AMP hit as life business sale falls over (AMP, ELD, PPT)

WHAT MATTERED TODAY

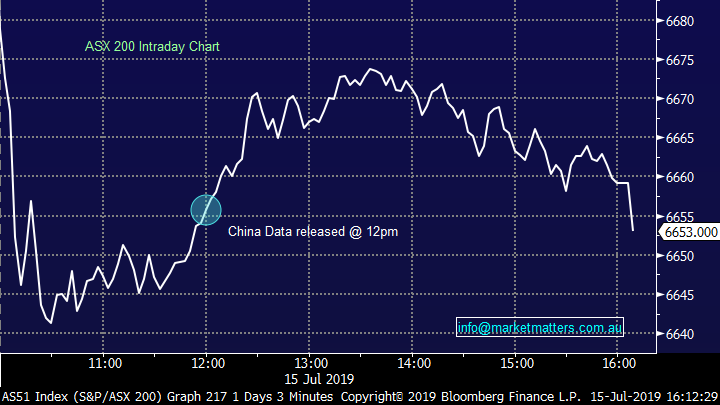

Another fairly quiet day across markets from a volume perspective however we did see a flow of Chinese economic data mid-morning that moved the dial, plus there were a few big stock moves headlined by a 16% fall by AMP.

A very weak open locally despite strength in the US as we continue to witness some divergence between US equities and our own with the later the clear winner. While US markets remain around all-time highs, the ASX 200 is now back testing the 6650 region after rallying to a recent high of 6769. As we wrote this morning, we remain in “sell mode” for our Growth Portfolio but not in an aggressive manner with our cash level already elevated to 25%. Plus, we continue to consider a few stock “switches” that should make the portfolio more defensive in nature.

We reiterate no sell signals have been generated but our “Gut Feel” remains the next 200-point swing is more likely down than up i.e. sub 6600.

A big day for Chinese economic data and across the board we saw meets or beats which provided some support for the local share market from the lows. Retail sales were stronger than expected, GDP was in line at 6.3% however that was lower than prior periods – the Chinese economy is slowing but not materially so while Industrial production, which measures actual industrial output from manufacturing, mining and utilities was also stronger than expected and in line with the prior period. All up, some decent numbers from China today and that helped to support some of the China facing stocks on the ASX.

Chinese Economic Data Today

Source:Bloomberg

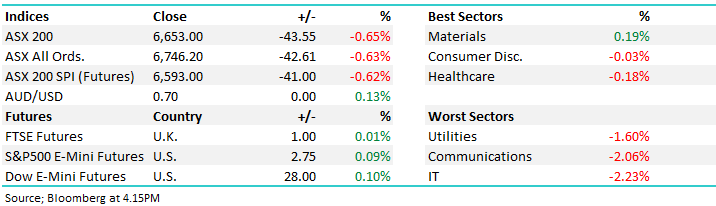

Overall, the ASX 200 lost -43pts today or -0.65% to 6653. Dow Futures are trading up +28pts / +0.10%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

AMP -15.81%; the embattled financial services company traded to new all-time lows today following news that the RBNZ expects to block the $3.3bn sale of their Life business to Resolution. In an early morning announcement, AMP noted that feedback from the NZ central bank put the deal in jeopardy with regulators wanting to force extra requirements from Resolution which would significantly alter the metrics of the deal. The most significant impost to the deal is the RBNZ requesting Resolution alters its branch structure such that some New Zealand assets are ring-fenced for local policy holders. Along with the news, AMP noted it still expects surplus capital despite the result but it would not pay an interim dividend.

On one hand the sale would relieve a lot of stress on the AMP book – the life business was chewing up substantial amounts of capital without really earning a penny. On the other hand, many shareholders were disappointed with the price the company received given it was well below book value and it gives the company an opportunity to extract some more value out. Although AMP is cheap on historical metrics – currently trading below 0.9x book vs the historical average of 1.8x – the concern is that AMP will now need to raise capital.

We’ve written about AMP a number of times of late, and it’s been tempting to buy from a risk / reward perspective, however we’ve been looking for a washout low. That could have been today, however it seems all too hard for now particularly with the ambiguity around its capital position, and now resolution yet around client remediation.

AMP Chart

Perpetual (PPTl) -4.97%: A poor update today in terms of funds under management (FUM) as at 30 June 2019 – the company losing 0.3bn in aggregate however that was sugar coated by a strong market performance which added $1.1 billion. Total FUM sat at $27.1 billion, a decrease of $0.3 billion on the prior quarter however there were net outflows for the quarter of $1.1 billion, largely a consequence of a big $1.2 billion outflow from Australian Equities primarily from Institutional and Intermediary Channels. Elsewhere, they reported $0.1 billion of net outflows from Global Equities and $0.2 billion of net inflows to Cash and Fixed Income which did include the $0.4 billion for Perpetual Credit Income Trust (ASX:PCI)

While we hold PPT in the Income Portfolio, today’s announcement is a weak one and again the stock has failed to break the mid $40 region. We now have this position on a short leash.

Perpetual (PPT) Chart

Elders (ELD) unchanged: The agricultural space is heating up with news today that Elders is set to enter the farming wholesale supply market with the acquisition of Australian Independent Rural Retailers (AIRR). This has been an area that has seen some recent activity after Landmark, which is owned by US listed Nutrien recently bought Ruralco.

The rationale for ELD being that following the overseas takeover of Landmark there are a lot of independents out there who may decide to move across to an alternative wholesale network, and Elders wants to tap into that opportunity. They’re paying a combination of stock and shares valued at $187m with ELD raising $137m through Macquarie + the issuance of $79m with of new stock. While we don’t own ELD, this is clearly an interesting move at a weak point in the cycle.

Elders (ELD) Chart

Broker moves;

· Carsales.com Cut to Reduce at Morgans Financial; PT A$12.49

· Aristocrat Rated New Buy at Citi; PT A$35

· Rio Tinto Downgraded to Sell at Redburn

OUR CALLS

**No amendments today**

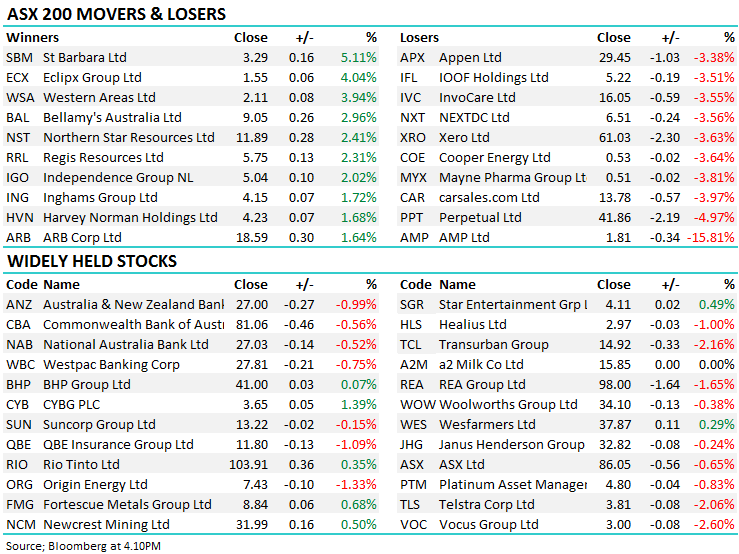

Major Movers Today – Obviously AMP the standout however Telstra (TLS) also weak. WSA caught my eye on Nickel’s strength outpacing IGO which has been rare in recent weeks / months.

Have a great night

James, Harry the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 15/07/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence