A tale of two halves (ECX, BIN, LYC)

WHAT MATTERED TODAY

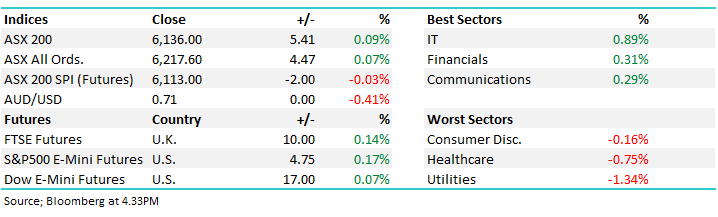

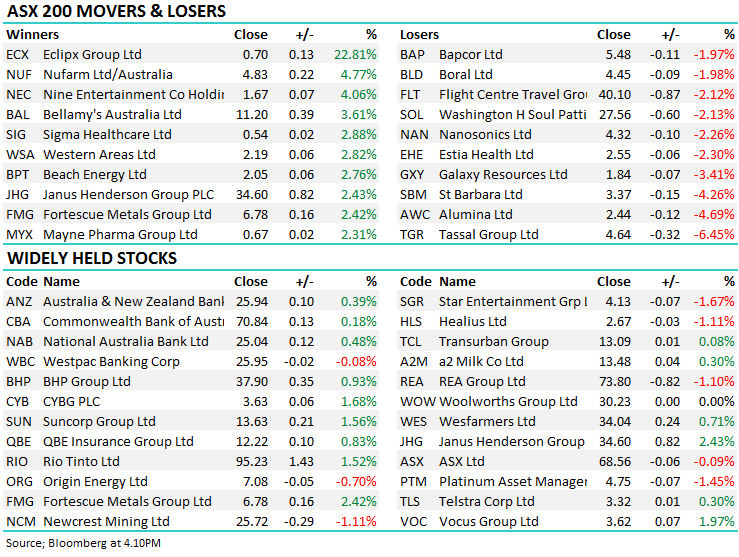

The ASX200 started the day soft, briefly dipping below the 6100 mark just before midday with bank stocks being the biggest drag at the time. Buyers stepped up in the afternoon with 3 of the big 4 moving back into the black – Westpac (WBC) the laggard post Monday’s remediation update – while the miners also caught a bid with investors cheering yesterday’s reopening of the ports in Western Australia as Cyclone Veronica moves on. These sectors combined to see the index close back in the black right on the close, 40 points from the day’s low.

The big macro news today was the RBNZ signalling the next rate move would likely be lower, sending the NZD crashing. It is trading more than 1% lower against our Aussie, and over 1.5% lower against the greenback. The central bank left rates on hold for now but pointed to weaker local and global data impacting future moves saying "the more likely direction of our next OCR move is down." A few of the NZ based stocks did well as a result – Spark New Zealand (SPK) and Air New Zealand (AIZ) both added more than 1%, while Kathmandu (KMD) bounced back from yesterday’s sell off post the first half result with a +3.29% climb today.

Overall today, the ASX 200 added +5 points or +0.09% to 6130. Dow Futures are trading up +4pts / +0.07%

