Another close above 6000 bodes well for Aussie stocks (WFD, FMG)

WHAT MATTERED TODAY

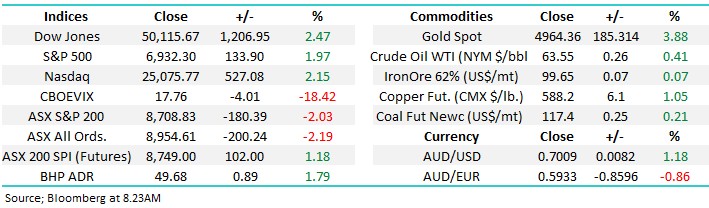

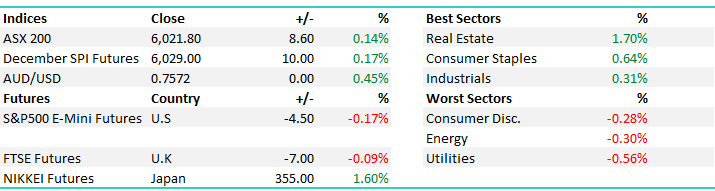

The local market opened with strength this morning with buying in all key sectors, obviously spurred on by the takeover of Westfield, however we also saw good leads from overseas markets with the financials leading the charge overnight. All going well until US Futures took a hit mid-afternoon following news of a Democratic win in the Alabama Senate election, which is seen as a setback for Trump and the tax reform process. If the mkt has rallied on the Tax agenda, any hit to that will clearly prompt some selling. In reality it was only slight dip today and the fact the ASX remained resilient & closed over 6000 with a strong close for a second straight day warms the heart. We continue to target 6125 on the ASX 200 this year.

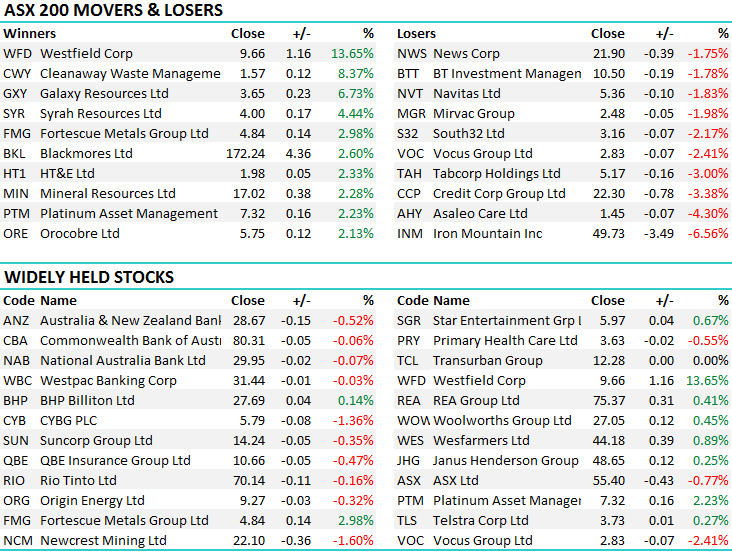

Obviously Westfield was strong today up +13.65% and contributing +8 index points to the ASX 200, while banks were up early as were the resource stocks, only to succumb to the trends in US Futures. The property sector was obviously best on ground today courtesy of Westfield while the interest rates sensitive Utilities were he weakest link (again). An overall range today of +/- 24 points, a high of 6027, a low of 6003 and a close of 6021, up +8pts or +0.14%.

ASX 200 Intra-Day Chart – good move higher into the close after US Futures induced weakness mid afternoon

ASX 200 Daily Chart

TOP MOVERS

1.Westfield (WFD) $9.66 / 13.65% - Clearly the talk of the town today and we covered in the AM report this morning (CLICK HERE) however a few additional points worth mentioning around 1. The implication for shareholders and 2. Around the implication for the index more broadly.

WFD shareholders will get 0.01844 shares in Unibail for each WFD share they own, PLUS US$2.67 per WFD share in cash. In terms of WFD shareholders now holding Unibail shares, WFD shareholders will own approximately 28% of the combined group. This then gets more complicated. WFD shareholders will be able to elect to hold shares in the new Group in Paris or in Sydney (via CDI’s). Although the Australian CDI’s would qualify for indexation, it’s too early to tell what indices it will be included in (or not). I’d assume that it would be in the ASX 200 which means it would also be in the REIT Index.

So, the key takeout is that there will be cash looking for a home in other REITs given the cash component being paid, and we saw that being pre-empted in the mkt yesterday with some strong moves in the likes of Scentre (SCG) and others. This ‘forced buying’ in our view should be used as an opportunity to sell into – we certainly will be with our position in Vicinity (VCX) in the MM Income Portfolio where we are long from $2.74

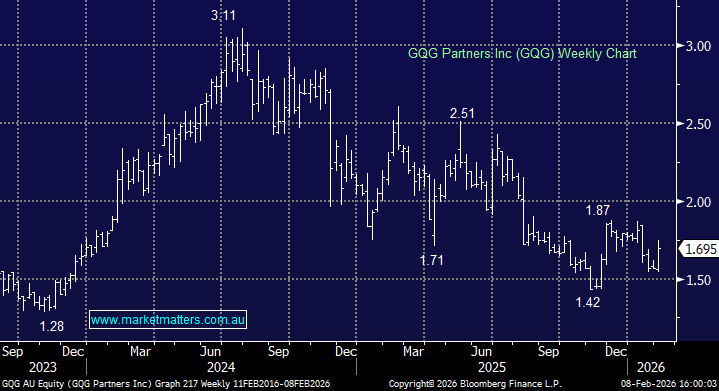

Westfield Monthly Chart

2 .Fortescue Metals (FMG) $4.84 / 2.98% - Finally some buying in the Iron Ore miner today stemming from an upgrade by UBS. They upgraded to BUY with a $5.30 price target and reckon that high commodity prices and strong free cash flow generation is a great benefit to Fortescue. Not a huge amount of insight in that rationale however in our view the BIG discount being applied to FMG Ore is more a cyclical phenomenon rather than a structural one – and the gap will close rendering FMG extremely cheap at current levels. We own from $4.60 in the Growth Portfolio.

Fortescue Daily Chart

OUR CALLS

No changes to the portfolio’s today…

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 13/12/2017. 5.00PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here