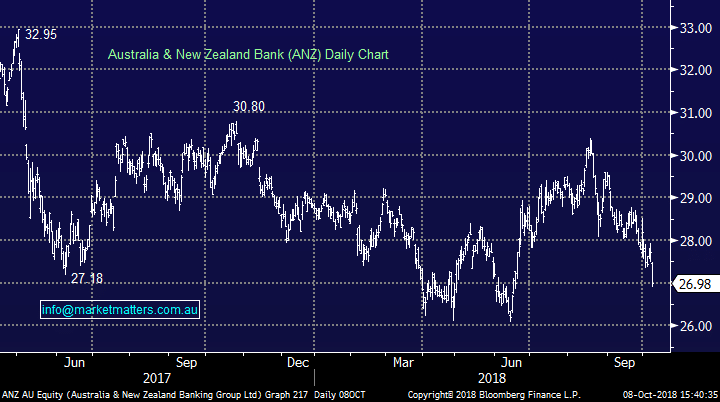

ANZ announces remediation provisions, costs ahead of full year result

Stock ANZ $26.93 as at 8/10/2018 Event There’s just a few weeks before three of the big four banks rule off their financial year, and today we got our second look at how the Royal Commission has impacted the banks. This morning ANZ announced; A total of $711M in after-tax expenses and revenue reduction for 2H18 which comprised of:

- $213M for refunds to customers and related remediation costs;

- $161M for the cost of the program to determine the customer remediation payments;

- $206M for software write-offs associated with the sale of international businesses. Since those businesses will no longer provide revenue to ANZ, related software costs need to be expensed immediately;

- $104M relating to redundancy and other costs associated with agile working; and

- $27M directly relating to the Royal Commission.

Market Matters Take/Outlook

ANZ is down over 2.5% today on a charge that is more than 20% of their first half cash earnings figure. In our view, that shows the market is already heavily negative the big 4 with these charges largely built in.

Market Matters Take/Outlook

ANZ is down over 2.5% today on a charge that is more than 20% of their first half cash earnings figure. In our view, that shows the market is already heavily negative the big 4 with these charges largely built in.