AGL pulls Vocus bid (BIN, VOC, EHL, PLS)

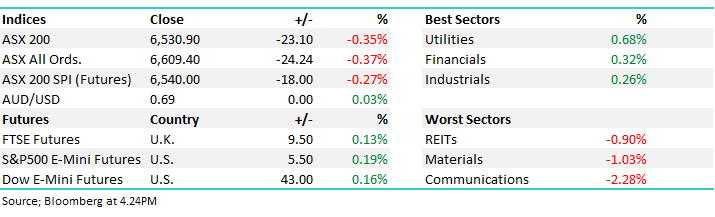

WHAT MATTERED TODAY

A fairly lacklustre Monday across the board with the banks / utilities offsetting some weakness amongst the material stocks + the Telco’s were weak as a sector thanks to the pulled VOC bid from AGL, seems something smells with VOC that each potential acquirer works out pretty quickly when they enter the data room - however it doesn’t seem to be earnings related given they’ve reconfirmed EBITDA guidance again – something else, but it’s there and it’s not buried that deep. More on that below.

Elsewhere, AfterPay (APT) -6.11% continued its sell-off and it will be interesting to see how much momentum money comes out of this momentum stock. Seems uncanny that they raise funds + owners sell $100m of stock just ahead of AUSTRAC findings. The fact that an external auditor is to be appointed to review compliance on AML is clearly a concern for the mkt. When things turn on hot stocks, they turn pretty quickly with the stock now off ~30% from the recent highs. It’s clear this is an incredible business and growth in the US has been exceptional, however all good runs do end and at MM we’ve always held the concern about regulatory risk. That’s meant we’ve missed this run, so we’re certainly not gloating, however it’s a fast growing consumer finance business that will / has attracted regulatory scrutiny at the same time founders are selling down stock - just doesn’t sit right.

Asian market were okay today – mostly higher while US Futures ticked around par.

Overall, the ASX 200 fell -23points or -0.35% to 6530. Dow Futures are trading up +35pts / +0.13%.

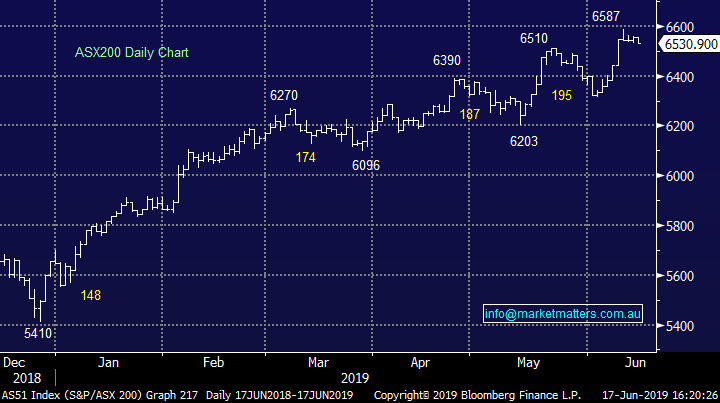

ASX 200 Chart

ASX 200 Chart – portfolio sell down on the close by the look.

CATCHING OUR EYE;

