All calm on the surface but plenty of action underneath – market closes unchanged (ORA, BSL)

WHAT MATTERED TODAY

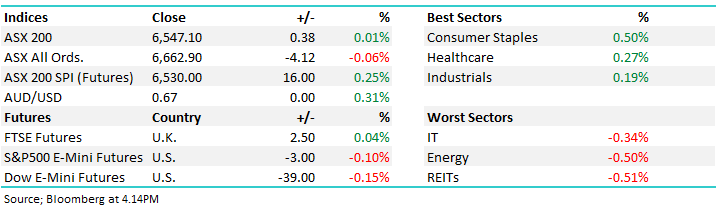

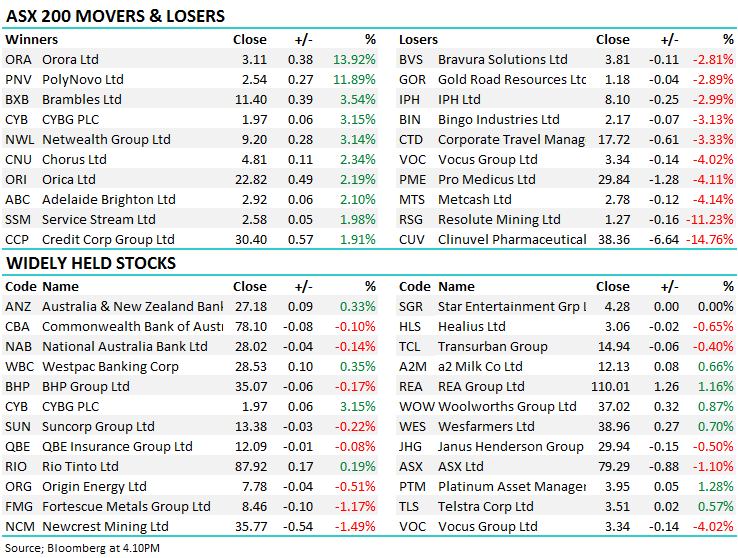

A roller coaster ride in today’s session, with mixed reports that Chinese officials will stay for the course of the trade talks then after a short time, we see reports where they won’t, and this is clearly creating some market volatility, with our own market largely keying off US Futures. Local SPI futures were +41pts after the US close this morning however US Futures tanked on open, down more than -200pts on the DOW before we opened, which wiped off the optimism implied by the SPI. When trade finally got going this morning, there was some optimism early with the ASX rallying +24 points higher towards 6570, only to find resistance and close flat on the session.

Defensive sectors were the outperformers for a second day which is fairly typical of this type of volatile environment. Metcash (MTS) caught my eye today after gapping down on the open down on the session before fighting back fairly hard from the lows – a stock that’s on our radar for the income portfolio.

Overall, the ASX 200 closed flat today at 6547, Dow Futures are trading down -35pts/-0.14%.

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE;

Orora (ORA) +13.92%; rallied after Japanese firm, Nippon Paper pulling together $1.7B to purchase ORA’s packaging unit, helping to overcome some of the pain seen after the full year result in August. The sale will leave Orora with their Australasian beverage and broad North American businesses with the company saying it does not expect any meaningful loss in synergies as a result of the sale.

A good result for Orora, which had struggled to please investors in recent times. If the whole company was to be valued on the same multiple, ORA would trade another 8-10% higher. There was little news regarding the current year’s performance ahead of the company’s AGM. This is positive news for other packaging companies with Pact Group (PGH), the deep value play we have in the Growth Portfolio finishing up +2.19%.

Orora (ORA) Chart

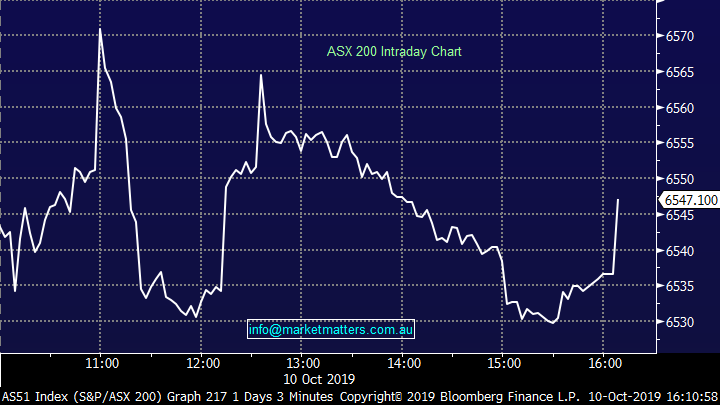

BROKER MOVES; Bluescope was hit early on a broker downgrade from Goldmans’, down more than 3% at their worst before closing down -1.38%.

Bluescope (BSL) Chart

Peter Zuk, our ex-REIT analyst at Shaw has initiated on an old favourite of his in Centuria (CIP) with a hold equivalent.

• Chorus (CNU) Upgraded to Outperform at Forsyth Barr; PT NZ$5.80

• Rio Tinto (RIO) Upgraded to Buy at HSBC; PT 48.50 Pounds

• Service Stream (SSM) Upgraded to Buy at Baillieu Ltd; Price Target A$3

• BHP Reinstated at HSBC With Hold; PT A$39.50

• Centuria Industrial (CIP) Rated New Neutral at Credit Suisse

• Austal (ASB) Rated New Neutral at Goldman; PT A$4.09

• Viva Energy Group (VEA) Rated New Neutral at Credit Suisse; PT A$1.92

• Flight Centre (FLT) Raised to Outperform at Credit Suisse; PT A$49.91

• Flight Centre (FLT) Cut to Hold at Shaw and Partners; PT A$50

• Bluescope (BSL) Downgraded to Neutral at Goldman; PT A$12.20

• Kogan (KGN) Rated New Outperform at Credit Suisse; PT A$7.18

• Paradigm Biopharma (PAR) Cut to Speculative Hold at Bell Potter

OUR CALLS

No changes today – sometimes patience the key and at the moment, the markets ebbs and flows is not presenting any real opportunity for us – although we are keen on a few things at lower levels.

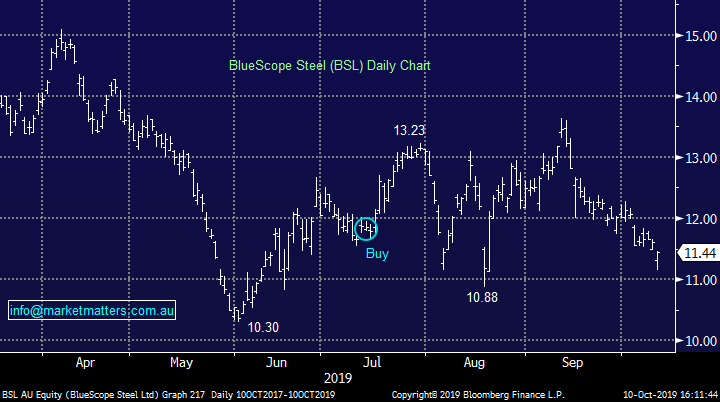

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.