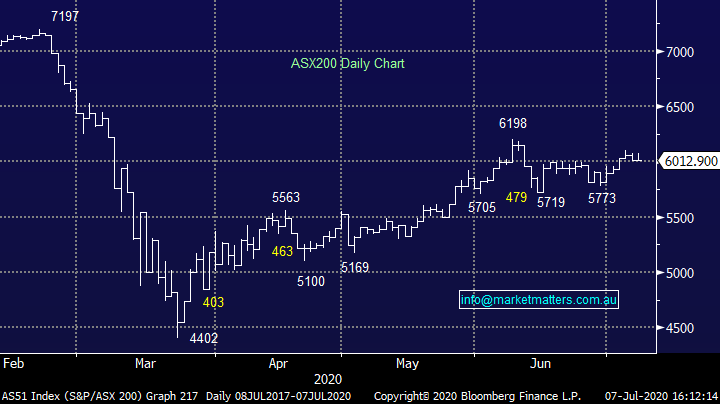

Afterpay gets deal away at $66.00 as Melbourne goes into lockdown (APT, SBM)

WHAT MATTERED TODAY

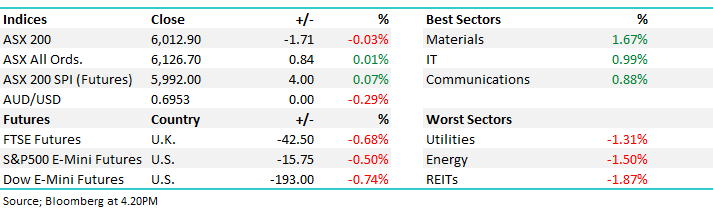

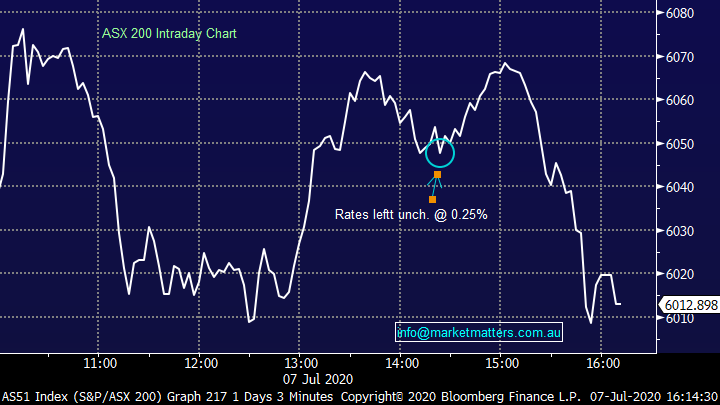

A really choppy session today for local stocks with a strong open, a flat middle, some decent buying after lunch before a combination of expanded Victorian lockdowns & weakness in US Futures knocked the market lower into the close. Asian markets have been getting a lot of the airtime this week and while the Shanghai Composite in China edged higher again, the bulk of Asia ended the session lower, although not materially so.

The RBA met this afternoon and kept rates on hold at 0.25% which was expected, they talked about the economic (and health outcomes) being better than expected thus far, flagging that the fall in hours worked in May was smaller than anticipated which suggests their forecast for a 10% contraction in the first half will prove too bearish. That said, they stressed the outlook remains uncertain, and the recent spike in cases in Victoria (and reimposition of restrictions in response) clearly highlights this.

They talked to a long path to full recovery, although the economy has shown more resilience than was first expected. They went on to say they will not increase the cash rate target until progress is being made towards full employment and they’re confident that inflation will be sustainably within the 2–3 per cent target band. Lower rates for longer remains the message.

The Aussie Dollar chopped around on the news before selling off late in the day to settle around 69.5c

Aussie Dollar Chart

At a sector level today, resources were strong thanks to intra-day strength in Iron Ore prices which added another 2.5% on continued supply issues while Copper & Alumina also have price tailwinds at the moment - Alumina (AWC) traded +3.01% higher today although Fortescue (FMG) was the standout adding more than 6%.

