ANZ leads market higher (ANZ, GMA)

WHAT MATTERED TODAY

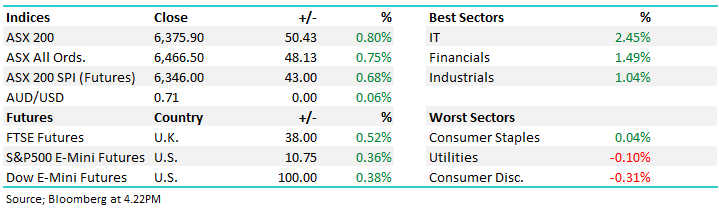

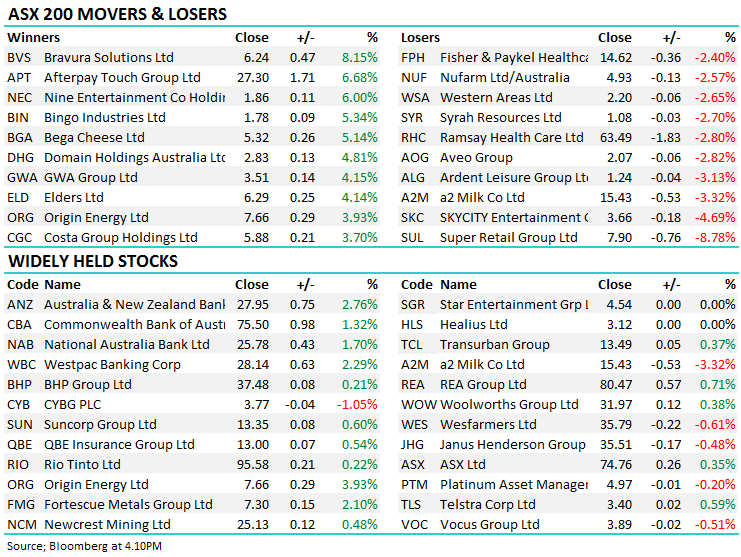

A bullish day for Aussie stocks with the banks underpinning the strength at the index level following ANZ’s 1H numbers – more on that below, however hard to not see the impressive performance from the likes of Afterpay Touch (APT) +5.37% and Zip Co (Z1P) +11.76% as momentum funds – some from overseas buy into SP + earnings momentum - pretty aggressive buying in each today plus Splitit (SPT) +$5.37 also joined in. The IT sector the most bullish on the board while the banks accounted for nearly half the markets gains. Resources were higher, but underperformed the broader mkt today.

Overall today, the ASX 200 added +50 points or +0.80% to 6375. Dow Futures are trading up +91pts / +0.35%

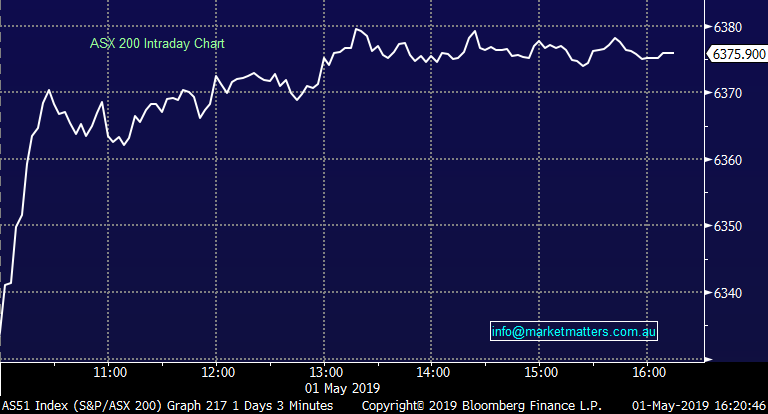

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Macquarie Conference – another day of decent moves today emanating from the MQG conference - big winners were some of the beaten down names like Bingo (BIN) that rallied +5.34% (we own) plus Nine Entertainment (NEC) +6% while there weren’t any real big disasters. We were chatting on the desk mid-afternoon that theme, given this year’s event has held fewer large casualties relative to other years. A day to go and now I’ve said that we’ll get some big movers tomorrow no doubt…

Here’s a look at how all companies performed that presented today:

Tomorrows agenda as follows….

8.45am – Wesfarmers (WES), Jumbo Interactive (JIN), Western Areas (WSA), Australian Finance Group (AFG)

9.30am – Seek (SEK), Independence Group (IGO), 3P Learning (3PL)

10.30am – Pinnacle Investment Management Group (PNI), Clean Teq (CLQ), Australian Pharmaceutical Industries (API)

11.15am – Challenger (CGF), Pro Medicus (PME), Sandfire Resources (SFR), G.U.D. Holdings (GUD),

12.00pm – Cleanaway Waste Management (CWY), InvoCare (IVC), OZ Minerals (OZL), Contact Energy (CEN)

1.30pm – Downer Group (DOW), IOOF (IFL), Orocobre (ORE), Abacus Property Group (ABP),

2.15pm – Orora (ORA), GTN, Pilbara Minerals (PLS), Heartland Group (HGH)

3.00pm – Atlas Arteria (ALX), GWA, Carnarvon Petroleum (CVN), Marley Spoon (MMM)

4.00pm – WorleyParsons (WOR), Aurelia Metals (AMI), IPH

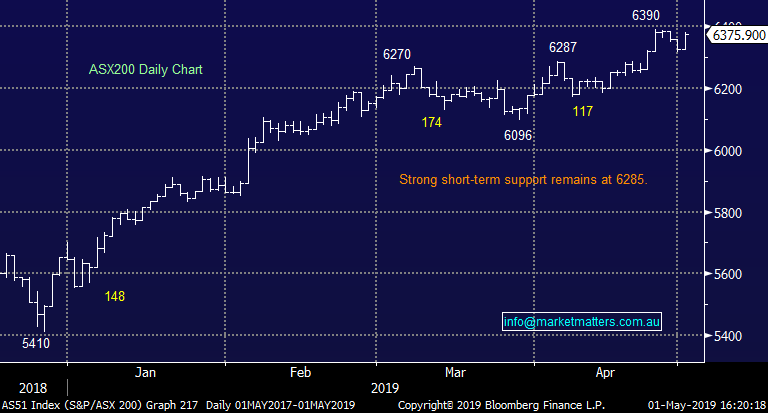

ANZ +2.76% - Rallied strongly today on the back of a good earnings report, or more accurately, good relative to downbeat market expectations. A few brokers put out bullish commentary intra-day. Shaw’s good banking analyst Brett Le Mesurier saying…. ANZ reported a 1H19 profit of $3173M as expected and a higher cash profit of $3514M. This profit included $201M after-tax gains from asset sales, so on a comparable basis with other banks, the cash profit was $3313M. There were customer remediation costs of $100M in 1H19, royal commission costs of $13M and restructuring costs of $51M pre-tax. These were described as large and notable items as were the gains from asset sales.

There was no change in the net interest margin and little change in loans from 2H18 to 1H19. Markets income increased by $67M from 2H18 to 1H19, which prevented the decline in total income. The bad debt charge of $393M represented 45% of new impaired assets in 1H19. There was no change in impaired loans from 30/9/18 to 31/3/19 but 90 day past due loans increased with home loans worthy of special mention. The best part of the result was the large growth in business loans with expanding margins. Hopefully, a large increase in problem loans won’t follow in the next few years. The CET1 ratio was 11.5% which will help the company cope with higher capital requirements in New Zealand, should they eventuate. In short, a fair result with little to depress or inspire.

It’s cheap, and should trade higher along with the rest of the sector.

ANZ (ANZ) Chart

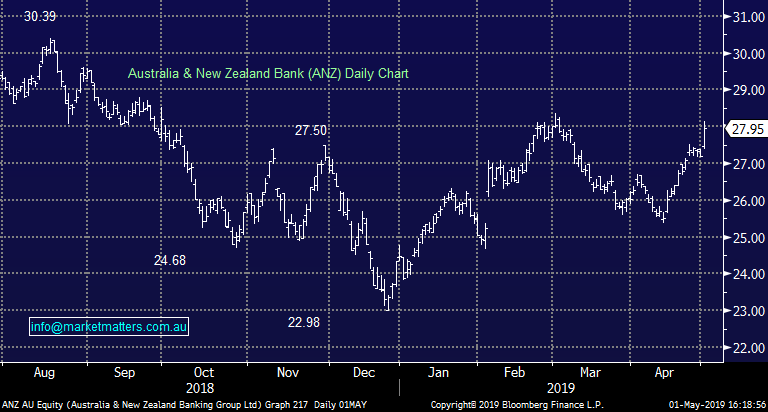

Gemworth (GMA) +3.35% - reported quarterly earnings today and the stock rallied, more so on the lack of bad news than anything particularly good in the result. Top line continues to be a challenge however these are a capital heavy story that is held for income in the MM income portfolio. In terms of commentary about the housing mkt, which is always interesting, they expect housing to continue to cool through 2019 thanks to weak wage growth and as credit conditions tighten and the sector absorbs increased levels of supply. No new news really while they did say that there are signs first home buyers are coming back into the fray, the cohort that typically need mortgage insurance.

We remain comfortable holders of GMA for income, supported by their $100m on mkt share buy-back program that has more than $70m left.

Genworth (GMA) Chart

Broker moves: A big day from brokers with the MS downgrade of Ramsay (RHC) seeing that stocks off -2.8% while the mkt has now turned more bullish on Independence Group (IGO) after their quarterly

· Ramsay Health Cut to Underweight at Morgan Stanley; PT A$58

· Beach Energy Downgraded to Sell at Citi; PT A$1.80

· Beach Energy Downgraded to Sell at Canaccord; PT A$1.88

· Senex Downgraded to Neutral at Citi; PT A$0.41

· Regis Resources Upgraded to Neutral at UBS; PT A$4.80

· Independence Group Upgraded to Buy at UBS; PT Set to A$5

· Independence Group Raised to Outperform at Macquarie; PT A$5.10

· Independence Group Raised to Buy at Argonaut Securities

· Southern Cross Media Downgraded to Neutral at UBS; PT A$1.25

· Super Retail Downgraded to Neutral at UBS; PT A$8.50

· Domain Holdings Upgraded to Neutral at Macquarie; PT A$2.70

· Domain Holdings Cut to Underperform at Credit Suisse; PT A$2.30

· Domain Holdings Cut to Reduce at Morgans Financial; PT A$2.19

· Oil Search Upgraded to Hold at Morningstar

· New Hope Upgraded to Buy at Morningstar

· oOh!media Upgraded to Buy at Morningstar

· GPT Group Upgraded to Hold at Morningstar

· Steadfast Downgraded to Sell at Morningstar

· REA Group Cut to Neutral at Evans and Partners; PT A$87.65

· Redbubble Downgraded to Reduce at Morgans Financial; PT A$0.67

· Mirvac Group Downgraded to Underweight at JPMorgan; PT A$2.65

· Regis Resources Raised to Buy at Argonaut Securities; PT A$5.24

· Nufarm Downgraded to Hold at Morgans Financial; PT A$5.50

OUR CALLS

No moves today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 01/05/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.