ASX 200 Chart

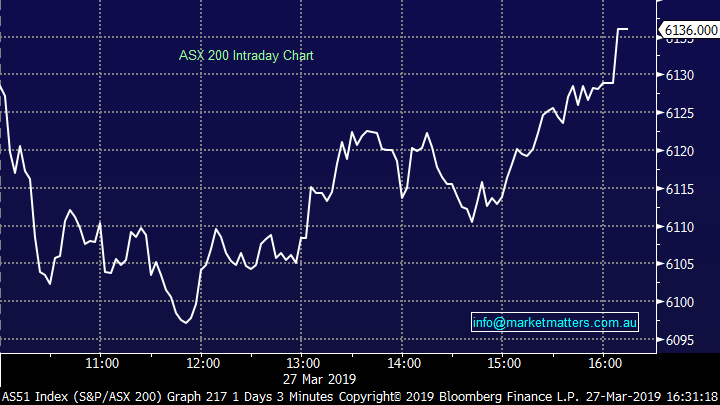

ASX 200 Chart

**Clarification** In today’s income note we made mention of WAM Leaders (WLE) with a price of $1.25 implying that it was trading at a premium to NAV which sits at $1.20 at last update (28th Feb). That was incorrect. The actual price was meant to read $1.125 which was the price when the data was sourced. That means WAM Leaders is trading at a discount to its assets, which is quite rare for the Wilson stable. Their global LIC, WAM Global (WGB) is the other one trading at a discount – a bigger one - with NAV as at 28th February of $2.13 versus a share price today around $1.91. Sincere apologies for the error. As an aside, there seems to be a lot of interest in listed investment companies along with the new breed of listed investment trusts. Would it be worthwhile running a webinar on this? Cheers James

CATCHING OUR EYE;

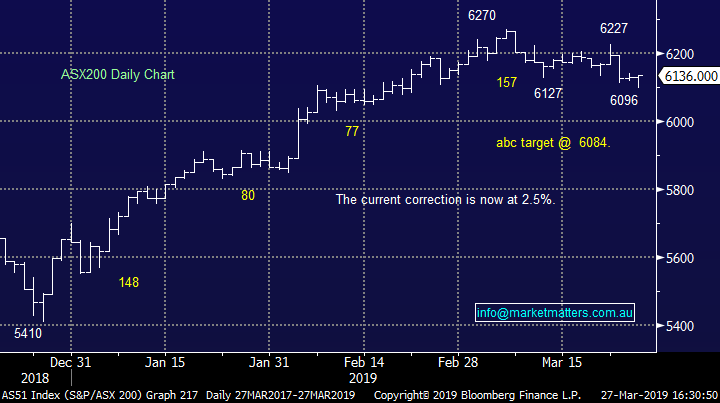

Eclipx (ECX), +22.81%, had fallen nearly 70% in the 5 sessions to yesterday’s record low close, but has staged a recovery today in the face of the weakness after the company assured the market it remains within its debt covenants whilst also looking to offload some non-core businesses. As a quick recap, the vehicle leasing and fleet management company told the market profit had slipped 42% in the first 5 months compared to the same period last year. This also coincided with the end of merger talks with McMillan Shakespeare (MMS).

Eclipx got on the front foot today to show the market it remained well within covenants whilst also announcing that it has received offers for its non-core businesses Grays and Right2Drive. These business are now officially on the market with the company planning to use the proceeds to pay down debt. ECX is cheap on many multiples, but won’t be cheap enough if it’s woes continue – a wise man once said a downgrade is never priced in. We remain concerned about the state of the business, a 42% downgrade should not sneak up on you like that.

Eclipx (ECX) Chart

Bingo (BIN) +0.32%, put its first share buy-back notice out this morning meaning that they started buying back stock yesterday as part of their announced $75m program. They’ve bought back around $4.2m worth of shares paying between $1.513 & $1.5697 – more to come which should be supportive of the stock. The stock ended up +0.32% today at $1.545 – we are expecting an announcement regarding the acquisition of Dial-a-dump next week.

Bingo (BIN) Chart

Lynas (LYC), +1.9%, had a surprising rally today despite essentially declining Wesfarmers’ takeover offer. The company said they would not work with the bidder with the current structure “in the indicative and highly conditional proposal.” Perhaps the market expects a revised offer from Wesfarmers.

Lynas (LYC) Chart

Broker Moves:

· Wesfarmers Downgraded to Hold at Morgans Financial; PT A$34.54

· Sandfire Raised to Outperform at Macquarie; Price Target A$7.80

· Mt Gibson Downgraded to Neutral at Macquarie; PT A$0.90

· New Hope Downgraded to Neutral at Macquarie; PT A$3

· Gold Road Downgraded to Neutral at Macquarie; PT A$1.10

· Webjet Rated New Outperform at RBC; PT A$17

· Beach Energy Upgraded to Hold at Morningstar

· Computershare Upgraded to Buy at Morningstar

· Service Stream Rated New Buy at Bell Potter; PT A$2.42

OUR CALLS

No changes today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 27/03/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.