A tired looking market gives up morning’s gains (Z1P, GUD, BAL)

WHAT MATTERED TODAY

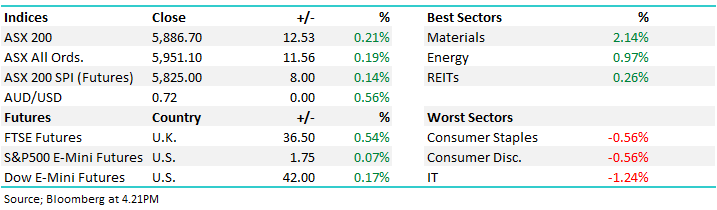

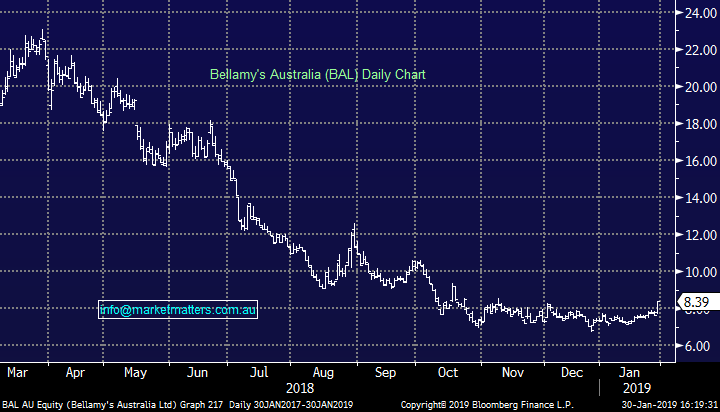

The local market once again failed around the 5900 level as it continues to struggle to find the next leg higher. The market jumped out of the blocks early to crack the key 5900 level before giving back all of the gains before lunch and chopping around par for the afternoon. A flurry of buying on the close did help in the index close in the black. Financials dragged again today, with the market keeping one eye on the final Royal Commission report due out on Monday. Local inflation data saw 4th quarter CPI slightly beat estimates with +0.5% quarter on quarter, yet the market didn’t seem too phased although the AUD did see a nice rally against the green back.

A downgrade by Air New Zealand (ASX: AIZ) sunk the travel names today with another revision to guidance citing recent booking trends as the reason for the 20% downgrade to pre-tax earnings. Auckland International (ASX: AIA) down -3.88%, Qantas (ASX: QAN) off -5.09% and Flight Centre (ASX: FLT) giving up -2.13% Iron ore names continued yesterday’s pop with another strong performance today. Short sellers seemed to cause a flurry of buying early in the day before each of the names edged lower throughout the day, although still finishing strongly higher. We sold Rio Tinto (ASX: RIO) in the Growth Portfolio today, which reached an early high of $89.65 / +7.3% before easing to close at $87.30 / +4.51%. Credit Corp (ASX: CCP) sunk on some poor analysts updates despite what seemed like a decent result yesterday. The stock gave back yesterday’s gains and some in today’s session. Newcrest (ASX: NCM) jumped with the gold price, but also a strongly quarterly with gold production up 19% and costs falling. The stock was up 3.57% to $24.34.

Overall, the ASX 200 closed up 12points or 0.21% to 5886. Dow Futures are currently trading up 42pt.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

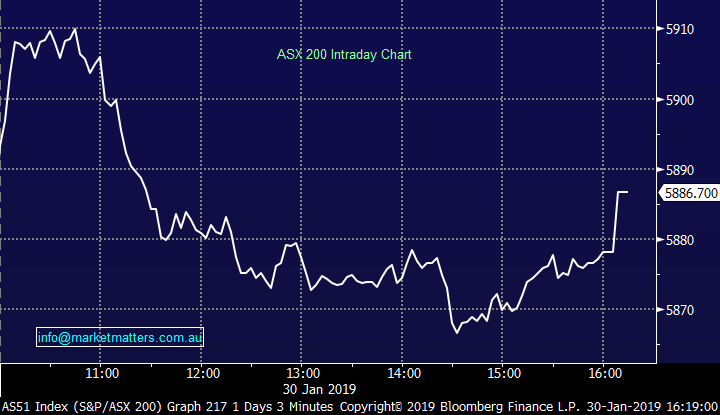

Broker Moves; Bellamy’s is the place to be for your China exposure, and not A2 Milk according to Morgan Stanley today. The broker moved to positive on BAL while moving to negative on A2M given the divergence in performance of each over the past 12 months. A2 Milk performed strongly over 2018, adding around 30%, which MS argue prices the company for perfection heading into reporting season. Any miss, or even a meet at the result could see the stock slaughtered, while Bellamy’s in contrast has fallen over 60% since last year’s highs in March, ensuring the market is pricing a high degree of negativity into the stock. With Bellamy’s “on the cusp of a turnaround,” the broker is looking to pick up the stock heading into the result, and the market followed its way into the stock today, forcing it up +9.67% in the session, the best performer in the ASX200.

