Apparently, Aussie’s are not spoiling their puppies…(CBA, GXL,CYB)

WHAT MATTERED TODAY

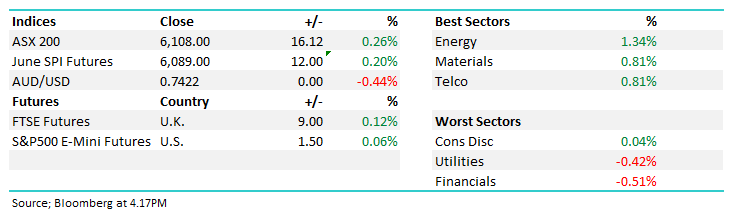

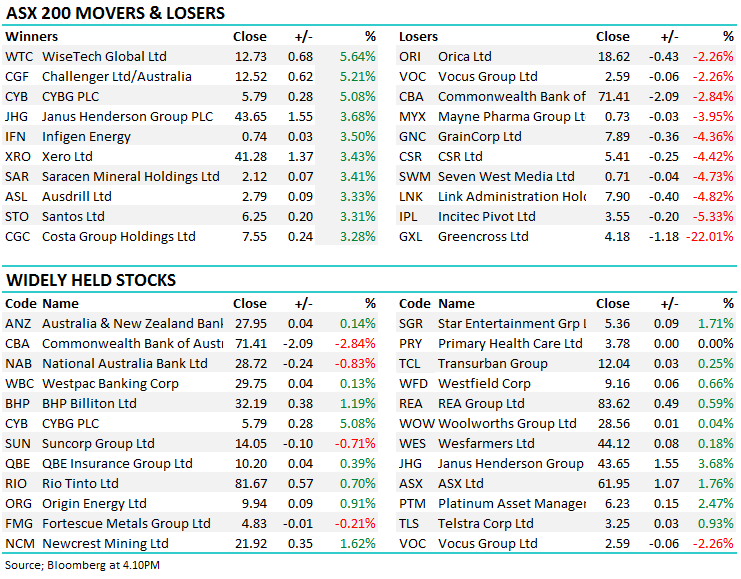

Once again the market flirted with the 6100 area today, failed to break out to new highs however closed stronger than we’ve seen in the past few sessions. Challenger Group (CGF) appears to be one of a few beneficiaries of the budget announcements, particularly in regards to changes to retirement income with a push towards annuities which would clearly assist their growth. Local energy names were also stronger with no surprises being thrown up in the budget announcement around the MRRT (rumblings were the Govt was going to tweak the way past expenditure could offset future income).

Elsewhere, Clydesdale (CYB) bounced back as brokers talked up the likelihood and positive impacts of the Virgin Money deal while CBA was hit hard following their March quarter update – more on this later. Pet retailer and veterinary clinic operator Greencross (GXL) was whacked -22%, after dropping EBITDA guidance more than 10% below consensus + Incitec Pivot was weaker after a soft half year result.

Overall, the ASX 200 added 16 points or +0.26% to close at 6108 – a reasonable session for local stocks setting up for higher prices it would seem….

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; A few interesting notes out this morning on CYBG and the ‘leaked’ deal with Virgin Money. My initial impression was that these sort of deals lead to some short term weakness in share prices of the acquirer (CYB), and that played out yesterday, however upon review, the deal now looks likely to be more positive for CYB, although that’s dependent on how much they pay. Any further creep could start to bite the share price of CYB, however for now, it seems good for both parties.. That said, we’ll still look to sell into any further strength around the ~$6 mark for CYB.

ELSEWHERE…

· JB Hi-Fi Downgraded to Hold at Deutsche Bank; PT Set to A$24

· Baby Bunting Upgraded to Neutral at Citi; PT A$1.50

· Challenger Upgraded to Buy at Citi; PT A$13.60

· Spark NZ Cut to Neutral at Forsyth Barr; Price Target NZ$3.50

· Westpac Reinstated at Shaw and Partners With Buy; PT A$32

· Independence Group Cut to Underperform at Macquarie; PT A$4.60

· Platinum Asset Upgraded to Neutral at Macquarie; PT A$6.25

Clydesdale (BYB) Chart

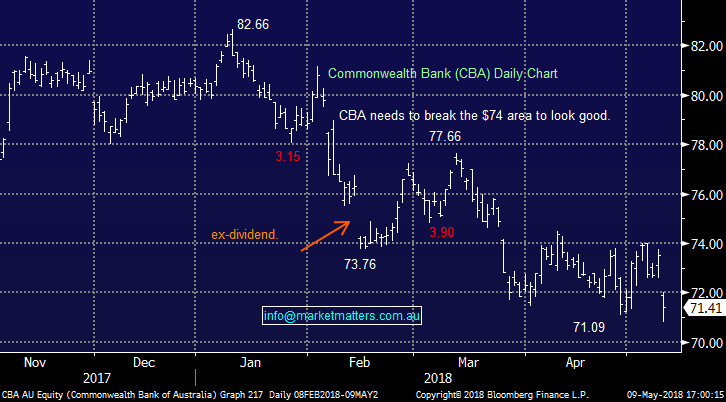

Commonwealth Bank (CBA) $71.41 / -2.84%; CBA was weaker following the release of the March Quarter update this morning. The result should really have come as no surprise for investors as cost rose as a result of the Royal Commission, net interest margin fell as customers switched from interest only into P&I loans, and income was lower from the 2 few days in the month accounting for around ~$100m. Bad debts continue to assist the banks bottom line, falling to just 0.14%, but impaired assets saw a small rise of $600m to $6.6bil which will be noted. All in all, it was a weak update from CBA and as I type away this afternoon I continue to ponder whether or not the result is being impacted by the change of leadership – the rebasement of market expectations under Matt Comyn. From a price action perspective, the stock opened lower then flat lined throughout the day. Only seeing flash note research from the bulge brackets + a full update from Shaw’s, it looks like analysts are revising earnings down by around ~2$, implying todays market reaction is about right.

We own CBA and have a clear inclination to be a buyer here despite the continual barrage of negative news flow.

Commonwealth Bank (CBA) Chart

Greencross $4.18 / -22.01%; retail updates of late continue to confirm a tough operating environment in many areas – Greencross which own vet practices + Petbarn was today smacked -22% after an earnings downgrade. In short GXL is essentially a retailer (retail accounts for 74% of group sales) however the downgrade announced today appears to be more about the vet business which is strange / hard to reconcile. Anyway, they announced that it now expects to deliver underlying FY2018 EBITDA of between $97 m and $100 m versus market expectations for a FY18 EBITDA of $110 Factset. We have no interest in GXL.

Greencross (GXL) Chart

OUR CALLS

No changes to the MM Portfolios today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 09/05/2018. 5.00PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here