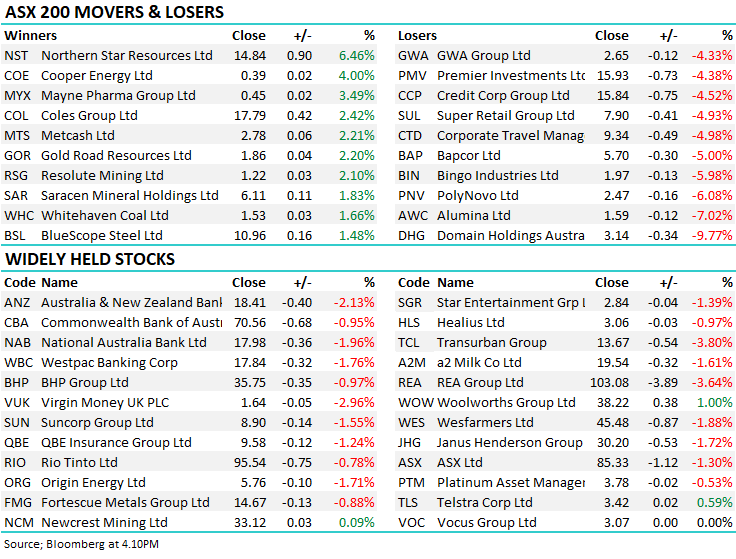

Northern Star (NST) +6.46%: jumped today after it followed St Barbara’s announcement yesterday and came out with a solid quarterly update of their own and managed to reinstate 7.5c their interim dividend. The gold miner pulled guidance in late March, at the peak of the crisis as a result of the added safety measures, and the complexity it brought to operations. With the year now complete, Norther Star managed 905koz mined, coming in marginally below the lower end of the withdrawn guidance of 920koz to 1,040koz. Despite the miss, the market was just happy to see a figure close to expectations, with the company managing to generate around $218m of cash in the quarter alone. With many in the market expecting the gold price to trend higher on low or negative real rates, investors should also be pleased to see Northern Star reducing the size of the hedge book, opening it up to increased profits on a strong underlying commodity. Just 15% of production over the next 3 years has been locked in. We are looking to pick up some gold exposure on the back foot and NST is on the shortlist.

Northern Star (NST) Chart

Alumina (AWC) -7.02%: Down sharply today on the back of an unfavourable tax ruling which hurts their dividend by around US1c in FY20. We won’t go into the details other than to say AWC think they are right, the ATO think their assessment is correct, experience suggests that dealings with the ATO don’t always end well with some/part payment likely. So, assuming that AWC will see some cash go out the door which will cap dividend payments in that period - in this case 3Q20 and US1c so far. A negative update from AWC today hence the fall in the stock. We hold in the growth portfolio; today’s news won’t change that.

Alumina (AWC) Chart

BROKER MOVES:

· Afterpay Cut to Neutral at Macquarie; PT A$70

· Wesfarmers Cut to Neutral at Macquarie; PT A$44.50

· JB Hi-Fi Cut to Neutral at Macquarie; PT A$41

· Domino's Pizza Enterprises Cut to Neutral at Macquarie

· Sandfire Resources Cut to Sell at Goldman

· Rio Tinto Cut to Neutral at Goldman

· Coca-Cola Amatil Cut to Neutral at Credit Suisse; PT A$9

· Nickel Mines Rated New Buy at Shaw and Partners; PT A$1.04

OUR CALLS

No changes today

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.