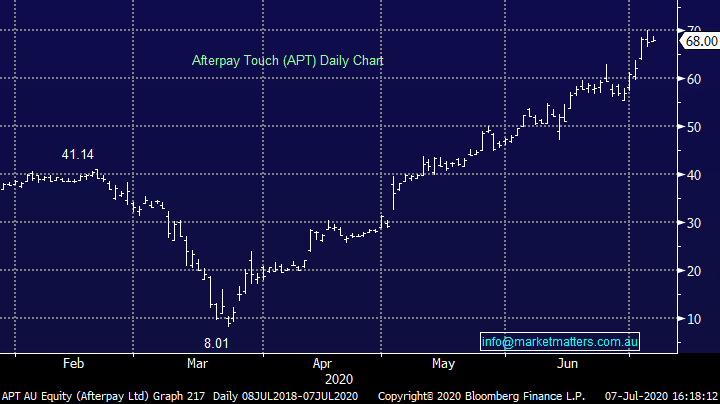

Afterpay (APT) tap investors while founders sell down

Afterpay (APT) – Trading Halt: The Buy Now Pay Later superstar this morning released a trading update for FY20 alongside a capital raise plus the founders are selling some stock, ~$250m worth. Firstly, the trading update was a good one, they’re seeing incredibly strong sales growth with transaction value (TV) in FY20 of $11.1b which is up 112% year on year, and it’s accelerating. The growth is organic and underpinned by their move into the US & the UK. Their Q4 run rate is annualising at $15.2b which looks good relative to their targets of $20b by FY22, they should smash that. They now have 9.9m active customers, more than double the amount from a year ago and if we take the run rate in Q4, that equates to more than 20,000 new customers per day – now that’s scale!

In terms of the raise, they’re taping institutions for $650m of new money through a bookbuild which has cleared at $66.00 (versus $68.00 last) and well above the $61.75 underwritten floor, plus they’re offering $150m via a share purchase plan for existing retail holders. All in all, this looks a very good update from APT hence why the bookbuild cleared at the top of the range. The last time they raised money was in mid-2019 at $23 which also included a founder sell-down.

Shares opened lower today, and hovering around the placement price.

Afterpay (APT) Chart