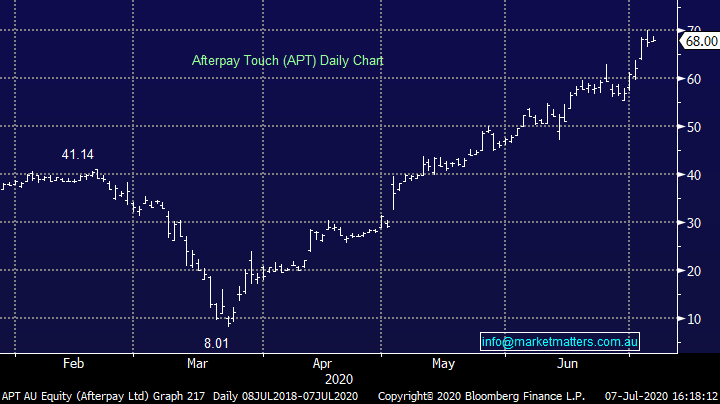

Overall, the ASX 200 ended down -1pt / -0.03% today to close at 6012 - Dow Futures are trading down -176pts / -0.52%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

Afterpay (APT) – Trading Halt: The Buy Now Pay Later superstar this morning released a trading update for FY20 alongside a capital raise plus the founders are selling some stock, ~$250m worth. Firstly, the trading update was a good one, they’re seeing incredibly strong sales growth with transaction value (TV) in FY20 of $11.1b which is up 112% year on year, and it’s accelerating. The growth is organic and underpinned by their move into the US & the UK. Their Q4 run rate is annualising at $15.2b which looks good relative to their targets of $20b by FY22, they should smash that. They now have 9.9m active customers, more than double the amount from a year ago and if we take the run rate in Q4, that equates to more than 20,000 new customers per day – now that’s scale!

In terms of the raise, they’re taping institutions for $650m of new money through a bookbuild which has cleared at $66.00 (versus $68.00 last) and well above the $61.75 underwritten floor, plus they’re offering $150m via a share purchase plan for existing retail holders. All in all, this looks a very good update from APT hence why the bookbuild cleared at the top of the range. The last time they raised money was in mid-2019 at $23 which also included a founder sell-down.

Afterpay (APT) Chart

St Barbara (SBM) +10.33%: had the help of a higher gold price, but the bulk of today’s jump for SBM came on the back of the 4th quarter production update which saw a strong finish to the year. While the full report is due later this month before the full year report, St Barbara managed just shy of 382koz of gold production in the financial year, in line with guidance of 370koz-400koz. The final quarter saw gold production top 100koz for the first time in a period since FY18. While other gold names continue to have operational issues (Northern Star most recently and Newcrest consistently over recent years), today’s update from St Barbara shows that at least one local gold name is ready to take advantage of the spiking gold price. The company also moved into a net cash position with total debt at $316m below their $406m cash position. We are looking at gold exposure and SBM is certainly on the radar after todays strong update.

St Barbara (SBM) Chart

BROKER MOVES:

· Lendlease Group Cut to Neutral at JPMorgan; PT A$13.50

· Mirvac Group Raised to Buy at Jefferies; PT A$2.58

· Reject Shop Rated New Buy at Ord Minnett; PT A$10.11

· BHP Cut to Neutral at Credit Suisse; PT A$37

· BHP Group PLC Cut to Neutral at Credit Suisse; PT 1,450 pence

OUR CALLS

No changes today

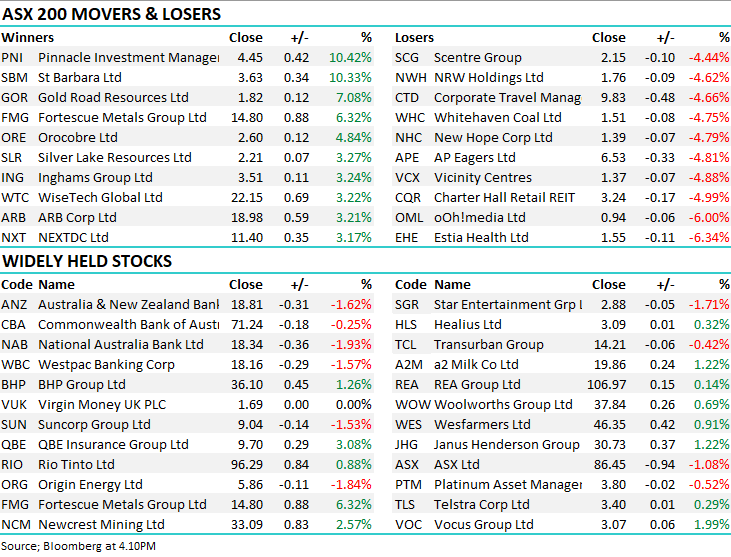

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.