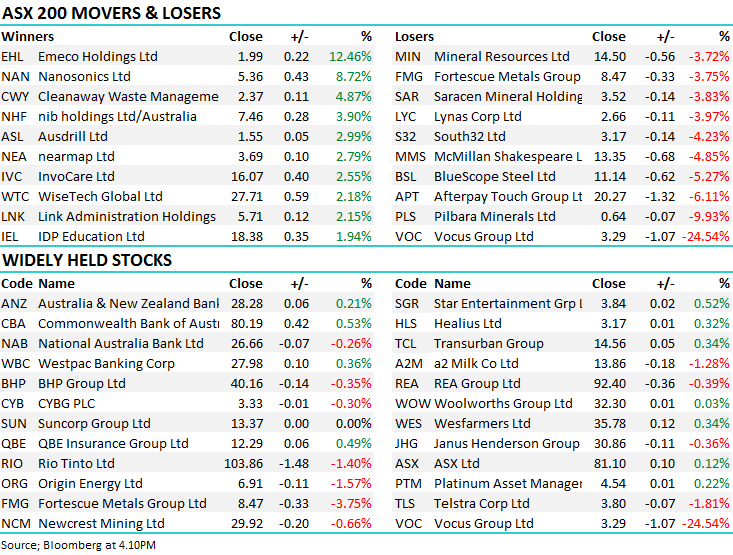

Around the grounds: Some interesting price action on stocks we own / follow today, Bingo (BIN) doing well today adding another ~2% to close at $2.15 – we remain bullish BIN, Telstra (TLS) fell 1.8% today and this is now looking (sort of) interesting. We wrote on the weekend that the next 2% correction could be a trigger and that more or less played out today – the stock now back on the radar. Shares in Emeco rallied +10% today as Paradice increased their holding – Harry covers that below, along with the failed VOC bid + Pilbara (PLS) which was hit today + NiB (NHF) also caught my eye today adding +3.9% to $7.46 - trading to new all-time highs.

In terms of BIN, we cover it this morning, however the short interest here is worth revisiting. The chart below shows that shares held short peaked at 75.6m as at end of May, and now sit at 64m, implying that 12m shares have been bought back to cover shorts in the last few weeks. To put this into context, average daily volume over the last month is 4.4m shares. While not a massive amount of shorts, I’m heartened by how negative the market is towards the stock – not surprising given how poorly a lot of companies go integrating large acquisitions, however the difference with BIN is that they had major issues before the acquisition completed – the stock dropped from ~$3.20 to ~$1.20 hence a lot of that negativity in our view was priced in already. Also worth remembering, they have a $75m share buy-back in place and have only spent around $7m. They also have a site visit on the 26th July which can also be another positive catalyst.

Bingo (BIN) Short Interest

We remain bullish BIN targeting another ~10% upside

Bingo (BIN) Chart

Emeco (EHL) +12.46%; best on ground today was Emeco which has seen some big swings in the share price over the past few days after reiterating guidance mid-last week. A substantial shareholder notice was filed late on Friday which saw fundie Paradice add another 5m shares to their holding. There was clearly a buyer out in the market today with the stock being well bid throughout the session, a sign a big buyer is struggling to get their hands on stock. We like Emeco for a number of reasons – mining investment is set to receive a boost on a number of fronts with the Adani mine kicking off, as well as a high iron ore price encouraging investment. We like Emeco as a result, and a meet at their next result should be enough to see the share price higher after missing 6 out of their last 7 results.

Emeco (EHL) Chart

Vocus (VOC) –24.54%; shares were hit today after AGL walked from the table – the second bidder within a fortnight to walk from talks just days into the due diligence process after EQT pull their bid 12 days ago. The announcement from AGL said they were “no longer confident that an acquisition of Vocus at the proposed terms would represent sufficient certainty of creating value for AGL shareholders.”

Management reiterated FY19 EBITDA guidance of $350m-$370m which is inline with analyst estimates at the $358m mark. Vocus also maintained the 3-year turnaround rhetoric to shareholders however for two deals to fall over in this manner points to some serious concerns with how the underlying business is operating – not to mention the distraction which comes with takeover bids. A tough one to digest – we are not buyers of today’s weakness but would consider a play if Vocus was to downgrade – sell the rumour, buy the fact!

Vocus (VOC) Chart

Pilbara (PLS) -9.93%; shares in lithium miner Pilbara were lower today with the company flagging soft sales into China despite hitting record production levels out of their WA facility. The problem lies downstream with Chinese customers struggling to meet construction timelines for lithium processing facilities. Pilbara has responded by reaching out to other potential buyers to fill the excess supply, however it appears to be having a tough time saying that “production … will be moderated during June and July” and instead the Pilgangoora mine will see maintenance and improvement works brought forward. It wasn’t a great announcement for the battery material space in general with Orocobre (ORE) and Galaxy Resources (GXY) both falling more than 3% as a result.

Pilbara Minerals (PLS) Chart

Broker moves:

· Healius Downgraded to Hold at Deutsche Bank; PT Set to A$3.01

· Brambles Downgraded to Sell at Morningstar

· AusNet Downgraded to Sell at Morningstar

OUR CALLS

No changes today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 17/06/19

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.