Bellamy’s (ASX: BAL) Chart

The note rings true to us here at MM, looking to avoid stock which the market is overly optimistic about while keeping an eye out for those which have plenty of negativity priced in.

ELSEWHERE:

· Fortescue Upgraded to Buy at HSBC; PT A$5.75

· Fortescue Downgraded to Hold at Morgans Financial; PT A$5.45

· Fortescue Downgraded to Sell at Morningstar

· Credit Corp Downgraded to Sell at Morningstar

· Credit Corp Downgraded to Hold at Baillieu Holst Ltd; PT A$23.90

· Credit Corp Cut to Neutral at Evans and Partners; PT A$22.95

· Credit Corp Downgraded to Neutral at JPMorgan; PT A$23

· GPT Group Downgraded to Sell at Morningstar

· AMP Downgraded to Hold at Morningstar

· TPG Telecom Upgraded to Hold at Morningstar

· Rio Tinto Upgraded to Neutral at Evans and Partners; PT A$70

· Spark NZ Downgraded to Sell at Goldman; PT NZ$3.65

· Resolute Mining Downgraded to Underperform at RBC; PT A$1.10

· Regis Resources Downgraded to Hold at Bell Potter; PT A$5.35

· Redbubble Upgraded to Add at Morgans Financial; PT A$1.27

· Bellamy’s Rated New Overweight at Morgan Stanley; PT A$11

· Blackmores Rated New Underweight at Morgan Stanley; PT A$104

· A2 Milk Co Rated New Underweight at Morgan Stanley; PT A$9.60

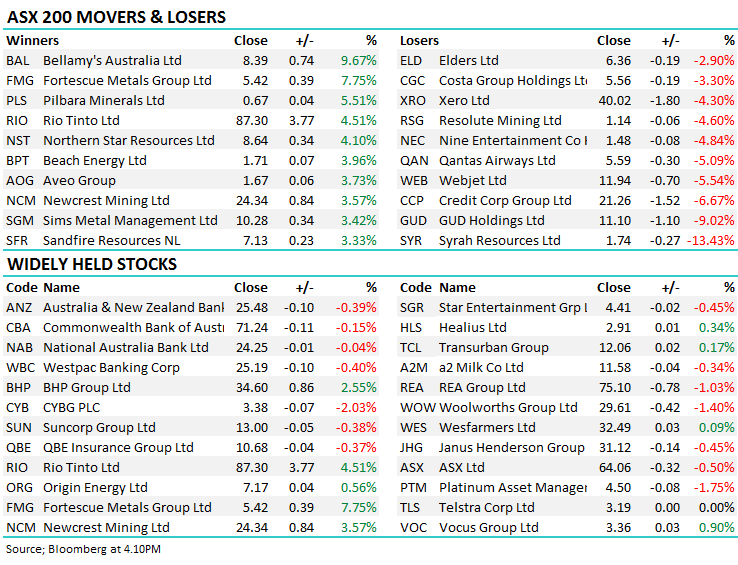

G.U.D. Holdings (ASX: GUD) $11.10 / -9.02%; The automotive parts business printed profit of $29.3m for the 6 months to December 2018, up ~$1m yoy, but fell well short of the markets expectations. With the consensus of analysts pricing a full year profit of $63.5m, it would now take a blockbuster second half to achieve market expectations, particularly given they often have a first half skew to earnings. GUD has been on a big acquisition spree which is yet to drop down into earnings however the CEO is standing firm, looking for further expansion

Whilst the automotive business is growing, the water products company slumped in the first half in tough conditions caused by the drought. Recent acquisitions are yet to bear fruit and the market is (understandably) getting nervous around integration risk. We do see the water business adding more to the second half, however the automotive side may continue to struggle. The stock set new 52-week lows today. Often seen as a barometer of the local economy, hopefully the soft result isn’t a sign of things to come in reporting season.

G.U.D. Holdings (ASX: GUD) Chart

Zip Co (ASX: Z1P) $1.135 / -2.58%; followed Afterpay’s (ASX: APT) efforts with new records of their own at the 2nd quarter update released today. The alternative credit provider noted that platform had surpassed 1mil users in the period, while also posting record revenue at $19.2m, up 28% on the first quarter.

The records really shouldn’t come as a surprise with Q2 including the Christmas shopping period, as well as a number of retailers launching on the platform, both of which helped the company add $4.6m profit. Despite all the positive trends, the Zip share price has fell today after opening strongly higher. It seems shareholders are looking to take profits off the table, but the announcement does give credit to the business model and the longer term trajectory of the company. We like Zip, but not one for us at this stage. Risks remain around regulation and credit markets, particularly with some of the profits driven by falling bad debts – this can’t remain forever.

Zip Co (ASX: Z1P) Chart

OUR CALLS

Growth Portfolio; We sold our 5% position in Rio Tinto (ASX: RIO) today for a 19.46% profit.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 30/01/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.